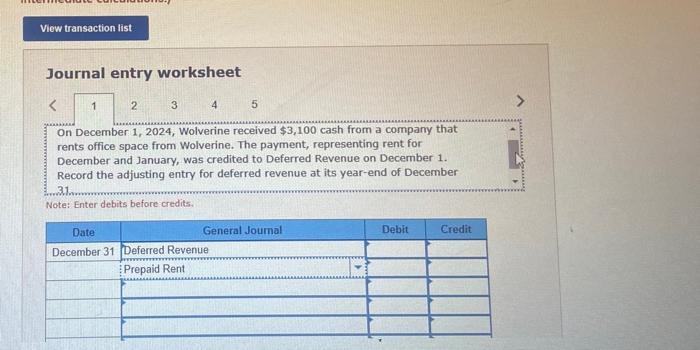

Question: Journal entry worksheet 5 On December 1,2024 , Wolverine received $3,100 cash from a company that rents office space from Wolverine. The payment, representing rent

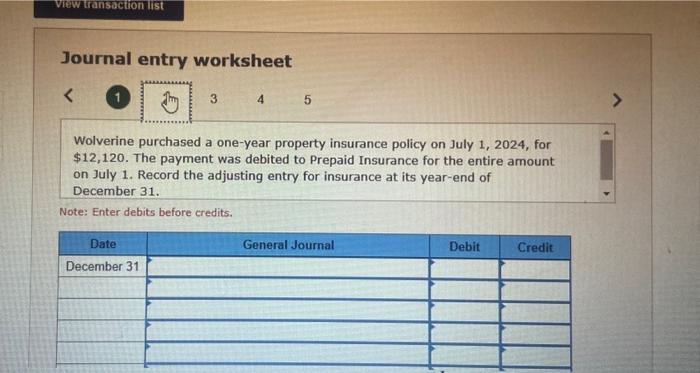

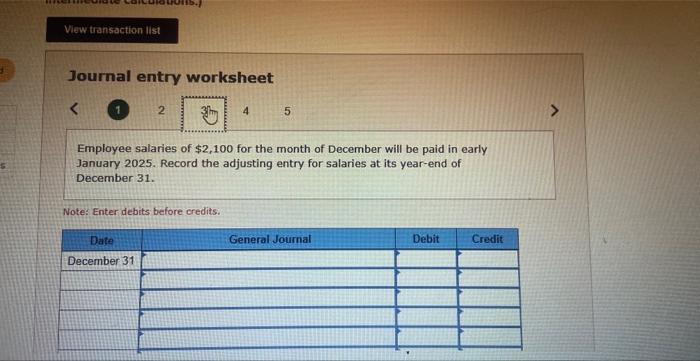

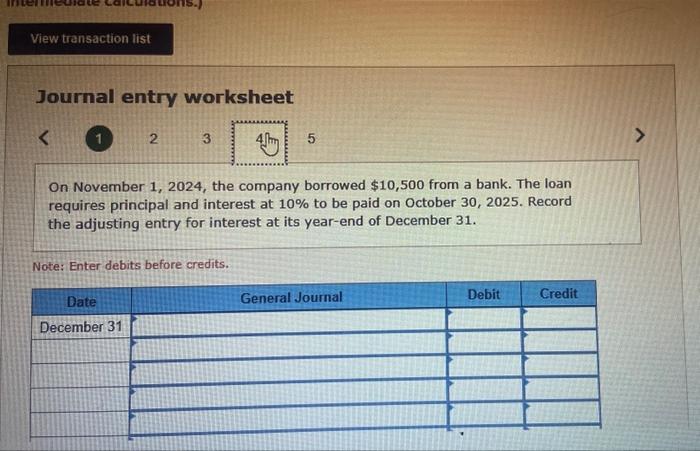

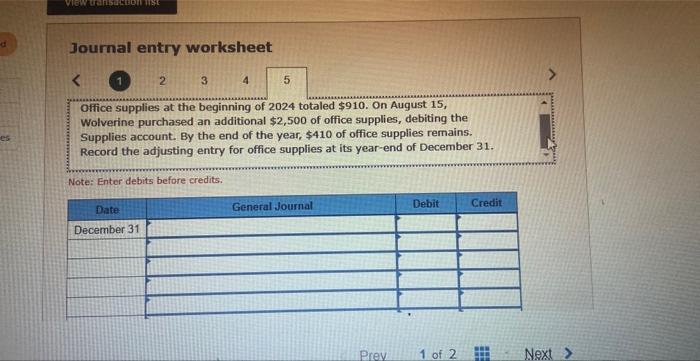

Journal entry worksheet 5 On December 1,2024 , Wolverine received $3,100 cash from a company that rents office space from Wolverine. The payment, representing rent for December and January, was credited to Deferred Revenue on December 1 . Record the adjusting entry for deferred revenue at its year-end of December Journal entry worksheet 5 Wolverine purchased a one-year property insurance policy on July 1,2024 , for $12,120. The payment was debited to Prepaid Insurance for the entire amount on July 1. Record the adjusting entry for insurance at its year-end of December 31. Note: Enter debits before credits. Journal entry worksheet Employee salaries of $2,100 for the month of December will be paid in early January 2025 . Record the adjusting entry for salaries at its year-end of December 31. Note: Enter debits before oredits. Journal entry worksheet On November 1,2024 , the company borrowed $10,500 from a bank. The loan requires principal and interest at 10% to be paid on October 30,2025 . Record the adjusting entry for interest at its year-end of December 31 . Note: Enter debits before credits. Journal entry worksheet 2 3 Oifice supplies at the beginning of 2024 totaled $910. On August 15, Wolverine purchased an additional $2,500 of office supplies, debiting the Supplies account. By the end of the year, $410 of office supplies remains. Record the adjusting entry for office supplies at its year-end of December 31. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts