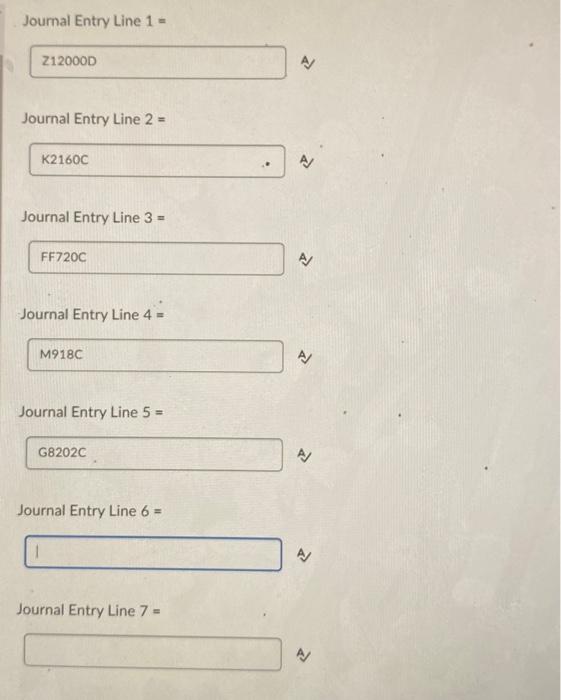

Question: Journal Entry Line 1= Journal Entry Line 2 = A Journal Entry Line 3 = A Journal Entry Line 4 = A Journal Entry Line

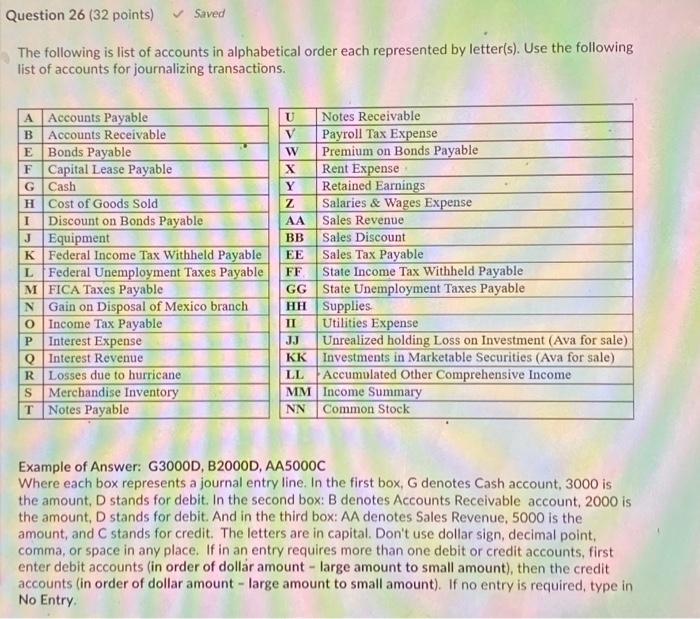

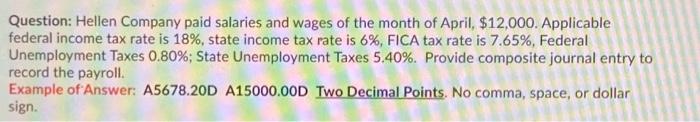

Journal Entry Line 1= Journal Entry Line 2 = A Journal Entry Line 3 = A Journal Entry Line 4 = A Journal Entry Line 5= A Journal Entry Line 6 = A Journal Entry Line 7= A Journal Entry Line 8= Question: Hellen Company paid salaries and wages of the month of April, $12,000. Applicable federal income tax rate is 18%, state income tax rate is 6%, FICA tax rate is 7.65%, Federal Unemployment Taxes 0.80%; State Unemployment Taxes 5.40%. Provide composite journal entry to record the payroll. Example of Answer: A5678.20D A15000.00D Two Decimal Points. No comma, space, or dollar sign. The following is list of accounts in alphabetical order each represented by letter(s). Use the following list of accounts for journalizing transactions. Example of Answer: G3000D, B2000D, AA5000C Where each box represents a journal entry line. In the first box, G denotes Cash account, 3000 is the amount, D stands for debit. In the second box: B denotes Accounts Receivable account, 2000 is the amount, D stands for debit. And in the third box: AA denotes Sales Revenue, 5000 is the amount, and C stands for credit. The letters are in capital. Don't use dollar sign, decimal point. comma, or space in any place. If in an entry requires more than one debit or credit accounts, first enter debit accounts (in order of dollar amount - large amount to small amount), then the credit accounts (in order of dollar amount - large amount to small amount). If no entry is required, type in No Entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts