Question: journal entry Required information Under the allowance method, bad debts expense is recorded with an adjustment at the end of each accounting period that debits

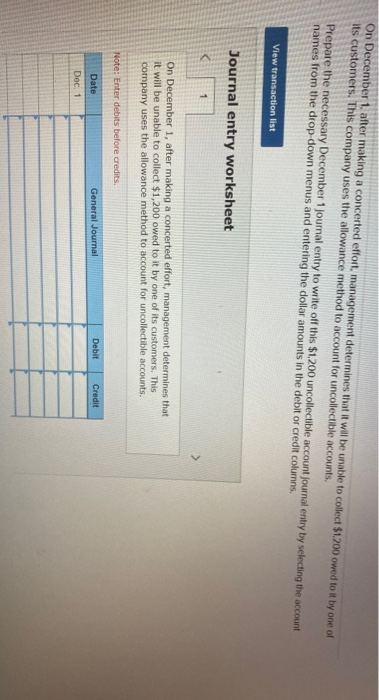

Required information Under the allowance method, bad debts expense is recorded with an adjustment at the end of each accounting period that debits the Bad Debts Expense account and credits the Allowance for Doubtful Accounts. The uncollectible accounts are later written off with a debit to the Allowance for Doubtful Accounts. On December 1, after making a concerted effort, management determines that it will be unable to collect $1200 owed to it by one of its customers. This company uses the allowance method to account for uncollectible accounts. Prepare the necessary December 1 journal entry to write off this $1,200 uncollectible account journal entry by selecting the account names from the drop-down menus and entering the dollar amounts in the debitor credit columns View transaction list Journal entry worksheet On December 1, after making a concerted effort, management determines that it will be unable to collect $1,200 owed to it by one of its customers. This company uses the allowance method to account for uncollectible accounts. Note: Enter debits before credits. Date General Journal Debit Credit Doc. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts