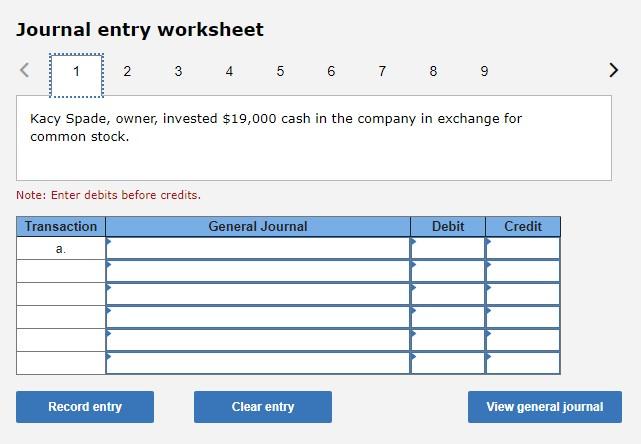

Question: Journal entry worksheet 2 3 4 5 6 7 8 9 > Kacy Spade, owner, invested $19,000 cash in the company in exchange for common

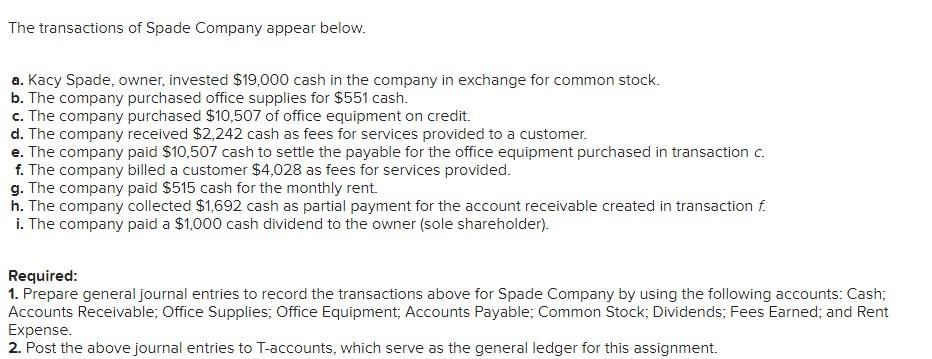

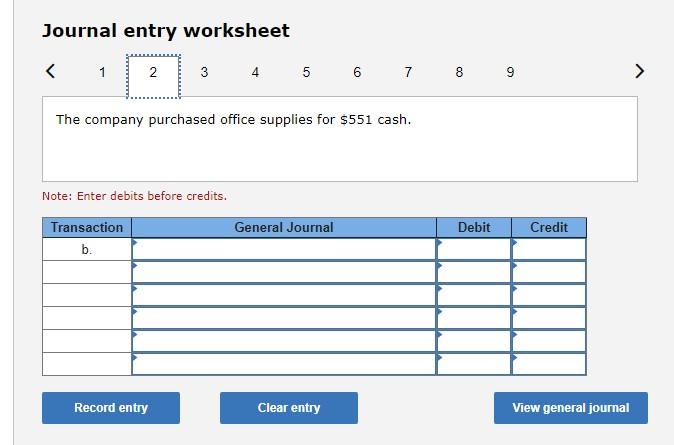

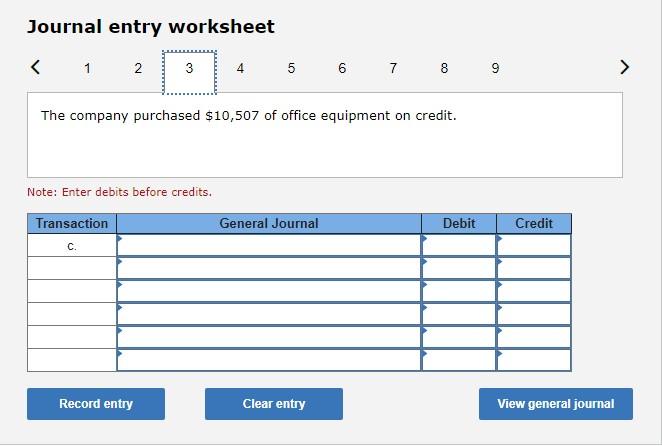

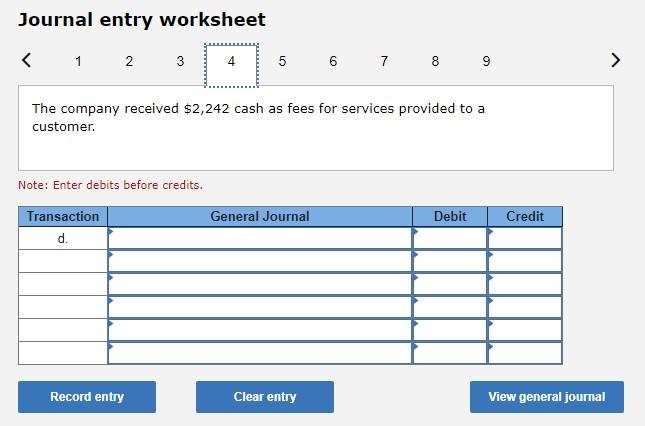

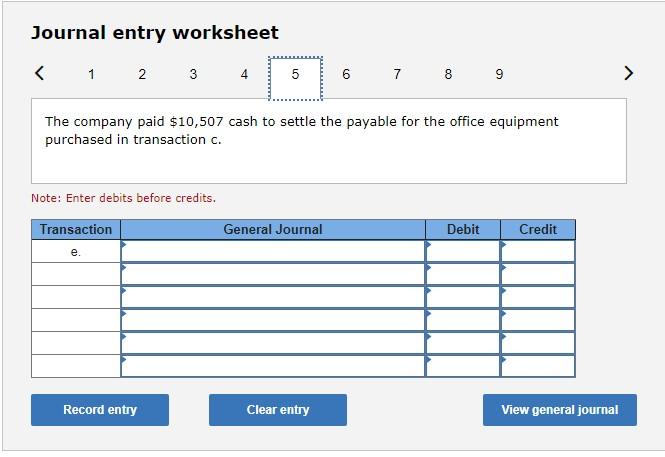

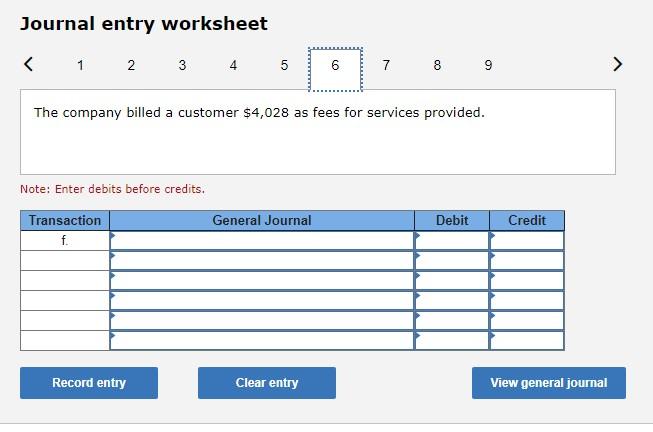

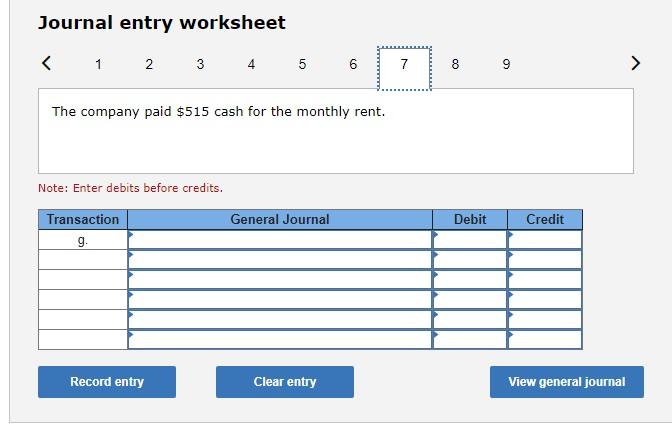

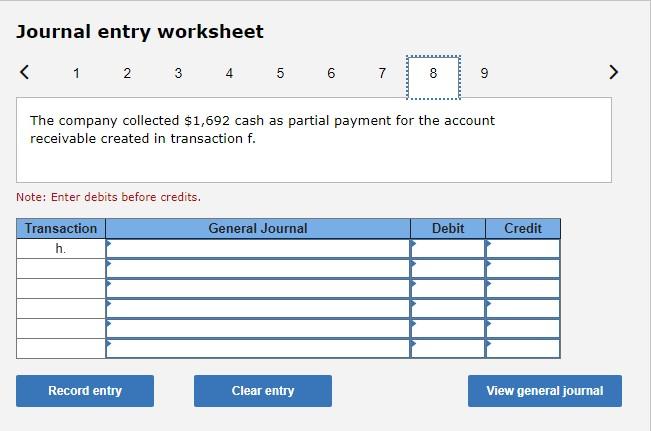

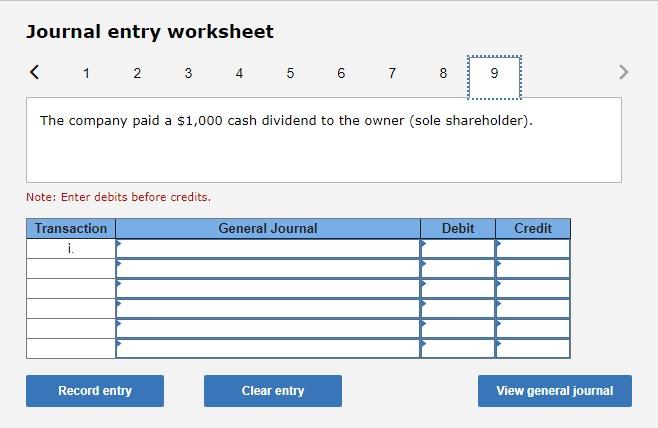

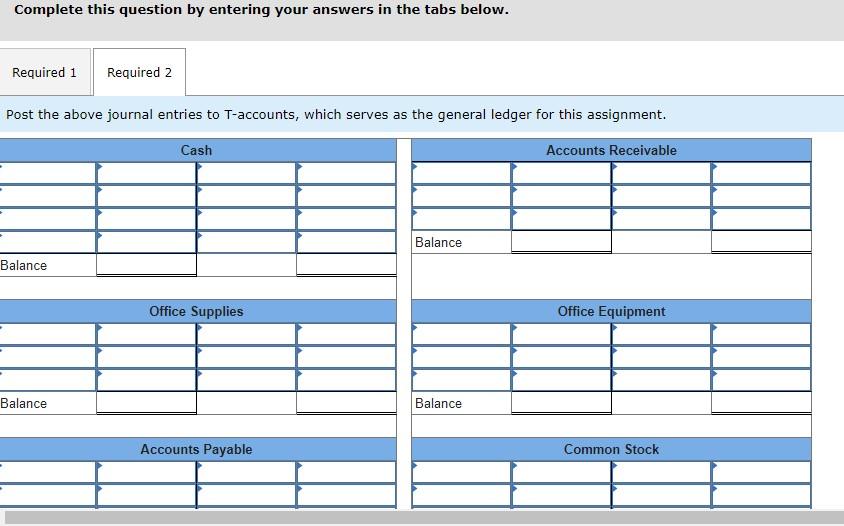

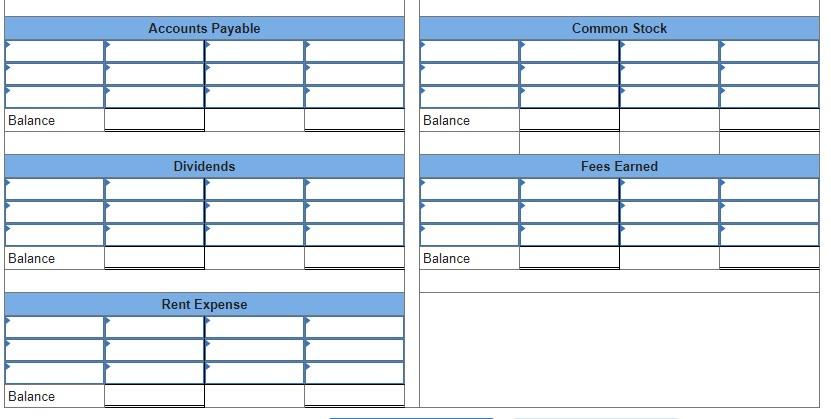

Journal entry worksheet 2 3 4 5 6 7 8 9 > Kacy Spade, owner, invested $19,000 cash in the company in exchange for common stock. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal The transactions of Spade Company appear below. a. Kacy Spade, owner, invested $19,000 cash in the company in exchange for common stock. b. The company purchased office supplies for $551 cash. c. The company purchased $10,507 of office equipment on credit. d. The company received $2,242 cash as fees for services provided to a customer. e. The company paid $10,507 cash to settle the payable for the office equipment purchased in transaction c. f. The company billed a customer $4,028 as fees for services provided. g. The company paid $515 cash for the monthly rent. h. The company collected $1,692 cash as partial payment for the account receivable created in transaction f. i. The company paid a $1,000 cash dividend to the owner (sole shareholder). Required: 1. Prepare general journal entries to record the transactions above for Spade Company by using the following accounts: Cash; Accounts Receivable: Office Supplies; Office Equipment; Accounts Payable; Common Stock; Dividends, Fees Earned; and Rent Expense. 2. Post the above journal entries to T-accounts, which serve as the general ledger for this assignment. Journal entry worksheet The company purchased office supplies for $551 cash. Note: Enter debits before credits. Transaction General Journal b. Debit Credit Record entry Clear entry View general journal Journal entry worksheet The company purchased $10,507 of office equipment on credit. Note: Enter debits before credits. Transaction General Journal Debit Credit C. Record entry Clear entry View general journal Journal entry worksheet The company received $2,242 cash as fees for services provided to a customer. Note: Enter debits before credits. General Journal Debit Credit Transaction d. Record entry Clear entry View general journal Journal entry worksheet 1 2 3 4 5 09 6 7 8 9 The company paid $10,507 cash to settle the payable for the office equipment purchased in transaction c. Note: Enter debits before credits. Transaction General Journal Debit Credit e. Record entry Clear entry View general journal Journal entry worksheet The company paid $515 cash for the monthly rent. Note: Enter debits before credits. General Journal Debit Credit Transaction g. Record entry Clear entry View general journal Journal entry worksheet 1 2 3 4 5 6 7 8 8 9 The company collected $1,692 cash as partial payment for the account receivable created in transaction f. Note: Enter debits before credits. Transaction h. General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts