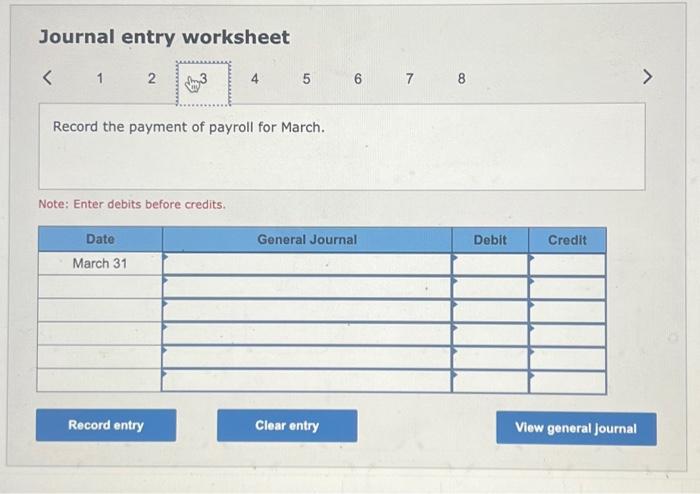

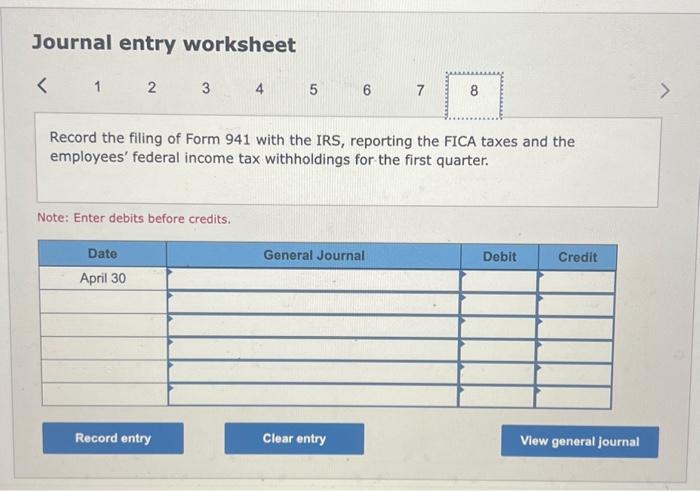

Question: Journal entry worksheet 45 Note: Enter debits before credits. Journal entry worksheet Record the filing of Form 941 with the IRS, reporting the FICA taxes

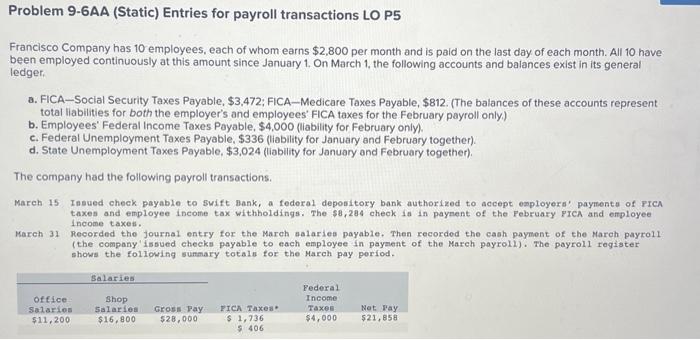

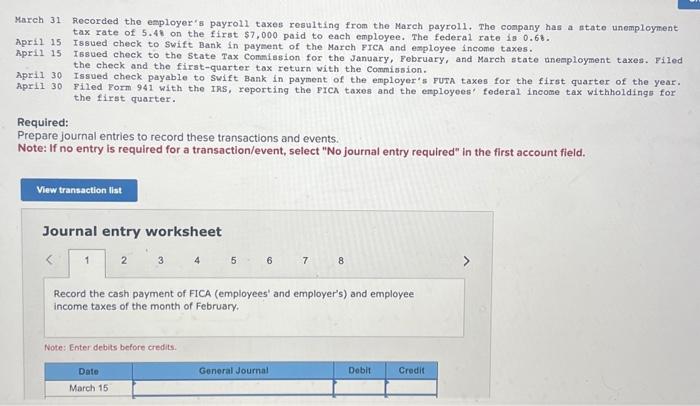

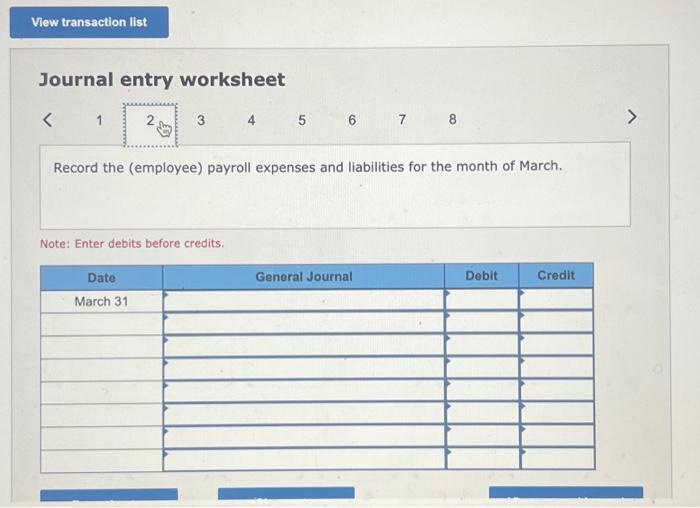

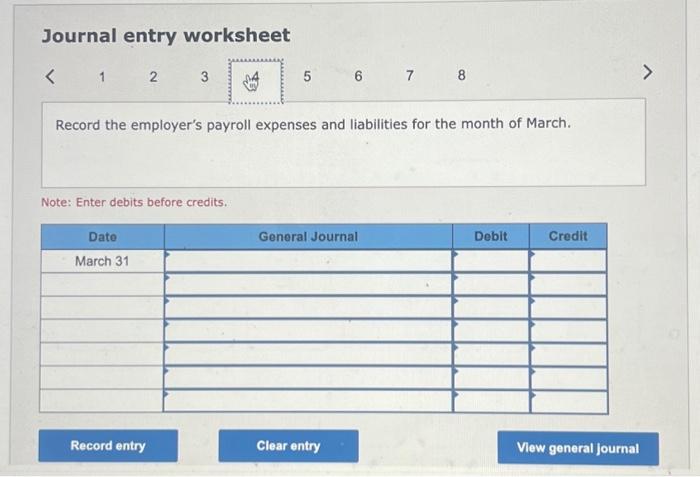

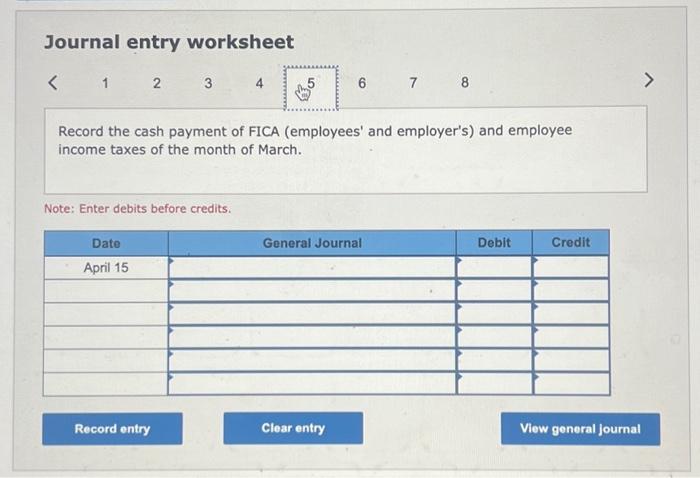

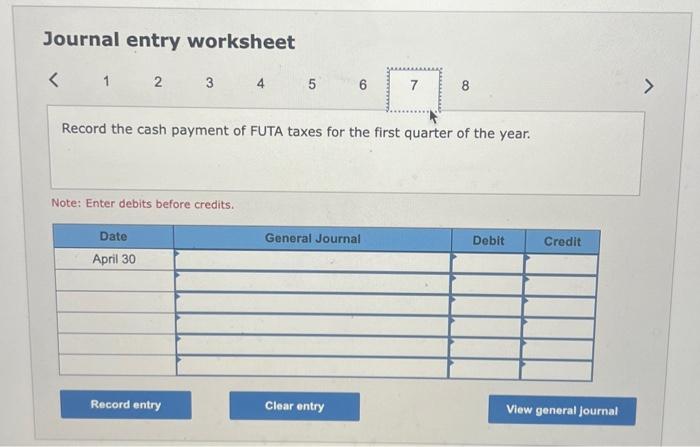

Journal entry worksheet 45 Note: Enter debits before credits. Journal entry worksheet Record the filing of Form 941 with the IRS, reporting the FICA taxes and the employees' federal income tax withholdings for the first quarter. Note: Enter debits before credits. Journal entry worksheet Record the employer's payroll expenses and liabilities for the month of March. Note: Enter debits before credits. Journal entry worksheet 45678 Record the (employee) payroll expenses and liabilities for the month of March. Note: Enter debits before credits. Journal entry worksheet Record the cash payment of FUTA taxes for the first quarter of the year. Note: Enter debits before credits. March 31 Recorded the esployer's payroll taxes resulting from the March payrol1. The company has a atate unemployment. tax rate of 5.41 on the first $7,000 paid to each employee. The federal rate 180.68 . Apri1 15 Issued check to Swift Bank in payment of the March FICA and exployee income taxes. April 15 Issued check to the State Tax Comnission for the January, Fobruary, and March state aneaployment taxes. Filed the check and the first-quarter tax return with the Commission. April 30 Issued check payable to Suift Bank in payment of the employer's FurA taxes for the first quarter of the year. April 30 Filed Form 941 with the IAS, reporting the PICA taxes and the erployees' federal income tax withholding for the first quarter. Required: Prepare journal entries to record these transactions and events. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 2345678 Record the cash payment of FICA (employees' and employer's) and employee income taxes of the month of February. Note: Enter debits before credits. Journal entry worksheet Record the cash payment of FICA (employees' and employer's) and employee income taxes of the month of March. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts