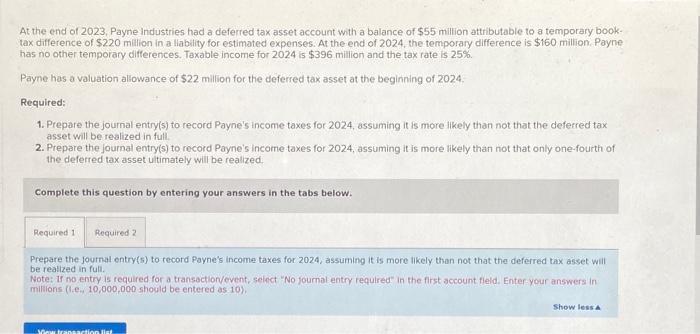

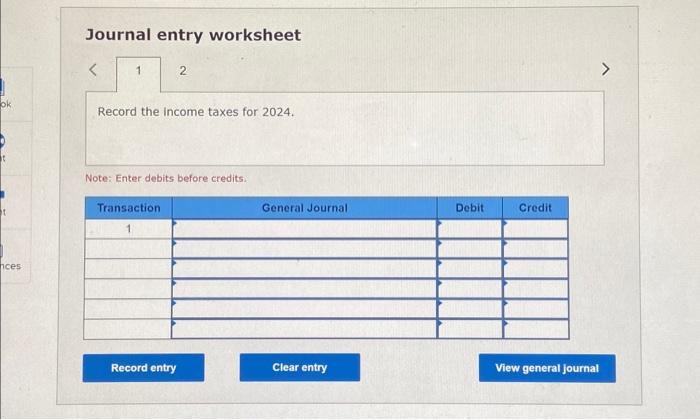

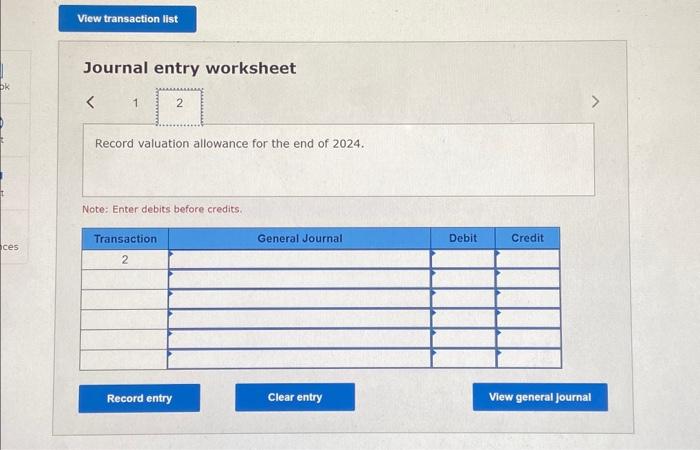

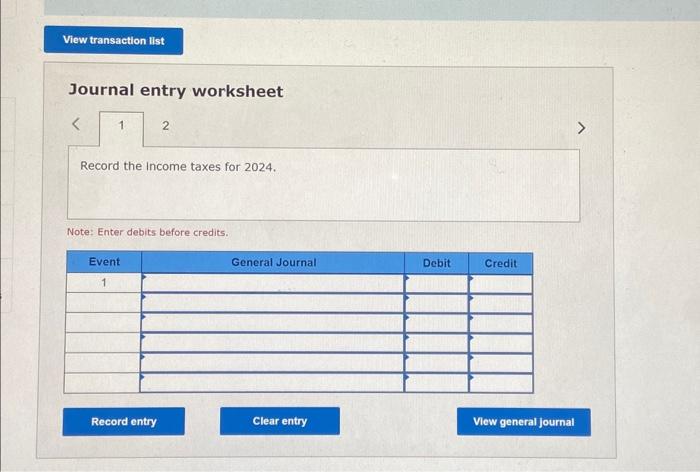

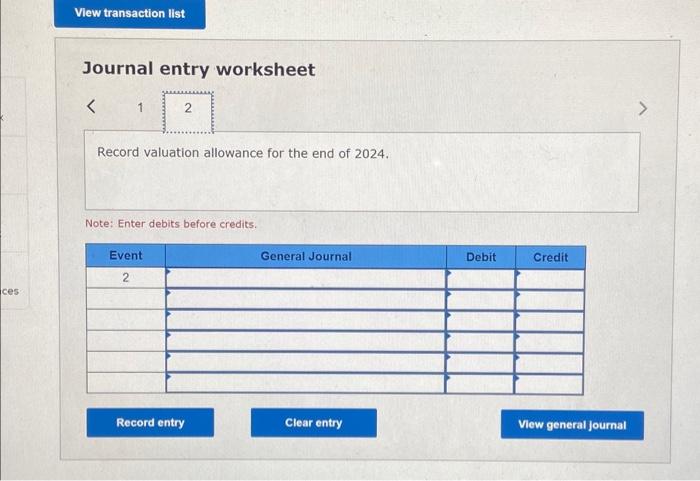

Question: Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record valuation allowance for the end of 2024 . Note: Enter debits before credits.

Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record valuation allowance for the end of 2024 . Note: Enter debits before credits. At the end of 2023, Payne industries had a deferred tax asset account with a balance of $55 miltion attributable to a temporary booktax difference of $220 million in a liability for estimated expenses. At the end of 2024 , the temporary difference is $160 million. Payne has no other temporary differences. Taxable income for 2024 is $396 million and the tax rate is 25%. Payne has a valuation allowance of $22 million for the deferred tax asset at the beginning of 2024 . Required: 1. Prepare the journal entry(s) to record Payne's income taxes for 2024, assuming it is more likely than not that the deferred tax asset will be realized in full. 2. Prepare the journal entry(s) to record Payne's income taxes for 2024 , assuming it is more likely than not that only one-fourth of the deferred tax asset uitimately will be realized. Complete this question by entering your answers in the tabs below. Prepare the Journal entry(5) to record Payne's income taxes for 2024, assuming it is more likely than not that the deferred tax asset will be realized in full. Note: if no entry is required for a transactionvevent, seinct "No foumal entry required" in the first account fleld. Enter your answers in militions (1.e., 10,000,000 should be entered as 10), Journal entry worksheet Record valuation allowance for the end of 2024 . Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts