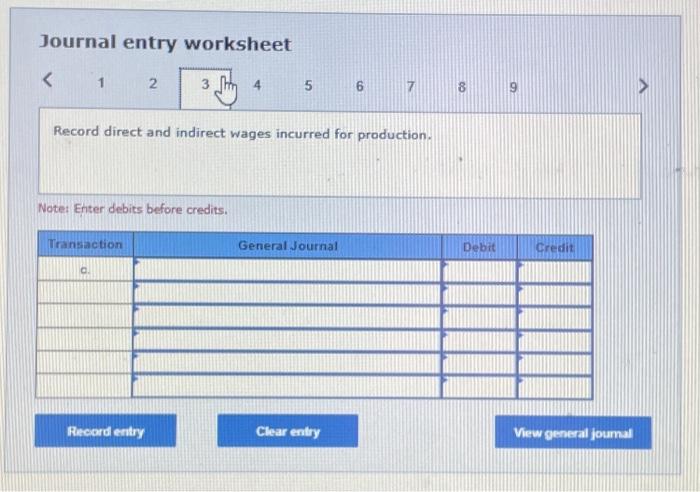

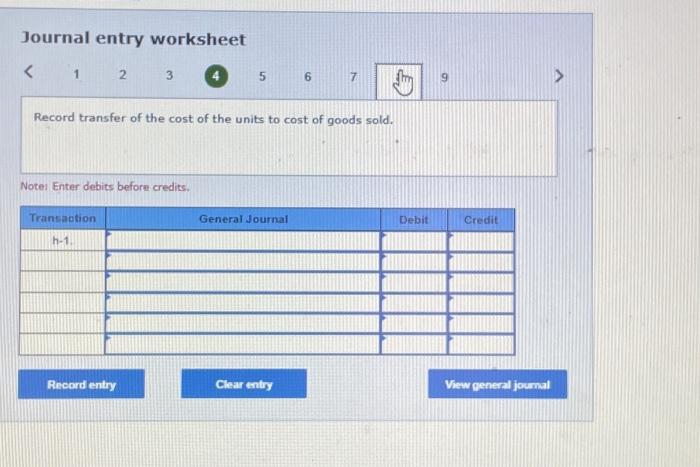

Question: Journal entry worksheet begin{tabular}{llll|l|l|} hline & 2 & 3 & 5 & 6 & 7 hline end{tabular} Record transfer of the cost of the

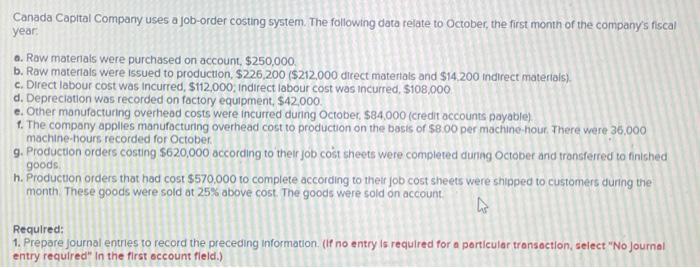

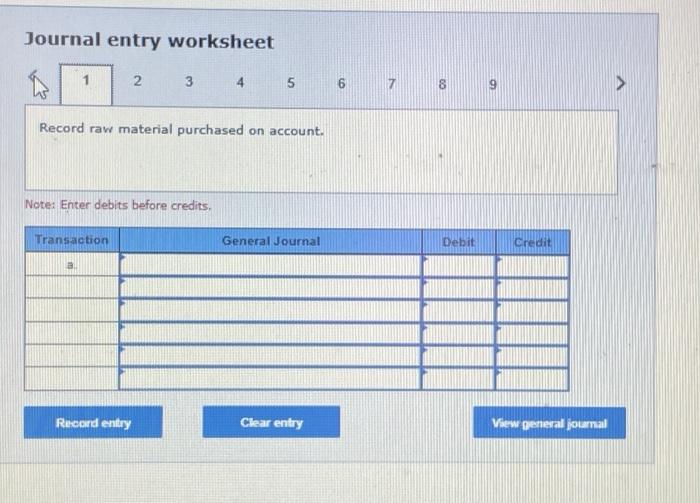

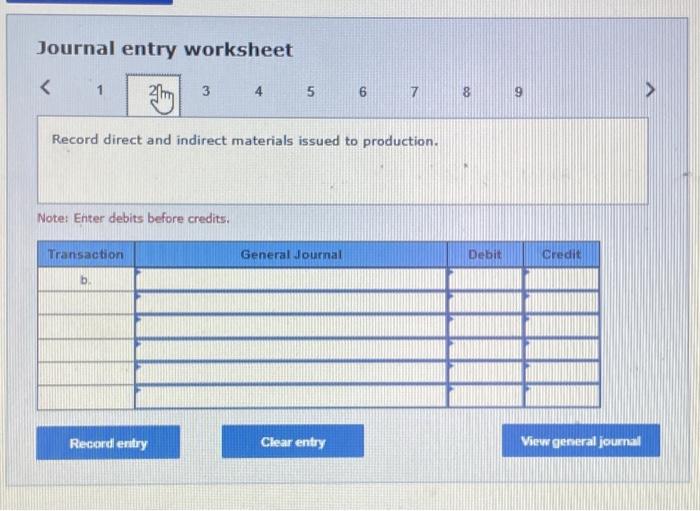

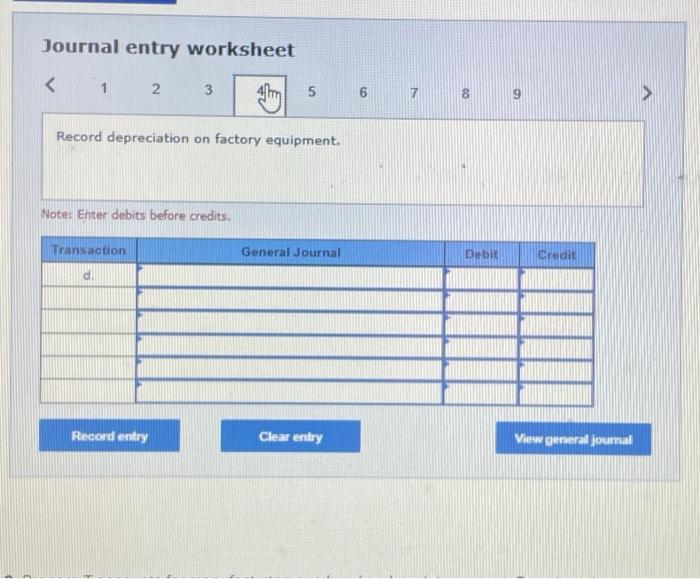

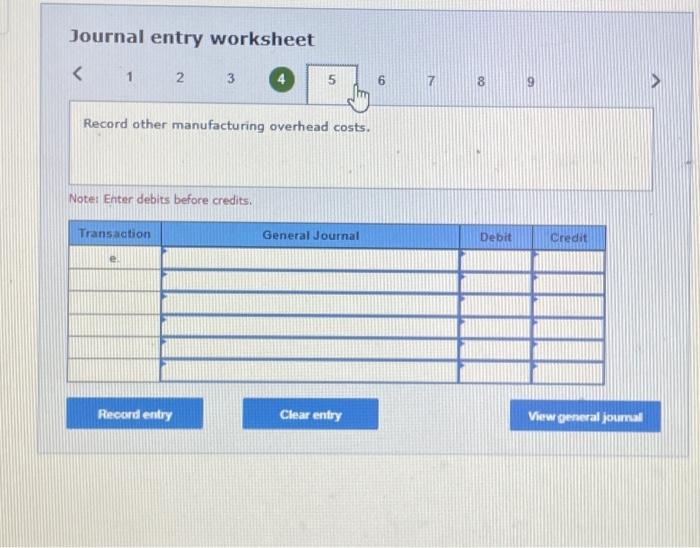

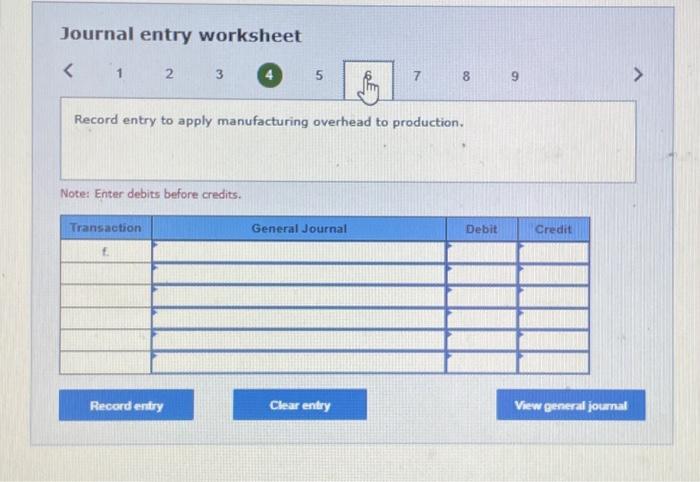

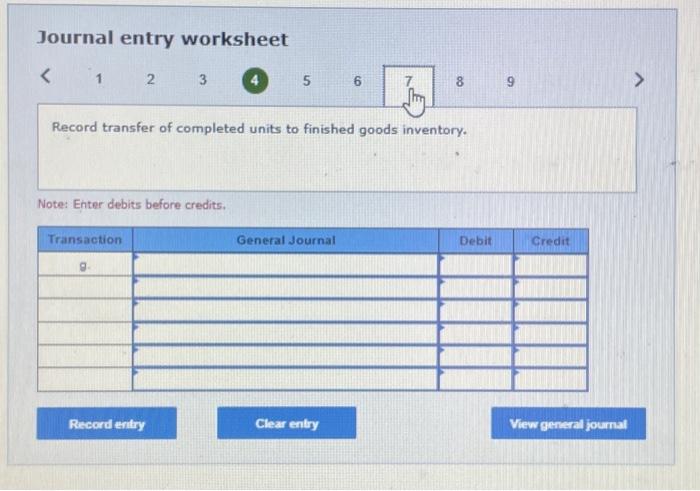

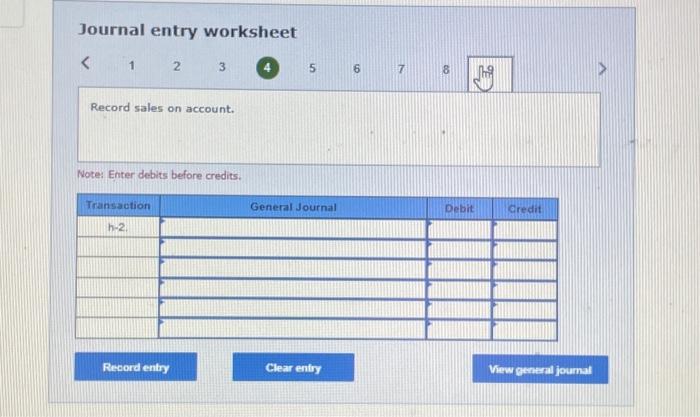

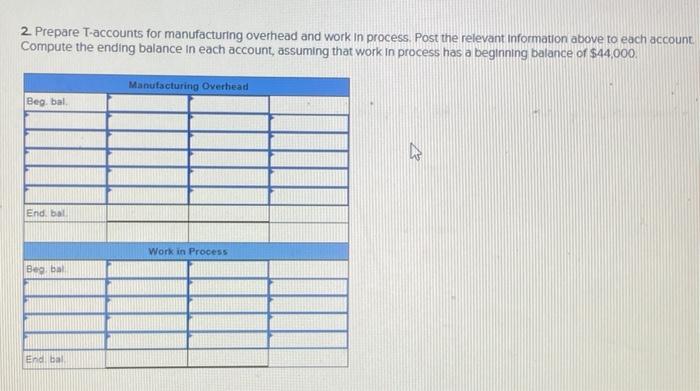

Journal entry worksheet \begin{tabular}{llll|l|l|} \hline & 2 & 3 & 5 & 6 & 7 \\ \hline \end{tabular} Record transfer of the cost of the units to cost of goods sold. Notes Enter debits before credits. Journal entry worksheet Journal entry worksheet 1 Note: Enter debits before credits. Journal entry worksheet \begin{tabular}{lll} 1 & 3 & 5 \\ \hline \end{tabular} Record transfer of completed units to finished goods inventory. Note: Ehter debits before credits. Journal entry worksheet Record direct and indirect materials issued to production. Note: Enter debits before credits. 2. Prepare T-accounts for manufacturing overhead and work in process. Post the relevant information above to each account Compute the ending balance in each account, assuming that work in process has a beginning balance of $44.000. Journal entry worksheet \begin{tabular}{lll} 1 & 2 & 3 \end{tabular} Record entry to apply manufacturing overhead to production. Note: Enter debits before credits. Canada Capital Company uses a job-order costing system. The following data relate to October, the first month of the companys fiscal year: a. Row materials were purchased on account, $250,000 b. Raw materials were issued to production, $226,200 (\$212,000 direct matertals and $14,200 indirect materials). c. Direct labour cost was incurred, $112,000; indirect labour cost was incurred, $108,000 d. Depreciation was recorded on factory equipment, $42,000 e. Other manufacturing overhead costs were incurred during October, $84,000 (credit occounts payable) 1. The company applies manufacturing overhead cost to production on the basis of $8.00 per machine-hour. There were 36.000 mochine-hours recorded for October. 9. Production orders costing $620,000 according to their job cost sheets were completed durng October and tronsferred to finished goods. h. Production orders that had cost $570,000 to complete according to theit job cost sheets were shipped to customers during the month. These goods were sold at 25% above cost. The goods were sold on account. Required: 1. Prepare journal entries to record the preceding information. (if no entry is required for a particular transoction, select "No journal entry requfred" In the first occount fleld.) Journal entry worksheet Record other manufacturing overhead costs. Note: Enter debits before credits. Journal entry worksheet 45 Record raw material purchased on account. Note: Enter debits before credits. Journal entry worksheet \begin{tabular}{ll|l|l} 4 & 5 & 6 & 7 \end{tabular} Record direct and indirect wages incurred for production. Notet Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts