Question: journal entry Required information A note receivable is a written promise to pay a specified amount of money at a stated future date. The maturity

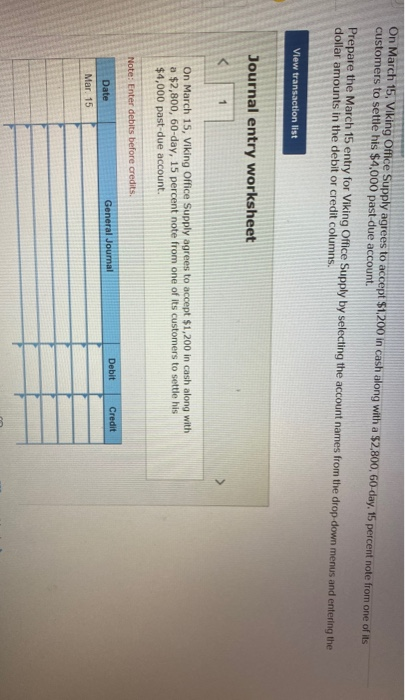

Required information A note receivable is a written promise to pay a specified amount of money at a stated future date. The maturity date is the day the note (principal and interest) must be repaid. Interest rates are normally stated in annual terms. The amount of interest on the note is computed by expressing time as a fraction of one year and multiplying the note's principal by this fraction and the annual interest rate. A note received is recorded at its principal amount by debiting the Notes Receivatble account. The credit amount is to the asset, product, or service provided in return for the note. On March 15, Viking Office Supply agrees to accept $1,200 in cash along with a $2,800, 60-day, 15 percent note from one of its customers to settle his $4,000 past-due account. Prepare the March 15 entry for Viking Office Supply by selecting the account names from the drop down menus and entering the dollar amounts in the debit or credit columns View transaction list Journal entry worksheet On March 15, Viking Office Supply agrees to accept $1,200 in cash along with a $2,800, 60-day, 15 percent note from one of its customers to settle his $4,000 past-due account. Note: Enter debits before credits. Debit Credit General Jourmal Date Mar. 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts