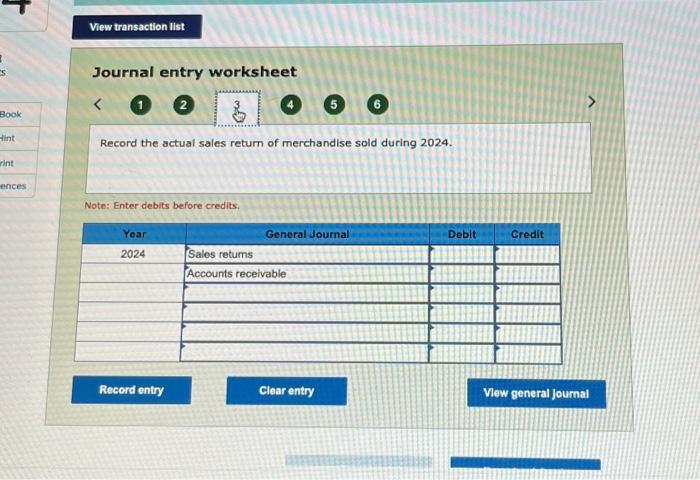

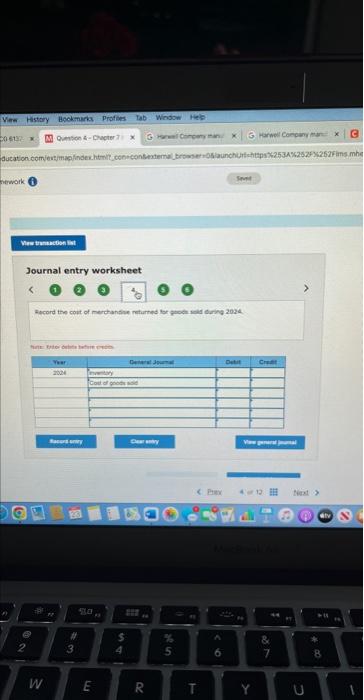

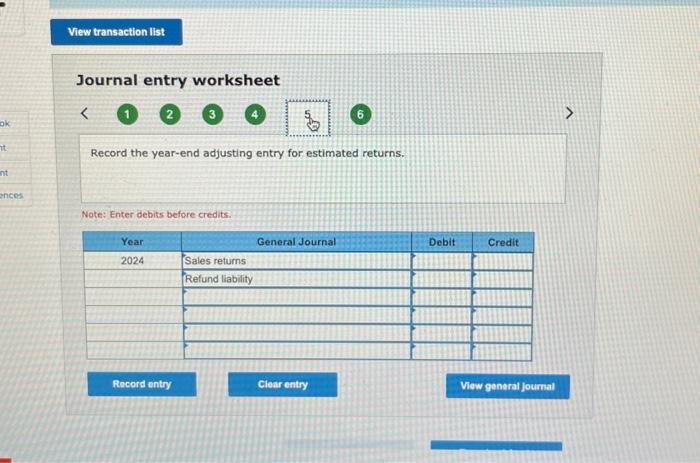

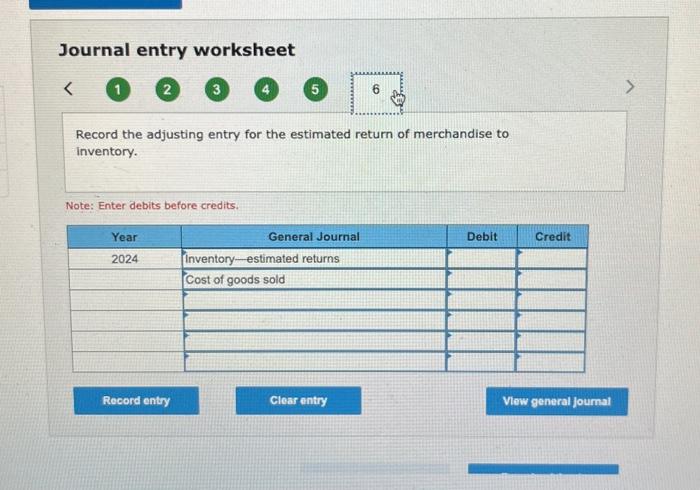

Question: Journal entry worksheet 1 2 3 Record the year-end adjusting entry for estimated returns. Note: Enter debits before credits. Journal entry worksheet 1 5 6

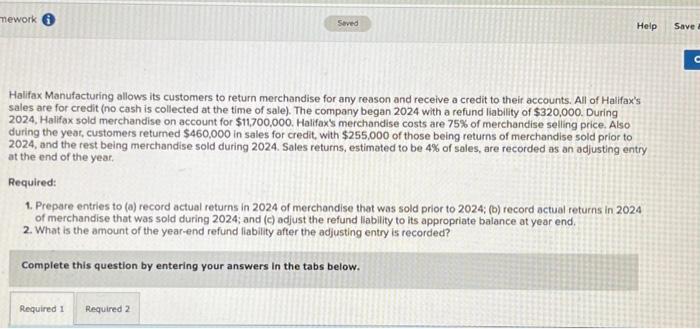

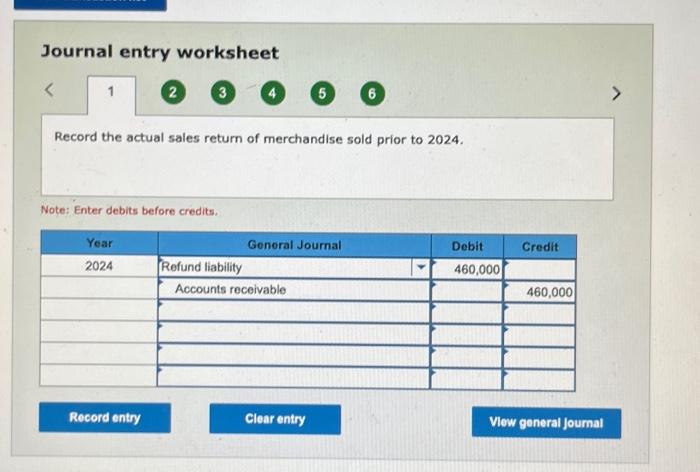

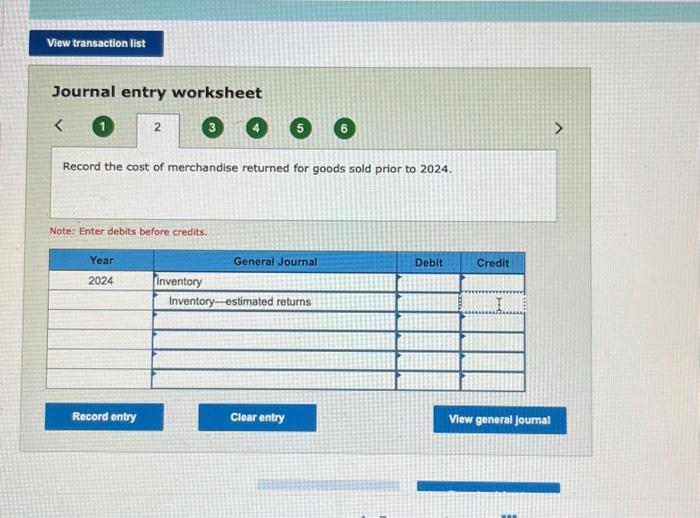

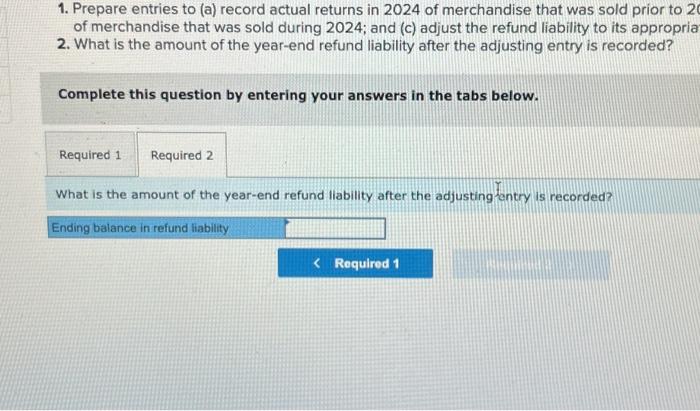

Journal entry worksheet 1 2 3 Record the year-end adjusting entry for estimated returns. Note: Enter debits before credits. Journal entry worksheet 1 5 6 Record the actual sales retum of merchandise sold during 2024. Note: Enter debits before credits. 1. Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2 of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropria 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. What is the amount of the year-end refund liability after the adjusting entry is recorded? Journal entry worksheet Journal entry worksheet Record the adjusting entry for the estimated return of merchandise to inventory. Note: Enter debits before credits. Journal entry worksheet Record the cost of merchandise returned for goods sold prior to 2024. Note: Enter debits before credits. Halifax Manufacturing allows its customers to return merchandise for any reason and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2024 with a refund liability of $320,000. During 2024 , Hallfax sold merchandise on account for $11,700,000. Halifax's merchandise costs are 75% of merchandise selling price. Also during the yeat, customers returned $460,000 in sales for credit, with $255,000 of those being returns of merchandise sold prior to 2024 , and the rest being merchandise sold during 2024. Sales returns, estimated to be 4% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2024; (b) record actual returns in 2024 of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. Journal entry worksheet (2) 3 (4) 5 (5) 6 Record the actual sales return of merchandise sold prior to 2024. Note: Enter debits before credits. Journal entry worksheet 1 2 3 Record the year-end adjusting entry for estimated returns. Note: Enter debits before credits. Journal entry worksheet 1 5 6 Record the actual sales retum of merchandise sold during 2024. Note: Enter debits before credits. 1. Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2 of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropria 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. What is the amount of the year-end refund liability after the adjusting entry is recorded? Journal entry worksheet Journal entry worksheet Record the adjusting entry for the estimated return of merchandise to inventory. Note: Enter debits before credits. Journal entry worksheet Record the cost of merchandise returned for goods sold prior to 2024. Note: Enter debits before credits. Halifax Manufacturing allows its customers to return merchandise for any reason and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2024 with a refund liability of $320,000. During 2024 , Hallfax sold merchandise on account for $11,700,000. Halifax's merchandise costs are 75% of merchandise selling price. Also during the yeat, customers returned $460,000 in sales for credit, with $255,000 of those being returns of merchandise sold prior to 2024 , and the rest being merchandise sold during 2024. Sales returns, estimated to be 4% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2024; (b) record actual returns in 2024 of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. Journal entry worksheet (2) 3 (4) 5 (5) 6 Record the actual sales return of merchandise sold prior to 2024. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts