Question: journal entry **if your write it on paper, please write neatly.*** Problem Section: Complete the accounting cycle for the period January 1 to February 28,

journal entry

**if your write it on paper, please write neatly.***

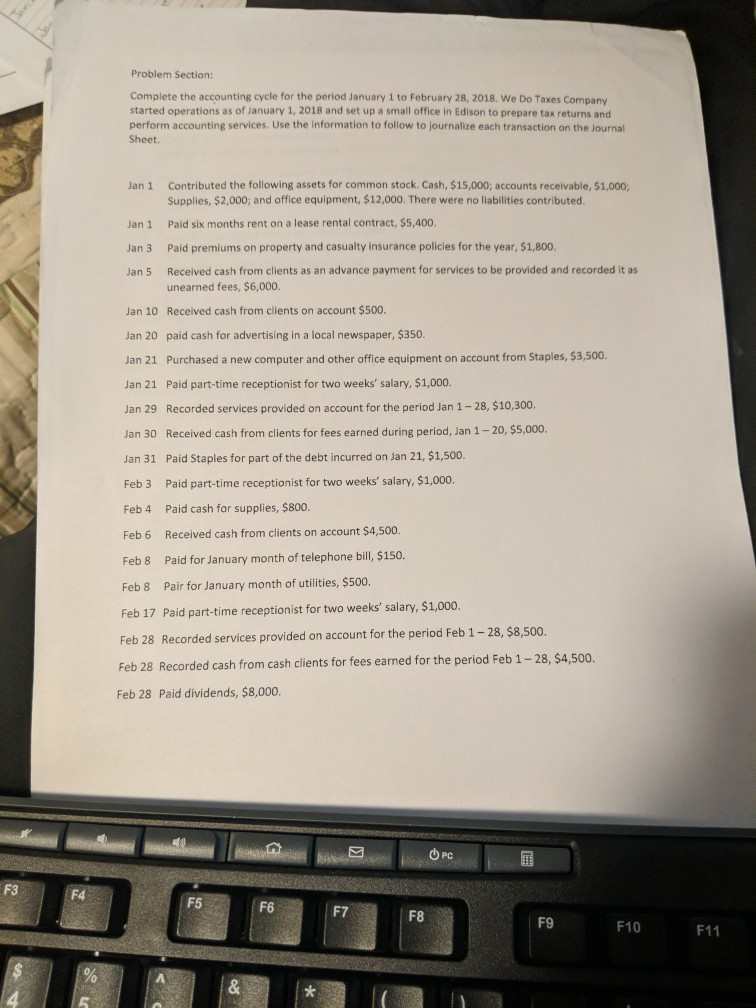

Problem Section: Complete the accounting cycle for the period January 1 to February 28, 2018, We Do Taxes Company started operations as of January 1, 2018 and set up a small office in Edison to prepare tax returns and perform accounting services. Use the information to follow to journalize each transaction on the Journal Sheet. Jan 1 Contributed the following assets for common stock. Cash, $15,000; accounts receivable, $1,000, Supplies, $2,000; and office equipment, $12,000. There were no liabilities contributed Jan 1 Paid six months rent on a lease rental contract, $5,400. Jan 3 Paid premiums on property and casualty insurance policies for the year. $1,800 Jan 5 Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $6,000 Jan 10 Received cash from clients on account $500. Jan 20 paid cash for advertising in a local newspaper, $350. Jan 21 Purchased a new computer and other office equipment on account from Staples, $3,500. Jan 21 Paid part-time receptionist for two weeks' salary, $1,000. Jan 29 Recorded services provided on account for the period Jan 1-28, $10,300. Jan 30 Received cash from clients for fees earned during period, Jan 1-20, $5,000. Jan 31 Paid Staples for part of the debt incurred on Jan 21, $1,500. Feb 3 Paid part-time receptionist for two weeks' salary, $1,000. Feb 4 Paid cash for supplies, $800. Feb 6 Received cash from clients on account $4,500. Feb 8 Paid for January month of telephone bill, $150. Feb 8 Pair for January month of utilities, $500. Feb 17 Paid part-time receptionist for two weeks' salary, $1,000. Feb 28 Recorded services provided on account for the period Feb 1-28, $8,500. Feb 28 Recorded cash from cash clients for fees earned for the period Feb 1 - 28, $4,500. Feb 28 Paid dividends, $8,000. OPC F3 F8 F10 F11 er bookmarks [G Calibri - 11 BIUAAE A Font D == E E Alignment General $ % O Number Conditional Formatting Format as Table Cell Styles For Clipboard Styles B3 2 Journal Page 1 Date Description Post Ref. Debit Credit Jornal Unadj Trial Bal Financials Ready T Accounts post d... El SONY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts