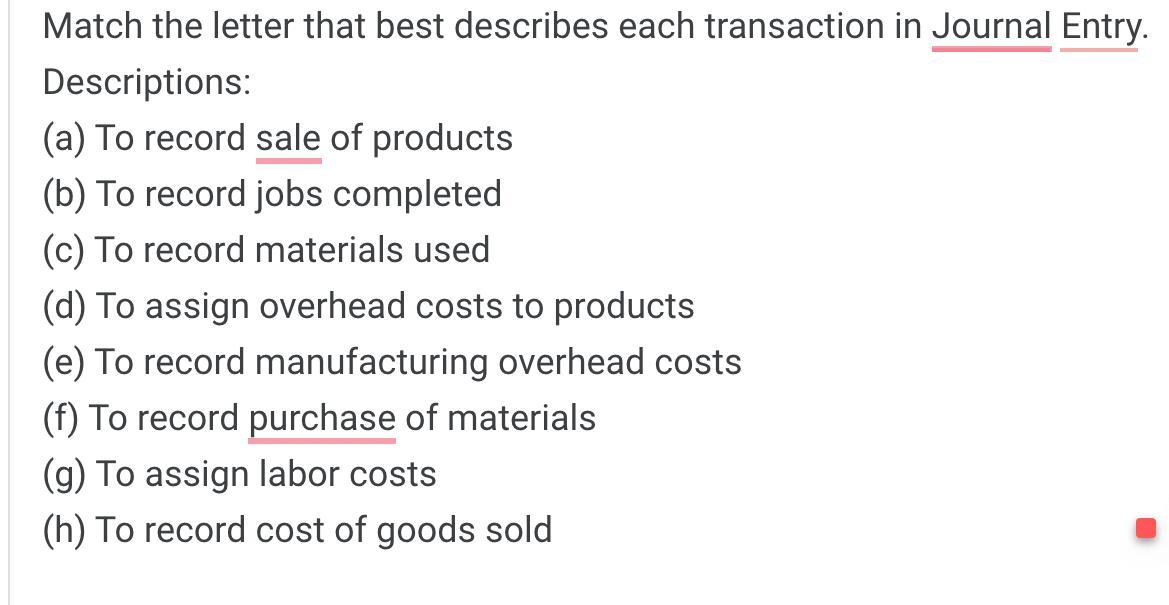

Question: Match the letter that best describes each transaction in Journal Entry. Descriptions: (a) To record sale of products (b) To record jobs completed (c)

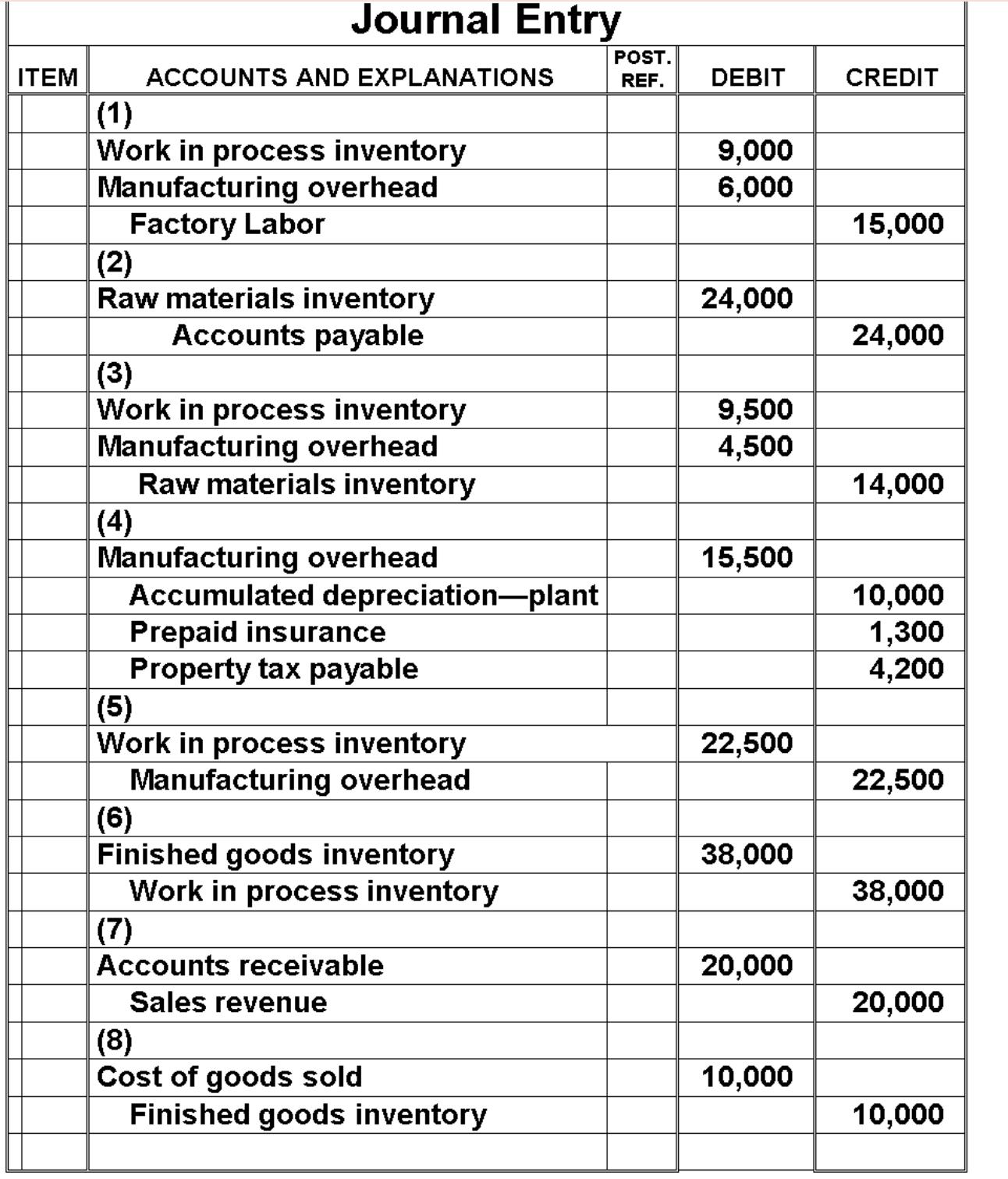

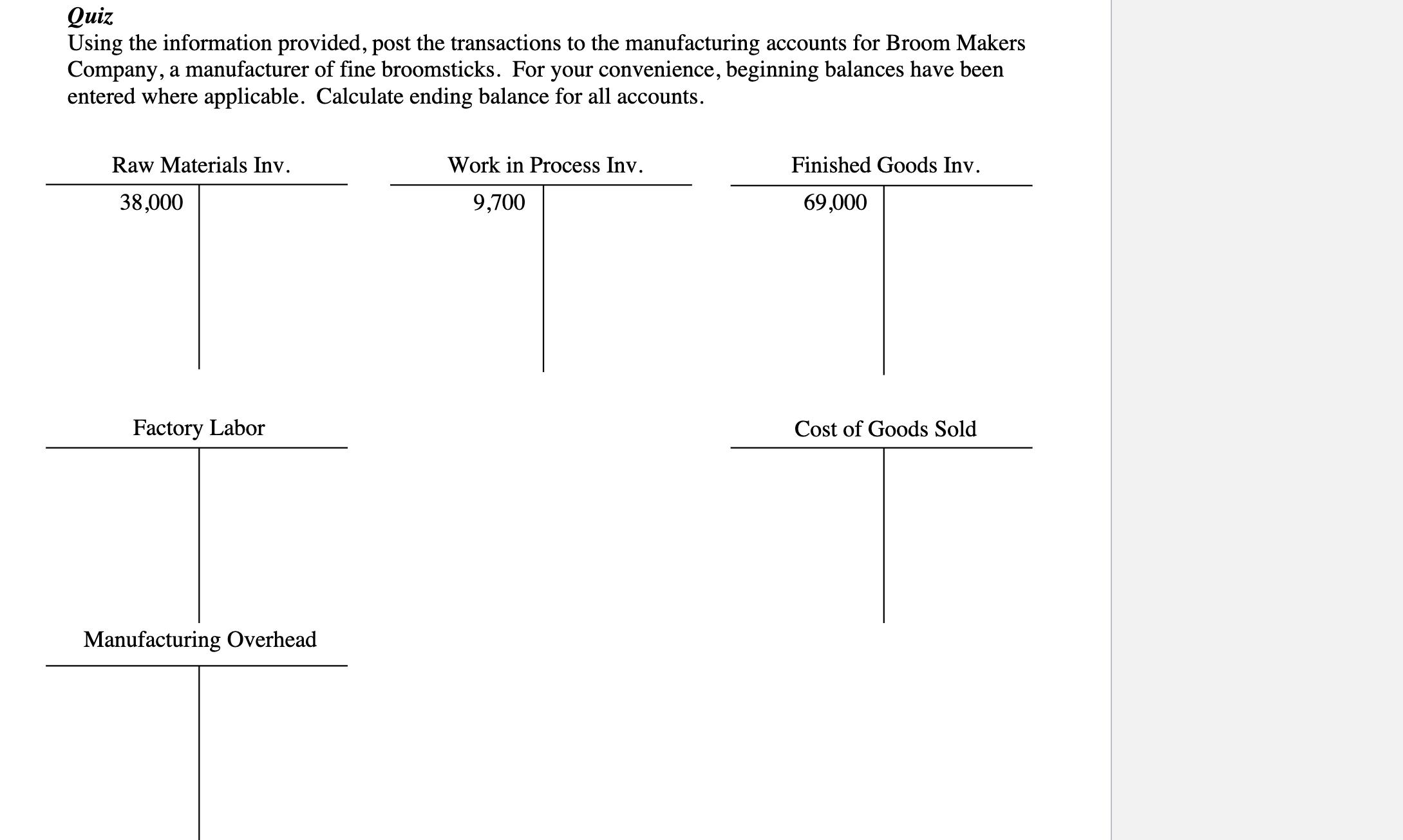

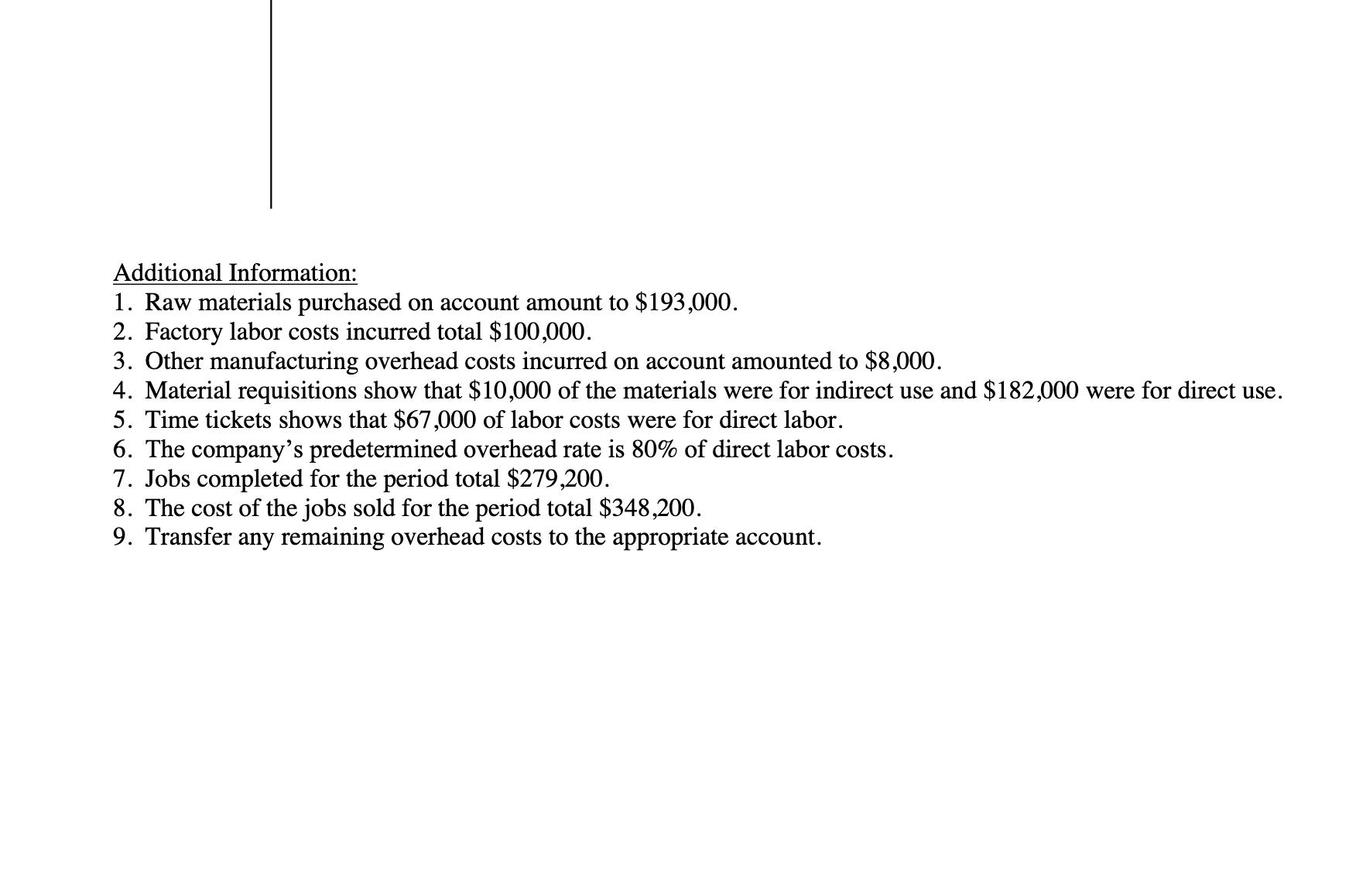

Match the letter that best describes each transaction in Journal Entry. Descriptions: (a) To record sale of products (b) To record jobs completed (c) To record materials used (d) To assign overhead costs to products (e) To record manufacturing overhead costs (f) To record purchase of materials (g) To assign labor costs (h) To record cost of goods sold Journal Entry ITEM ACCOUNTS AND EXPLANATIONS (1) POST. REF. DEBIT CREDIT Work in process inventory 9,000 Manufacturing overhead 6,000 Factory Labor 15,000 (2) Raw materials inventory 24,000 Accounts payable 24,000 (3) Work in process inventory 9,500 Manufacturing overhead 4,500 Raw materials inventory 14,000 (4) Manufacturing overhead 15,500 Accumulated depreciation-plant 10,000 Prepaid insurance 1,300 Property tax payable 4,200 (5) Work in process inventory 22,500 Manufacturing overhead 22,500 (6) Finished goods inventory 38,000 Work in process inventory 38,000 (7) Accounts receivable 20,000 Sales revenue 20,000 (8) Cost of goods sold 10,000 Finished goods inventory 10,000 Quiz Using the information provided, post the transactions to the manufacturing accounts for Broom Makers Company, a manufacturer of fine broomsticks. For your convenience, beginning balances have been entered where applicable. Calculate ending balance for all accounts. Raw Materials Inv. 38,000 Work in Process Inv. 9,700 Finished Goods Inv. 69,000 Factory Labor Manufacturing Overhead Cost of Goods Sold Additional Information: 1. Raw materials purchased on account amount to $193,000. 2. Factory labor costs incurred total $100,000. 3. Other manufacturing overhead costs incurred on account amounted to $8,000. 4. Material requisitions show that $10,000 of the materials were for indirect use and $182,000 were for direct use. 5. Time tickets shows that $67,000 of labor costs were for direct labor. 6. The company's predetermined overhead rate is 80% of direct labor costs. 7. Jobs completed for the period total $279,200. 8. The cost of the jobs sold for the period total $348,200. 9. Transfer any remaining overhead costs to the appropriate account.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts