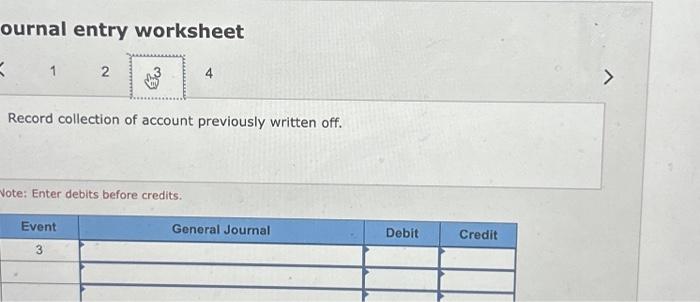

Question: Journal entry worksheet 2 4 Complete this question by entering your answers in the tabs below. How would accounts receivable be shown in the 2024

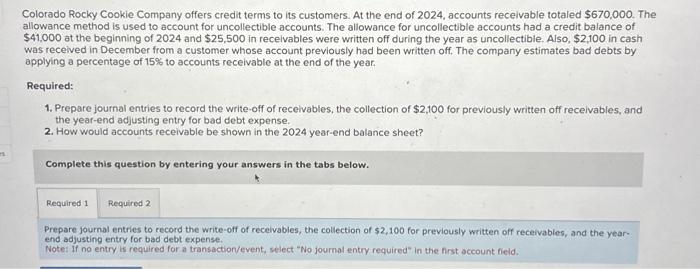

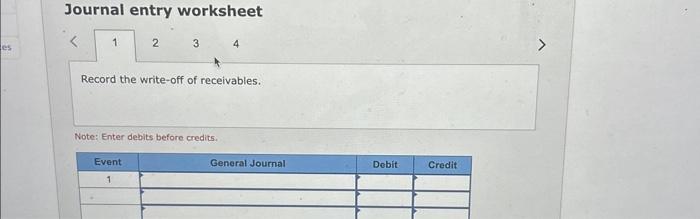

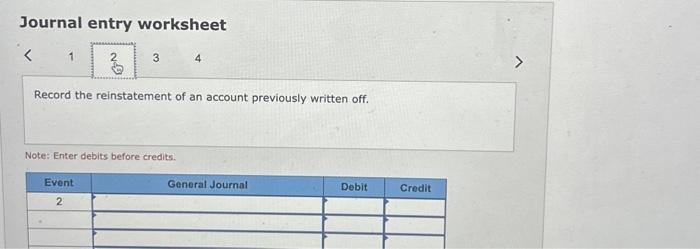

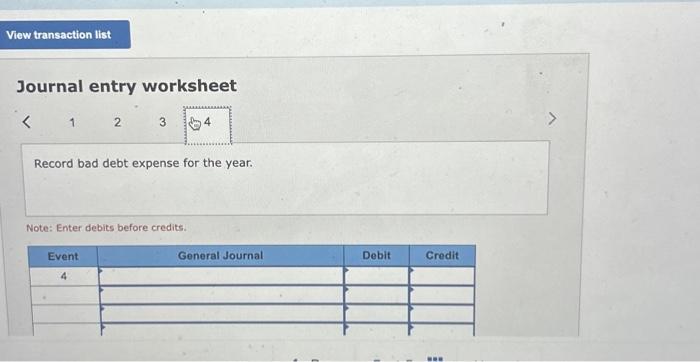

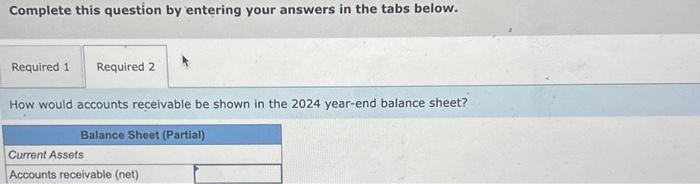

Journal entry worksheet 2 4 Complete this question by entering your answers in the tabs below. How would accounts receivable be shown in the 2024 year-end balance sheet? Colorado Rocky Cookie Company offers credit terms to its customers. At the end of 2024 , accounts receivable totaled $670,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $41,000 at the beginning of 2024 and $25,500 in receivables were written off during the year as uncollectible. Also, $2,100 in cash was received in December from a customer whose account previously had been written off, The company estimates bad debts by applying a percentage of 15% to accounts receivable at the end of the year. Required: 1. Prepare journal entries to record the write-off of recelvables, the collection of $2,100 for previously written off recelvables, and the year-end adjusting entry for bad debt expense. 2. How would accounts receivable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare journal entries to record the write-off of recelvables, the collection of $2,100 for previously written off receivables, and the yearend adjusting entry for bad debt expense. Note: if no entry is required for a transaction/event, select "No journal entry required" in the first sccount field. Journal entry worksheet 1 Note: Enter debits before credits. ournal entry worksheet Record collection of account previously written off. Note: Enter debits before credits. Journal entry worksheet Record the reinstatement of an account previously written off. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts