Question: journal entries solve ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https% 2534% 252F%252Fnewconnect.mheducation.com%%252F#/activity/question-group/.. TERM EXAM i Saved Help Save & Exit Submit Mackenzie Corp, is preparing the December 31, 2020, year-end financial

journal entries solve

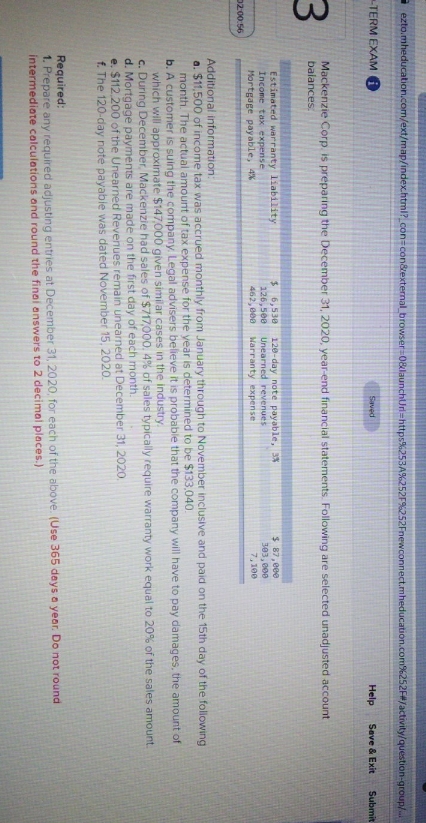

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https% 2534% 252F%252Fnewconnect.mheducation.com%%252F#/activity/question-group/.. TERM EXAM i Saved Help Save & Exit Submit Mackenzie Corp, is preparing the December 31, 2020, year-end financial statements. Following are selected unadjusted account m balances. Estimated warranty liability $ 6,530 120-day note payable, 3x $ 87,060 Income tax expense 126,500 Unearned revenues 303, 090 Mortgage payable, 4% 462,800 Warranty expense 7, 190 02:00:56 Additional information: a. $11.500 of income tax was accrued monthly from January through to November inclusive and paid on the 15th day of the following month. The actual amount of tax expense for the year is determined to be $133.040. b. A customer is suing the company. Legal advisers believe it is probable that the company will have to pay damages, the amount of which will approximate $147,000 given similar cases in the industry. c. During December, Mackenzie had sales of $717,000. 4% of sales typically require warranty work equal to 20% of the sales amount. d. Mortgage payments are made on the first day of each month. e. $112 200 of the Unearned Revenues remain unearned at December 31, 2020. f. The 120-day note payable was dated November 15, 2020. Required: 1. Prepare any required adjusting entries at December 31, 2020, for each of the above. (Use 365 days a year. Do not round intermediate calculations and round the final answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts