Question: journal entry answers for these Exercise 8-2 (Algo) Record notes payable (LO8-2) On November 1, 2024, Backpacking Training Corporation borrows $56,000 cash from Community Savings

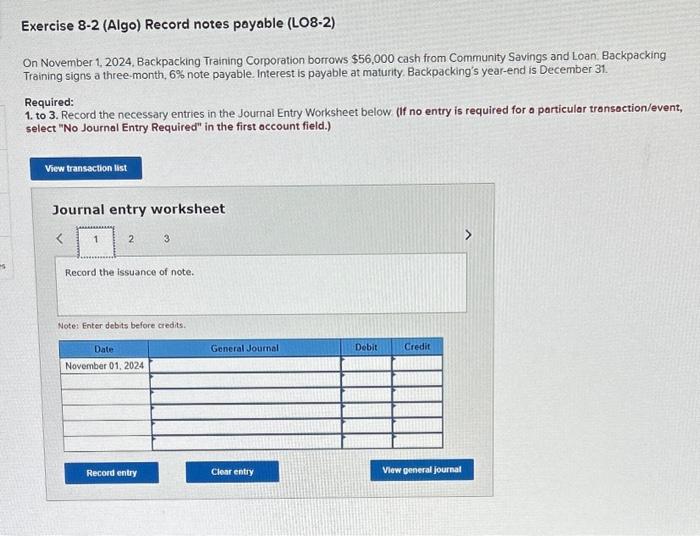

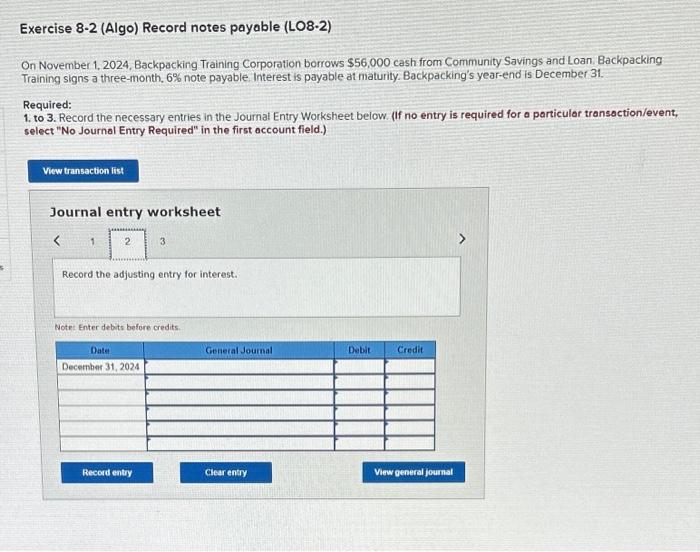

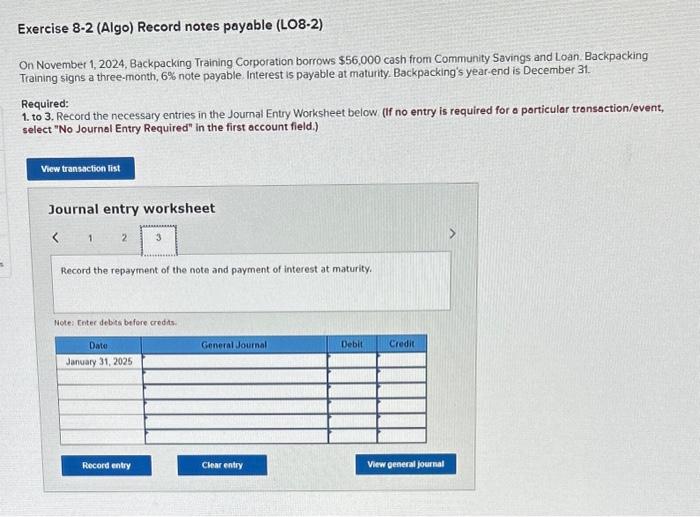

Exercise 8-2 (Algo) Record notes payable (LO8-2) On November 1, 2024, Backpacking Training Corporation borrows $56,000 cash from Community Savings and Loan, Backpacking Training signs a three-month, 6% note payable. Interest is payable at maturity. Backpacking's year-end is December 31. Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below (If no entry is required for a particular transoction/event, select "No Journal Entry Required" in the first occount field.) Journal entry worksheet Notel Enter debits before credits. Exercise 8-2 (Algo) Record notes payable (LO8-2) On November 1, 2024, Backpacking Training Corporation borrows $56,000 cash from Community Savings and Loan, Backpacking Training signs a three-month, 6% note payable. Interest is payable at maturity. Backpacking's year-end is December 31 . Required: 1. to 3. Record the necessary entries in the Joumal Entry Worksheet below. (If no entry is required for a particular transoction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet On November 1, 2024, Backpacking Training Corporation borrows $56,000 cash from Community Savings and Loan, Backpacking Training signs a three-month, 6% note payable. Interest is payable at maturity. Backpacking's year-end is December 31 . Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below (If no entry is required for o porticular tronsaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the repayment of the note and payment of interest at maturity. Note: Renter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts