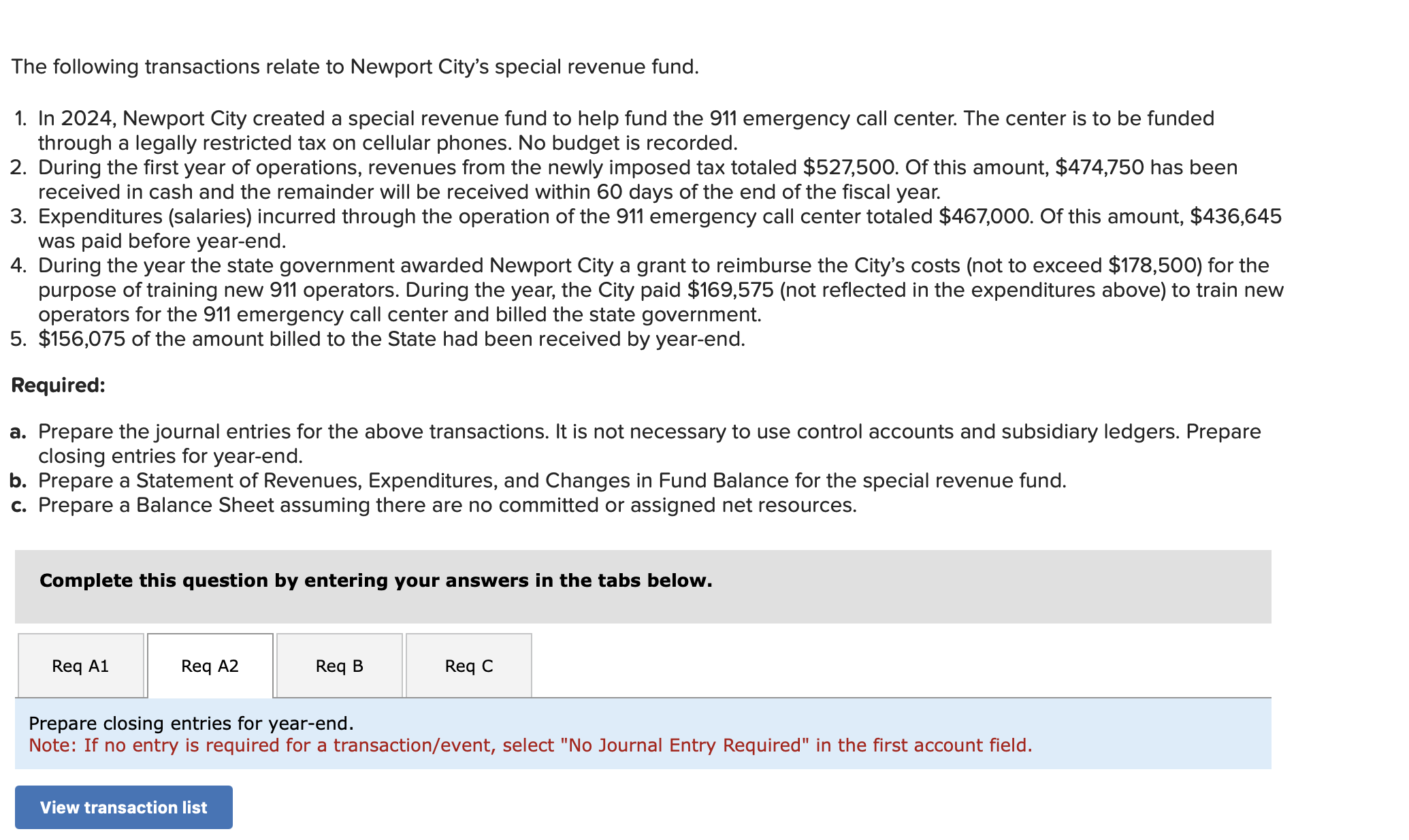

Question: Journal entry worksheet A Record the closing entry. Note: Enter debits before credits. table [ [ NEWPORT CITY ] , [ 9 1 1

Journal entry worksheet

A

Record the closing entry.

Note: Enter debits before credits. tableNEWPORT CITY CALL CENTER SPECIAL REVENUE FUNDStatement of Revenues, Expenditures, and Changes in Fund BalanceFor the Year Ended December table EmergencyServicesRevenues:PPTotal Revenues,Expenditures:Current:Total Expenditures,Net Change in Fund Balance,Fund Balance, January Fund Balance, December $tableNEWPORT CITY CALL CENTER SPECIAL REVENUE FUNDBalance SheetAs of December table EmergencyServicesAssetsTotal Assets,$ Liabilities and Fund BalancesLiabilities:Total Liabilities,Fund Balances:,Total Fund Balances,Total Liabilities and Fund Balances,$The following transactions relate to Newport City's special revenue fund.

In Newport City created a special revenue fund to help fund the emergency call center. The center is to be funded

through a legally restricted tax on cellular phones. No budget is recorded.

During the first year of operations, revenues from the newly imposed tax totaled $ Of this amount, $ has been

received in cash and the remainder will be received within days of the end of the fiscal year.

Expenditures salaries incurred through the operation of the emergency call center totaled $ Of this amount, $

was paid before yearend.

During the year the state government awarded Newport City a grant to reimburse the City's costs not to exceed $ for the

purpose of training new operators. During the year, the City paid $not reflected in the expenditures above to train new

operators for the emergency call center and billed the state government.

$ of the amount billed to the State had been received by yearend.

Required:

a Prepare the journal entries for the above transactions. It is not necessary to use control accounts and subsidiary ledgers. Prepare

closing entries for yearend.

b Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balance for the special revenue fund.

c Prepare a Balance Sheet assuming there are no committed or assigned net resources.

Complete this question by entering your answers in the tabs below.

Prepare closing entries for yearend.

Note: If no entry is required for a transactionevent select No Journal Entry Required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock