Question: Journal entry worksheet A C D Record the amortized excess value reclassification entry. Note: Enter debits before credits. Journal entry worksheet A B C D

Journal entry worksheet

A

C

D

Record the amortized excess value reclassification entry.

Note: Enter debits before credits. Journal entry worksheet

A

B

C

D

Record the excess value differential reclassification entry.

Note: Enter debits before credits.

tableEventAccounts,Debit,Credit Journal entry worksheet

A

B

C

D

Record the optional accumulated depreciation consolidation entry.

Note: Enter debits before credits.Required:

a Prepare all consolidation entries needed to prepare a threepart consolidation worksheet as of December

b Prepare a threepart consolidation worksheet for in good form..

Complete this question by entering your answers in the tabs below.

Prepare a threepart consolidation worksheet for

Note: Values in the first two columns the "parent" and "subsidiary" balances that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.

Show less A

tablePRICE CORPORATION AND SUBSIDIARYConsolidated Financial Statements WorksheetDecember X

tablePriceCorporation

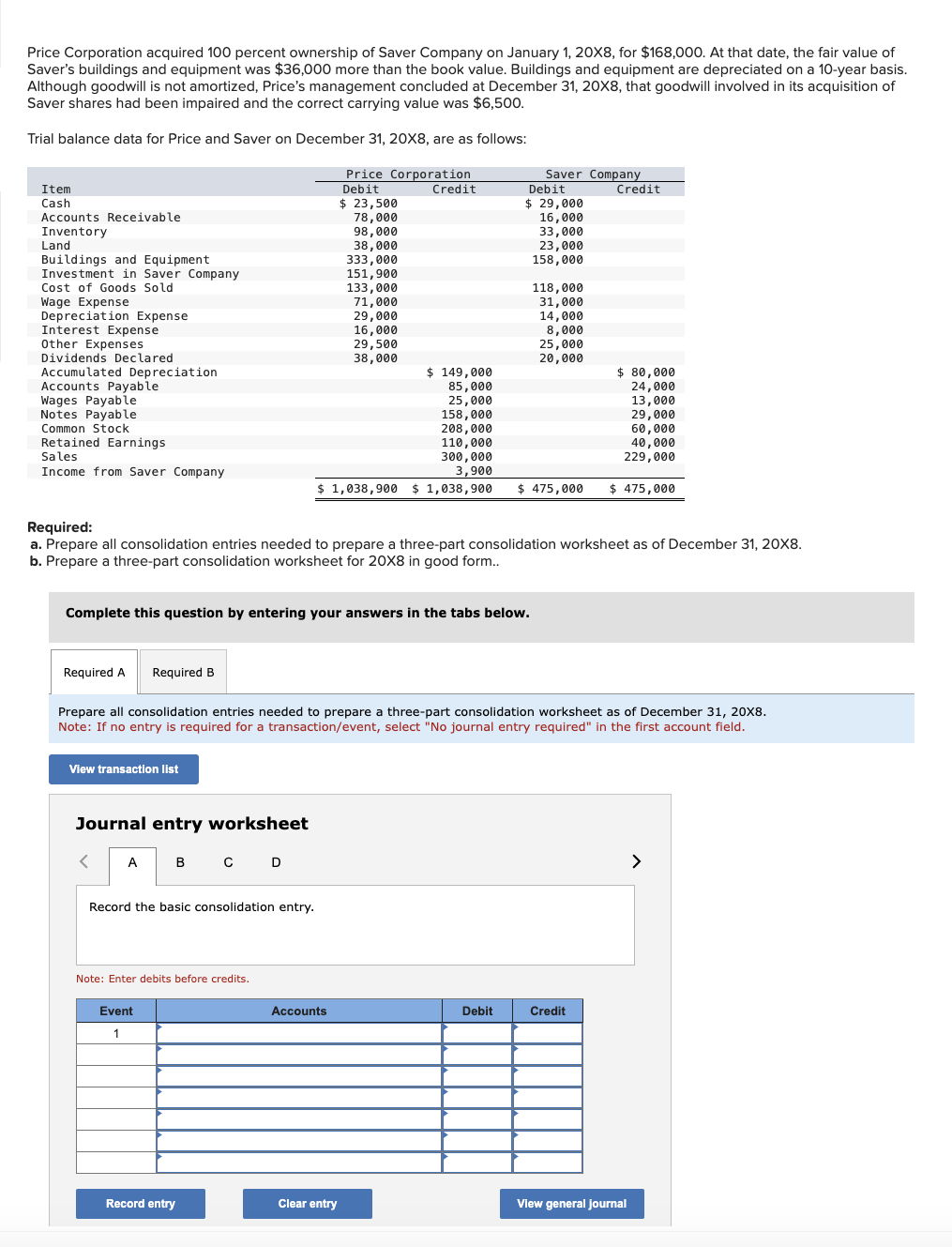

tableSaverCompanyConsolidation Entries,ConsolidatedDebit,CreditIncome StatementSalesLess: COGSLess: Wage expenseLess: Depreciation expenseLess: Interest expenseLess: Other expensesLess: Impairment lossIncome from Saver CompanyNet Income,$$$$$Statement of Retained EarningsBeginning balanceNet incomeLess: Dividends declaredEnding Balance,$$$$$AssetsCashAccounts receivableInventoryLandBuildings and equipmentLess: Accumulated depreciationInvestment in Saver Compan,,,,,,,GoodwillTotal Assets,$$$$$Liabilities and Stockholders,,,,,,,Accounts payable,,,,,,,Wages payable,,,,,,,Notes payable,,,,,,,Common stock,,,,,,,Retained earnings,,,,,,,Total Liabilities and Equity,$$$$Price Corporation acquired percent ownership of Saver Company on January for $ At that date, the fair value of

Saver's buildings and equipment was $ more than the book value. Buildings and equipment are depreciated on a year basis.

Although goodwill is not amortized, Price's management concluded at December that goodwill involved in its acquisition of

Saver shares had been impaired and the correct carrying value was $

Trial balance data for Price and Saver on December X are as follows:

Required:

a Prepare all consolidation entries needed to prepare a threepart consolidation worksheet as of December X

b Prepare a threepart consolidation worksheet for in good form..

Complete this question by entering your answers in the tabs below.

Prepare all consolidation entries needed to prepare a threepart consolidation worksheet as of December X

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record the basic consolidation entry.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock