Question: journal entries only and t chart Comprehensive Problem - Fred Silverman began a business called Silverman Accounting Service on March 1, 2022. You have just

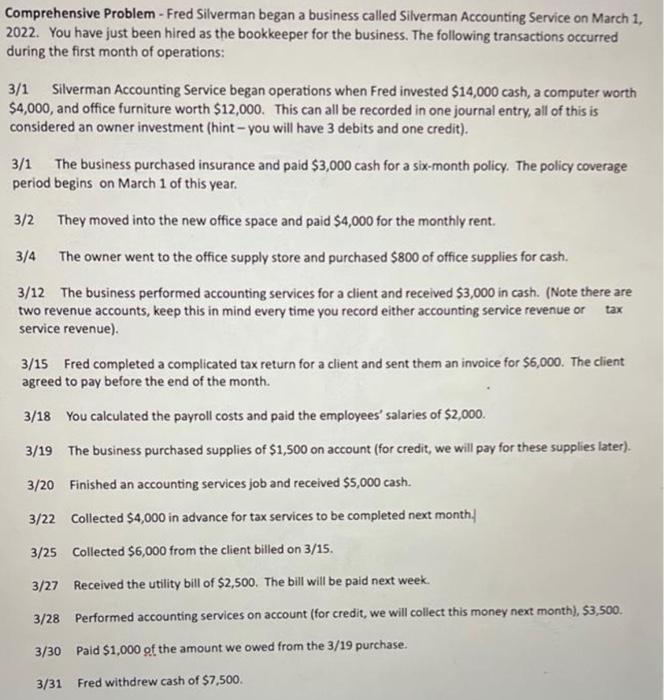

Comprehensive Problem - Fred Silverman began a business called Silverman Accounting Service on March 1, 2022. You have just been hired as the bookkeeper for the business. The following transactions occurred during the first month of operations: 3/1 Silverman Accounting Service began operations when Fred invested $14,000 cash, a computer worth $4,000, and office furniture worth $12,000. This can all be recorded in one journal entry, all of this is considered an owner investment (hint-you will have 3 debits and one credit). 3/1 The business purchased insurance and paid $3,000 cash for a six-month policy. The policy coverage period begins on March 1 of this year. 3/2 They moved into the new office space and paid $4,000 for the monthly rent. 3/4 The owner went to the office supply store and purchased $800 of office supplies for cash. 3/12 The business performed accounting services for a client and received $3,000 in cash. (Note there are two revenue accounts, keep this in mind every time you record either accounting service revenue or tax service revenue). 3/15 Fred completed a complicated tax return for a client and sent them an invoice for $6,000. The client agreed to pay before the end of the month. 3/18 You calculated the payroll costs and paid the employees' salaries of $2,000. 3/19 The business purchased supplies of $1,500 on account (for credit, we will pay for these supplies later). 3/20 Finished an accounting services job and received $5,000 cash. 3/22 Collected $4,000 in advance for tax services to be completed next month. 3/25 Collected $6,000 from the client billed on 3/15. 3/27 Received the utility bill of $2,500. The bill will be paid next week. 3/28 Performed accounting services on account (for credit, we will collect this money next month), $3,500. 3/30 Paid $1,000 of the amount we owed from the 3/19 purchase. 3/31 Fred withdrew cash of $7,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts