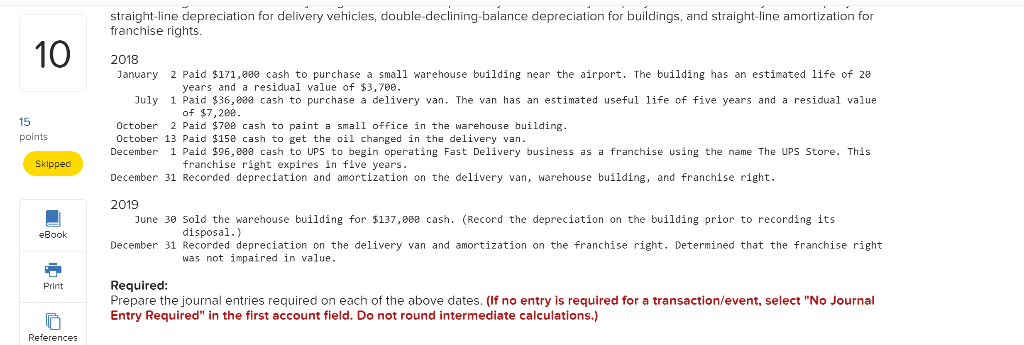

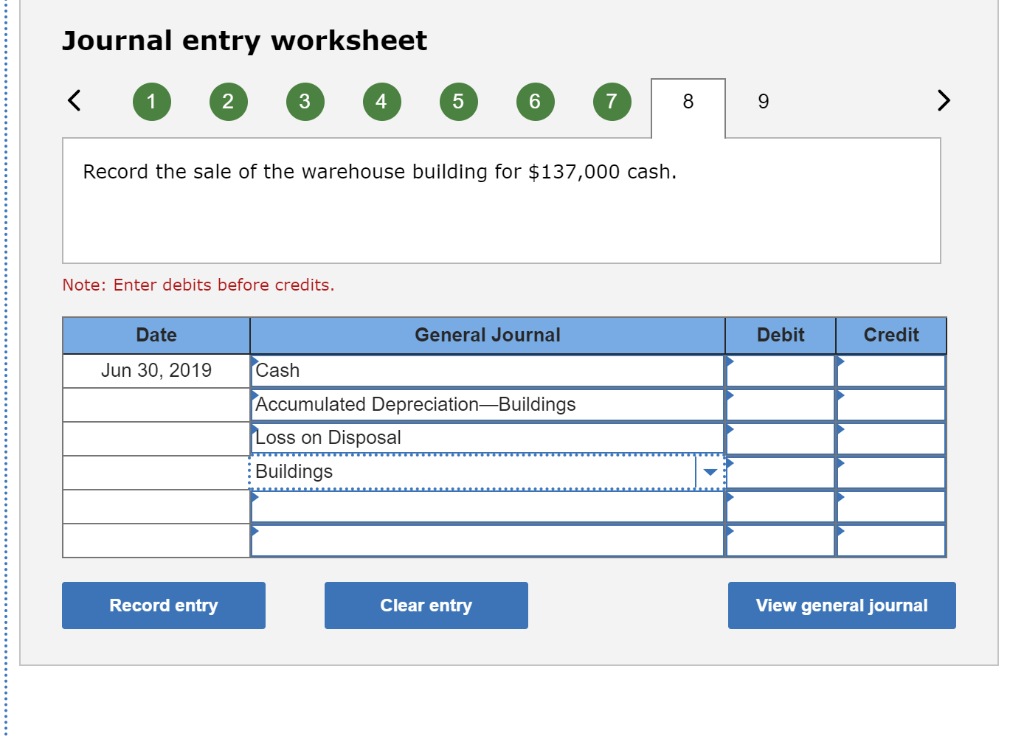

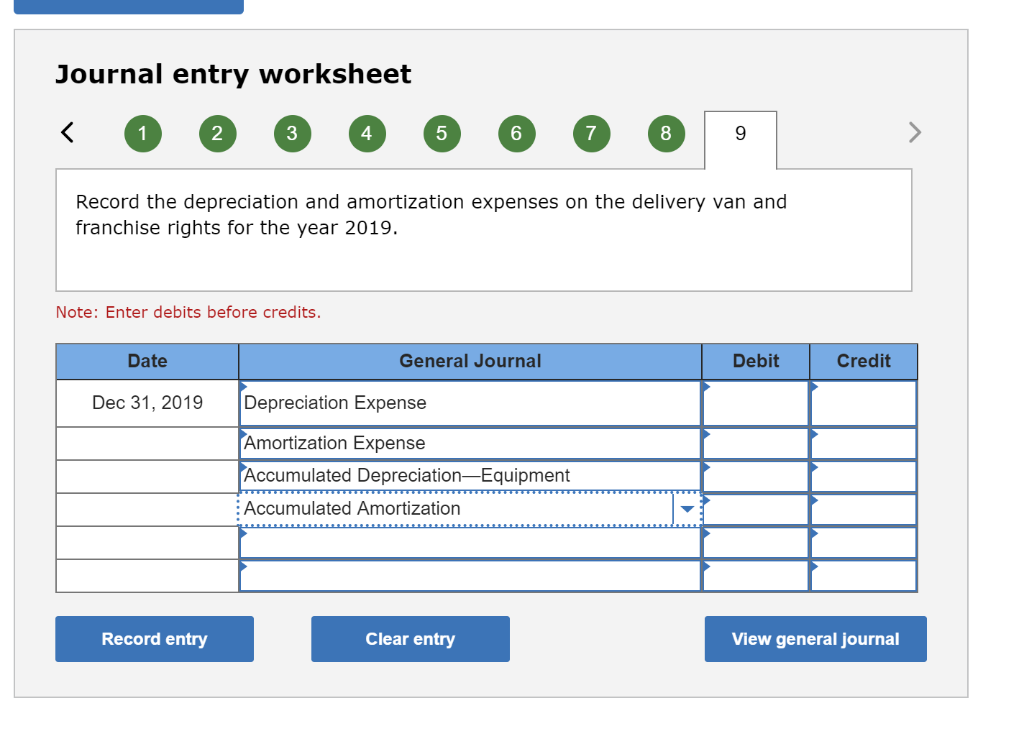

Question: Journal entry worksheet 1 2 3 4 5 8 Record the depreciation and amortization expenses on the delivery van, warehouse building, and franchise rights for

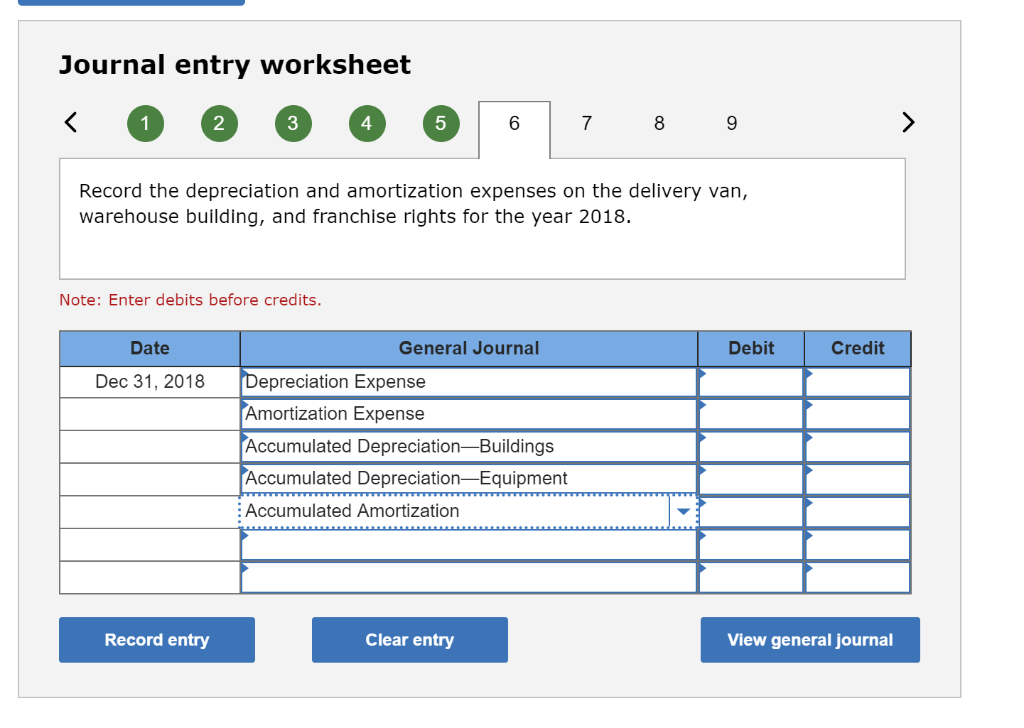

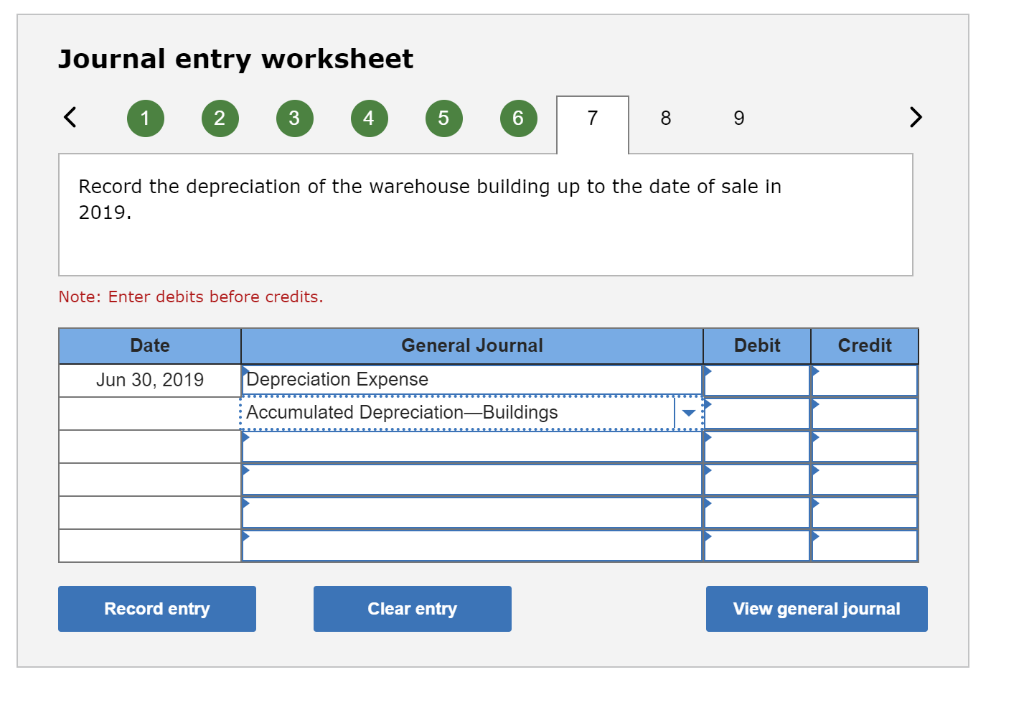

Journal entry worksheet 1 2 3 4 5 8 Record the depreciation and amortization expenses on the delivery van, warehouse building, and franchise rights for the year 2018. Note: Enter debits before credits. Date General Journal Debit Credit Depreciation Expense Amortization Expense Accumulated Depreciation Buildings Accumulated Depreciation-Equipment Accumulated Amortization Dec 31, 2018 Record entry Clear entry View general journal Journal entry worksheet 2 3 4 5 6 Record the depreciation of the warehouse building up to the date of sale in 2019. Note: Enter debits before credits. Date General Journal Debit Credit epreciation Expense Accumulated Depreciation-Buildings Jun 30, 2019 Record entry Clear entry View general journal Journal entry worksheet 2 3 4 6 7 8 9 Record the sale of the warehouse building for $137,000 cash. Note: Enter debits before credits. Date General Journal Debit Credit Cash Accumulated Depreciation-Buildings Jun 30, 2019 oss on Disposal Buildings Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts