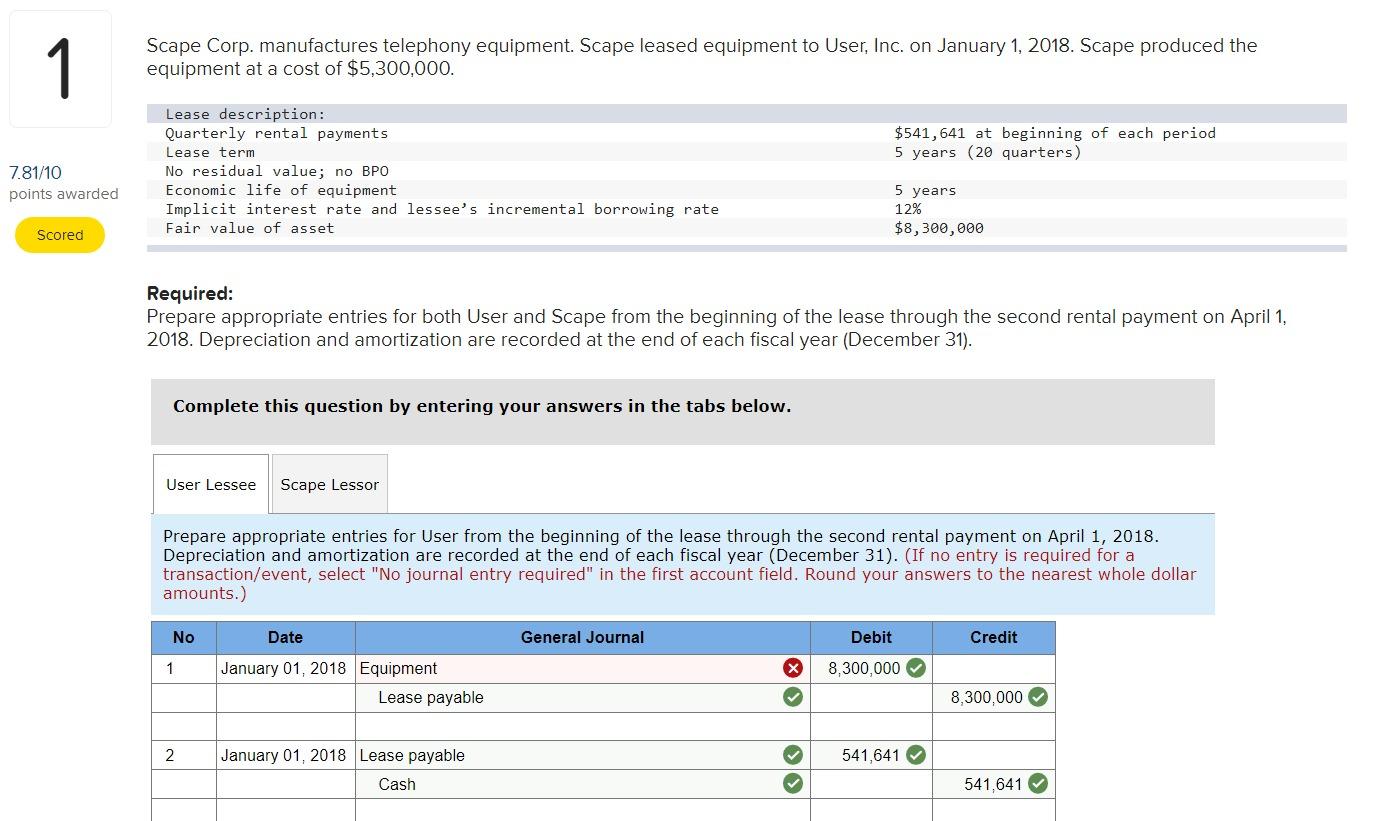

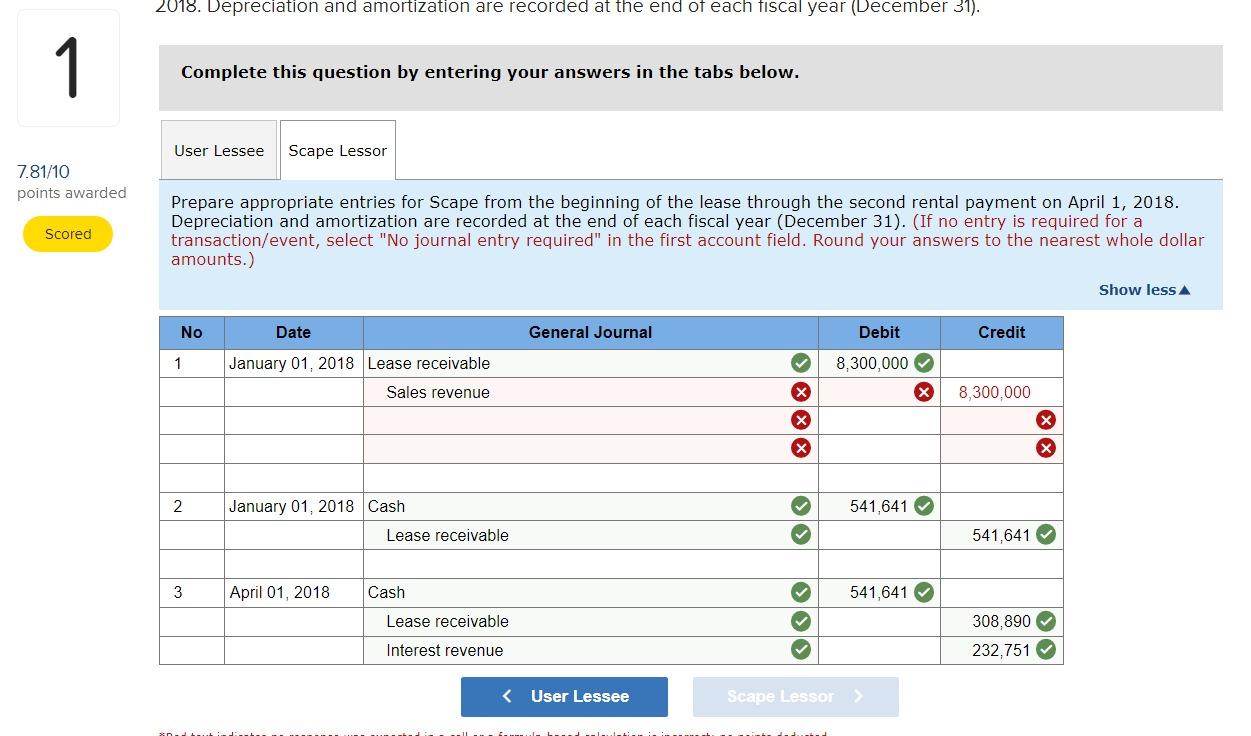

Question: Journal entry #1 on part one is incorrect. Journal entry #1 for part two is incorrect. 1 Scape Corp. manufactures telephony equipment. Scape leased equipment

Journal entry #1 on part one is incorrect. Journal entry #1 for part two is incorrect.

1 Scape Corp. manufactures telephony equipment. Scape leased equipment to User, Inc. on January 1, 2018. Scape produced the equipment at a cost of $5,300,000. $541,641 at beginning of each period 5 years (20 quarters) 7.81/10 points awarded Lease description: Quarterly rental payments Lease term No residual value; no BPO Economic life of equipment Implicit interest rate and lessee's incremental borrowing rate Fair value of asset 5 years 12% $8,300,000 Scored Required: Prepare appropriate entries for both User and Scape from the beginning of the lease through the second rental payment on April 1, 2018. Depreciation and amortization are recorded at the end of each fiscal year (December 31). Complete this question by entering your answers in the tabs below. User Lessee Scape Lessor Prepare appropriate entries for User from the beginning of the lease through the second rental payment on April 1, 2018. Depreciation and amortization are recorded at the end of each fiscal year (December 31). (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.) No Date General Journal Debit Credit 1 x 8,300,000 January 01, 2018 Equipment Lease payable 8,300,000 2 0 541,641 January 01, 2018 Lease payable Cash 541,641 2018. Depreciation and amortization are recorded at the end of each fiscal year (December 31). 1 1 Complete this question by entering your answers in the tabs below. User Lessee Scape Lessor 7.81/10 points awarded Scored Prepare appropriate entries for Scape from the beginning of the lease through the second rental payment on April 1, 2018. Depreciation and amortization are recorded at the end of each fiscal year (December 31). (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.) Show less No Date General Journal Debit Credit 1 January 01, 2018 Lease receivable 8,300,000 Sales revenue 8,300,000 x x 2 January 01, 2018 Cash 541.641 Lease receivable 541,641 3 April 01, 2018 Cash 541,641 Lease receivable 308,890 Interest revenue 232.751

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts