Question: Journal Entry - (there will be a 2-point deduction if you have missed writing the date and or explanation)T-Accounts - (wrong balance and/or account title

Journal Entry - (there will be a 2-point deduction if you have missed writing the date and or explanation)T-Accounts - (wrong balance and/or account title will NOT be counted)Trial Balance - (there will be a 2-point deduction if the name of the firm, the title of the statement, or the date period is not indicated. In addition, ifALORE formatis not followed, there will be aDEDUCTIONof 15 points)

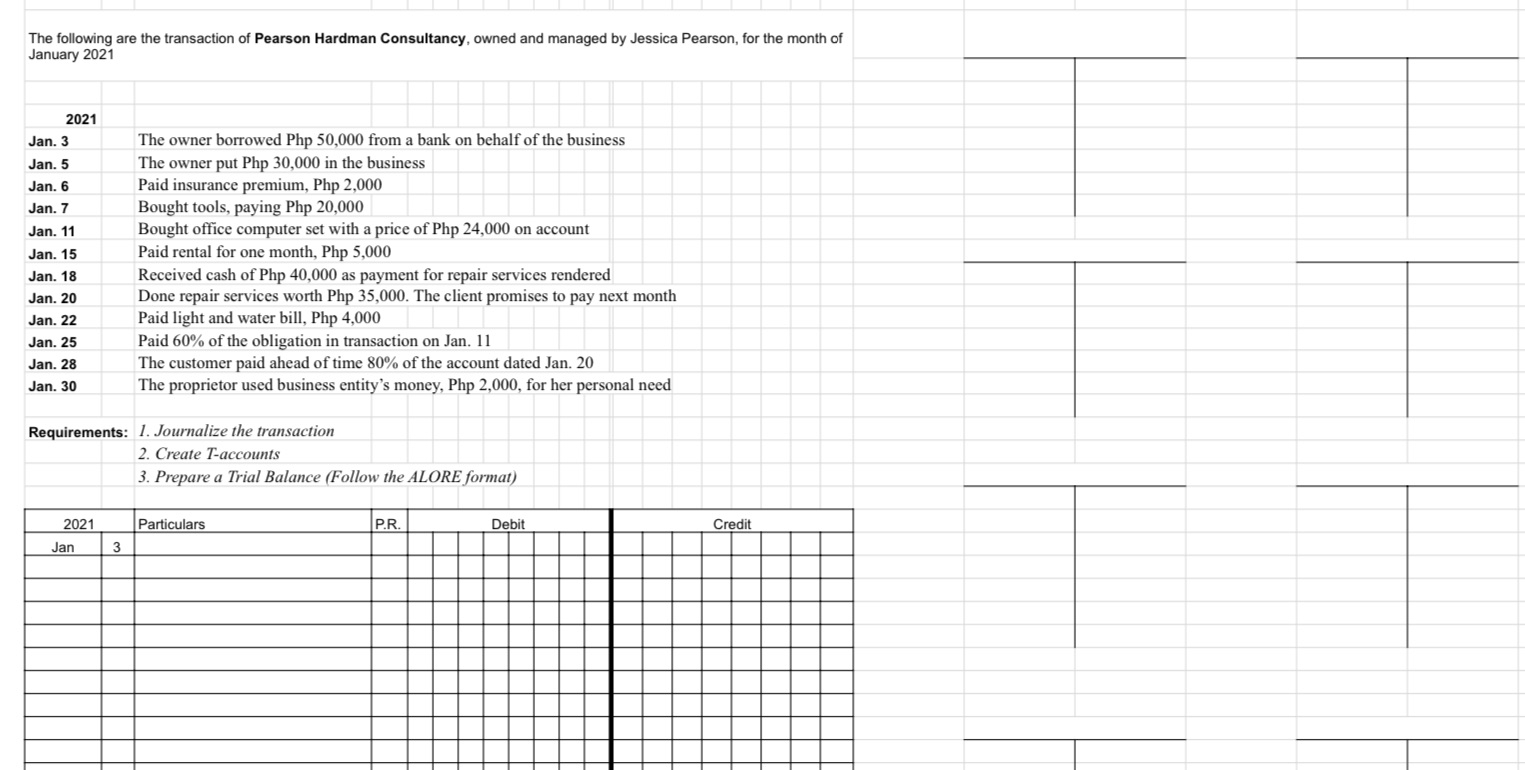

The following are the transaction of Pearson Hardman Consultancy, owned and managed by Jessica Pearson, for the month of January 2021 2021 Jan. 3 The owner borrowed Php 50,000 from a bank on behalf of the business Jan. 5 The owner put Php 30,000 in the business Jan. 6 Paid insurance premium, Php 2,000 Jan. 7 Bought tools, paying Php 20,000 Jan. 11 Bought office computer set with a price of Php 24,000 on account Jan. 15 Paid rental for one month, Php 5,000 Jan. 18 Received cash of Php 40,000 as payment for repair services rendered Jan. 20 Done repair services worth Php 35,000. The client promises to pay next month Jan. 22 Paid light and water bill, Php 4,000 Jan. 25 Paid 60% of the obligation in transaction on Jan. 11 Jan. 28 The customer paid ahead of time 80% of the account dated Jan. 20 Jan. 30 The proprietor used business entity's money, Php 2,000, for her personal need Requirements: 1. Journalize the transaction 2. Create T-accounts 3. Prepare a Trial Balance (Follow the ALORE format) 2021 Particulars P.R. Debit Credit Jan 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts