Question: Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Required

![credits. Required information [The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fb3dea60f16_41766fb3de9c1699.jpg)

![displayed below.] In 2024, the Westgate Construction Company entered into a contract](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fb3df342df5_42666fb3df2bff67.jpg)

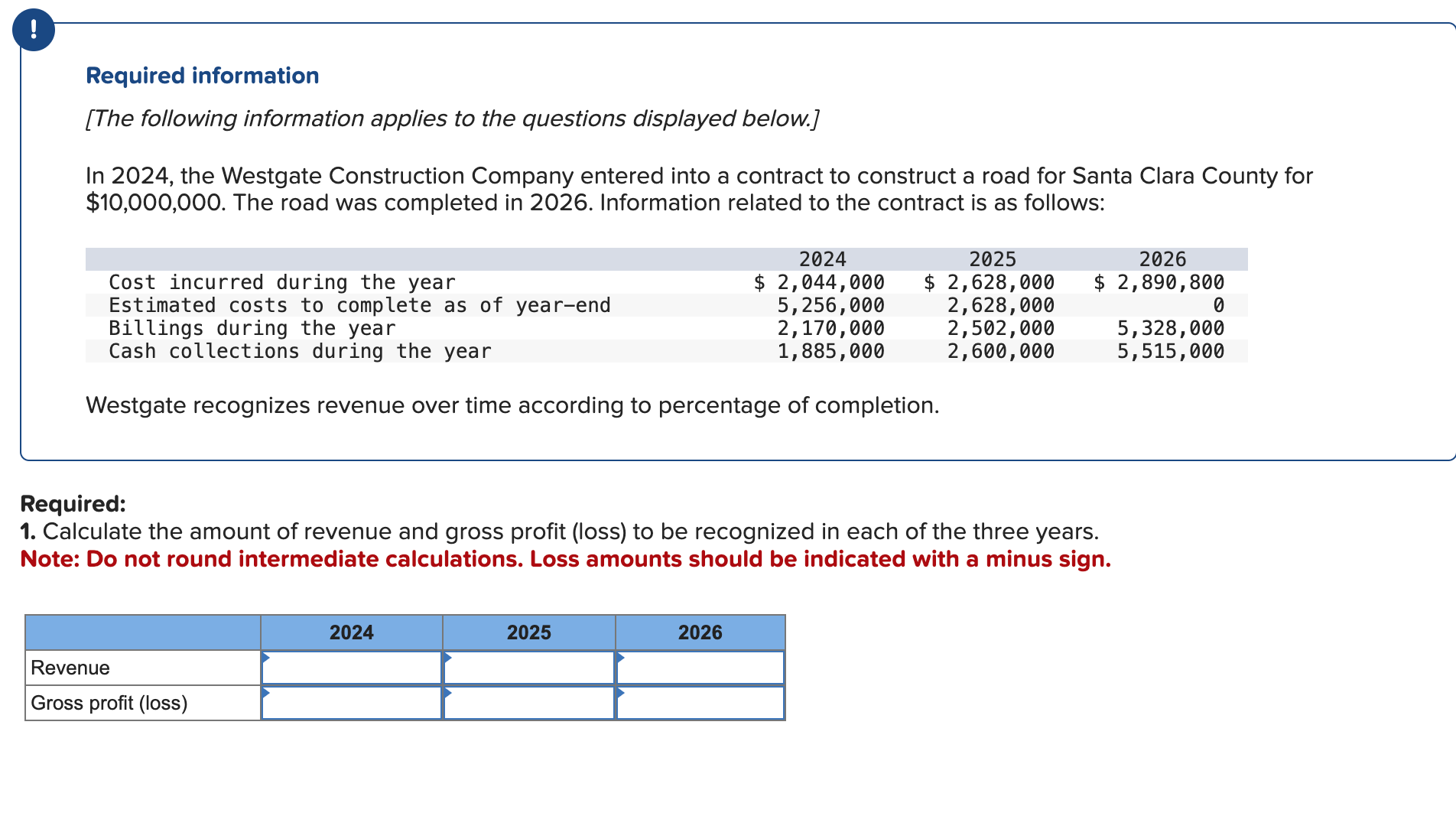

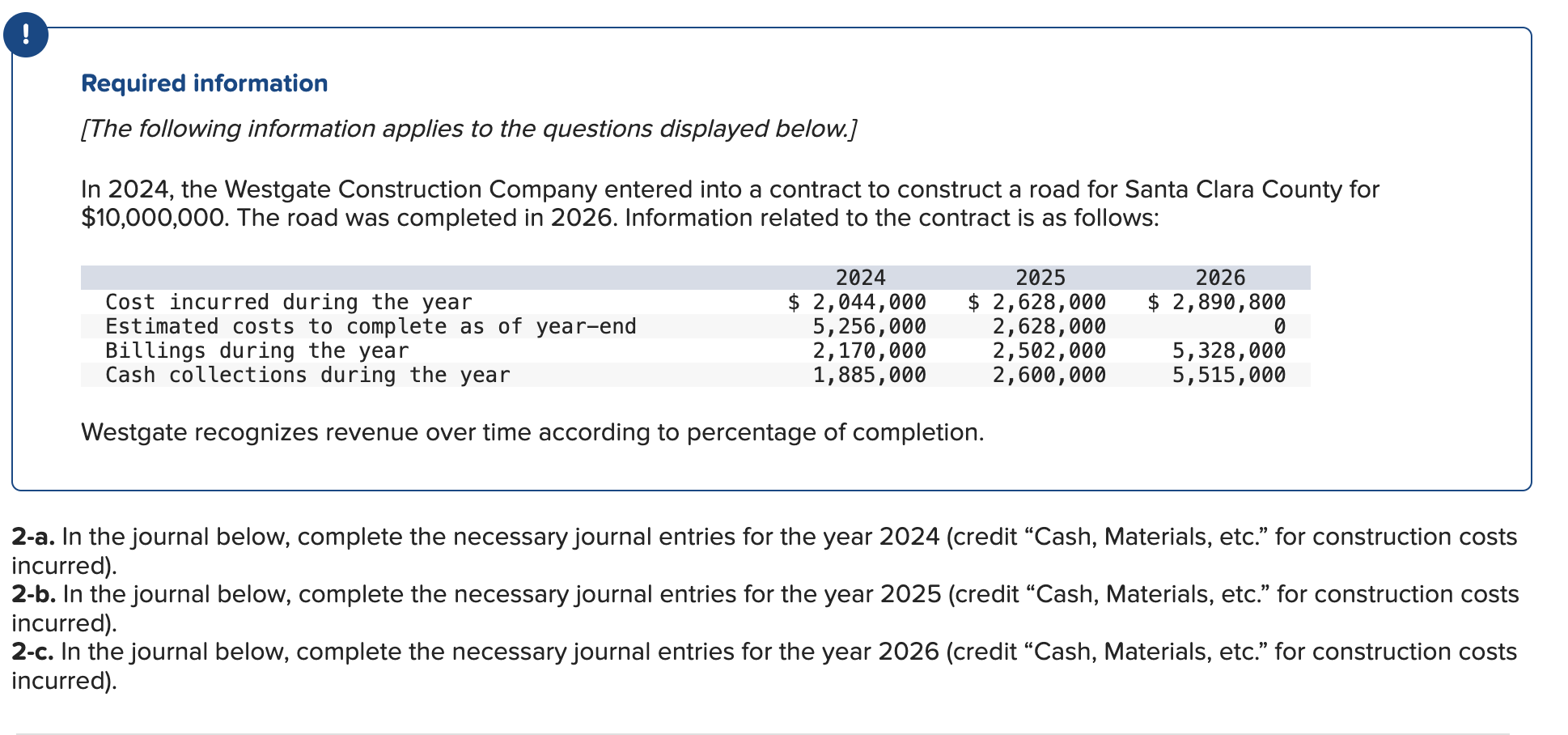

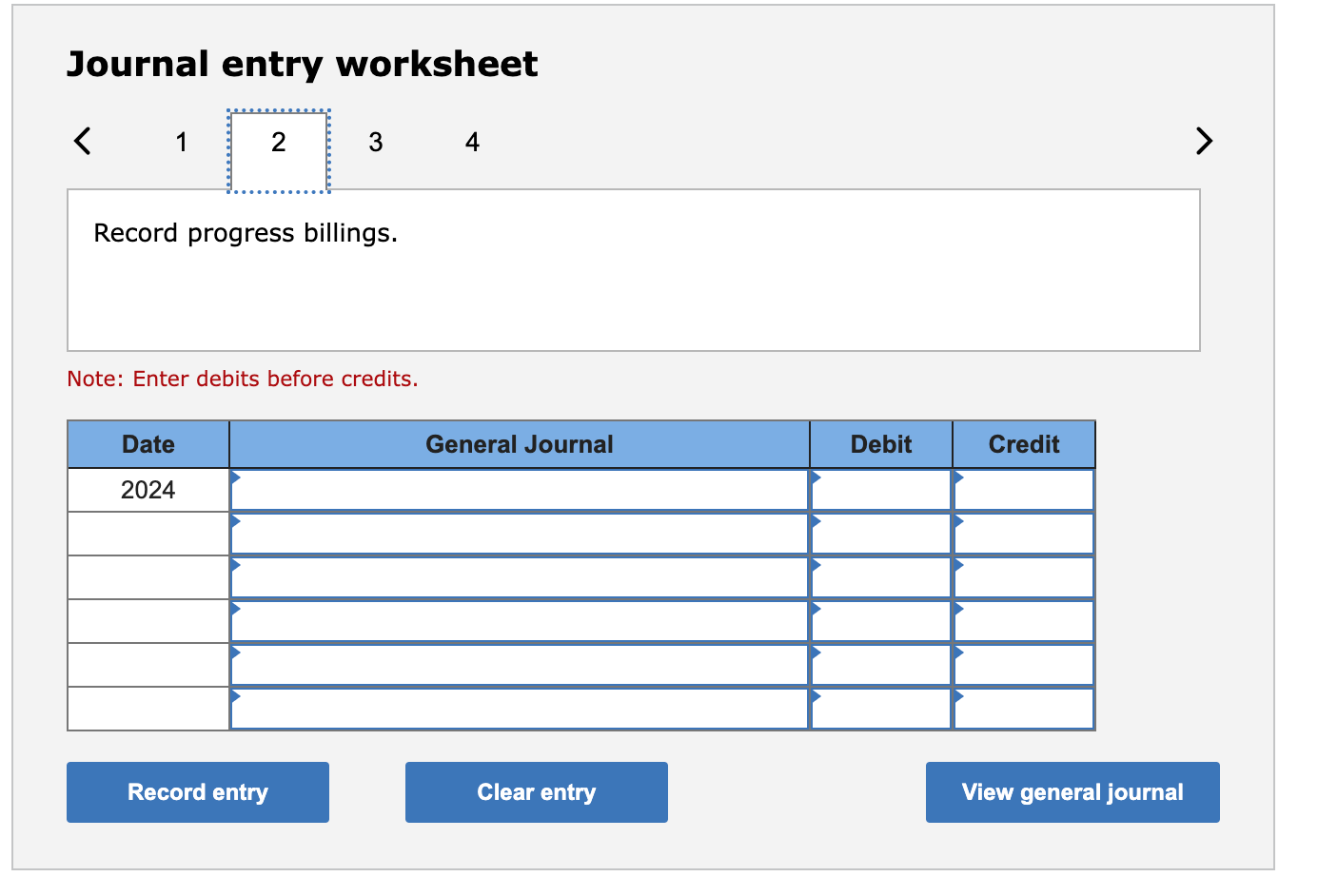

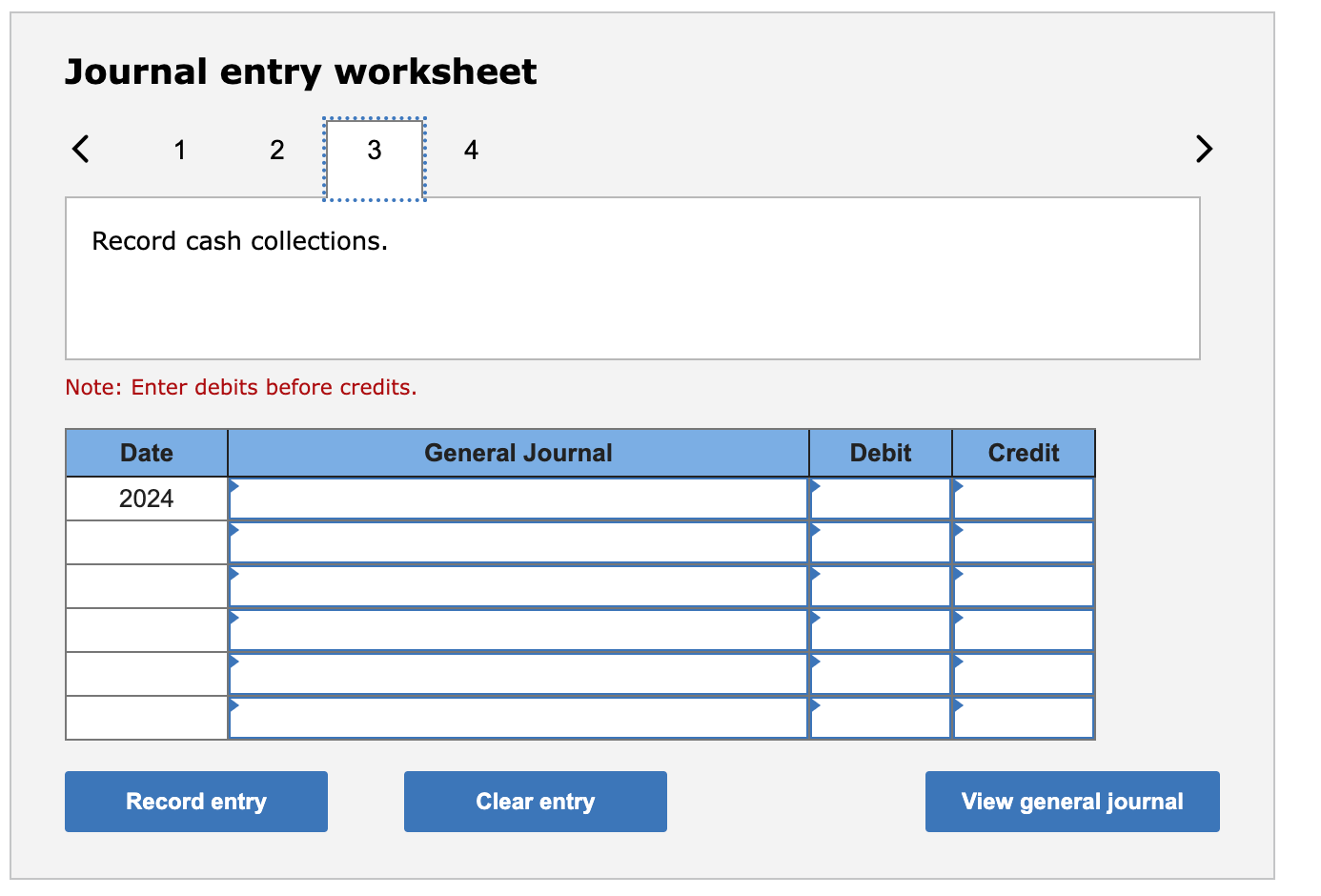

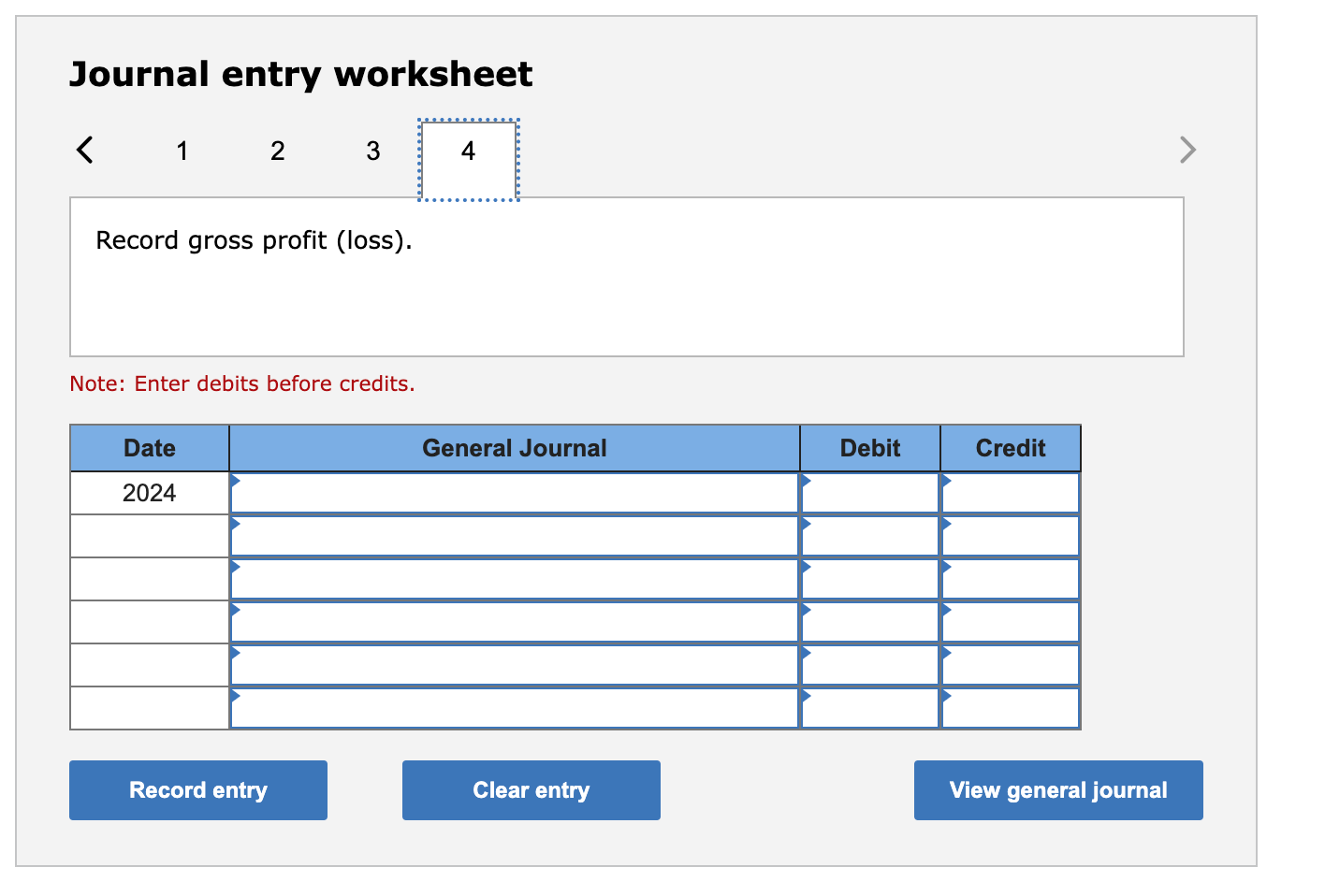

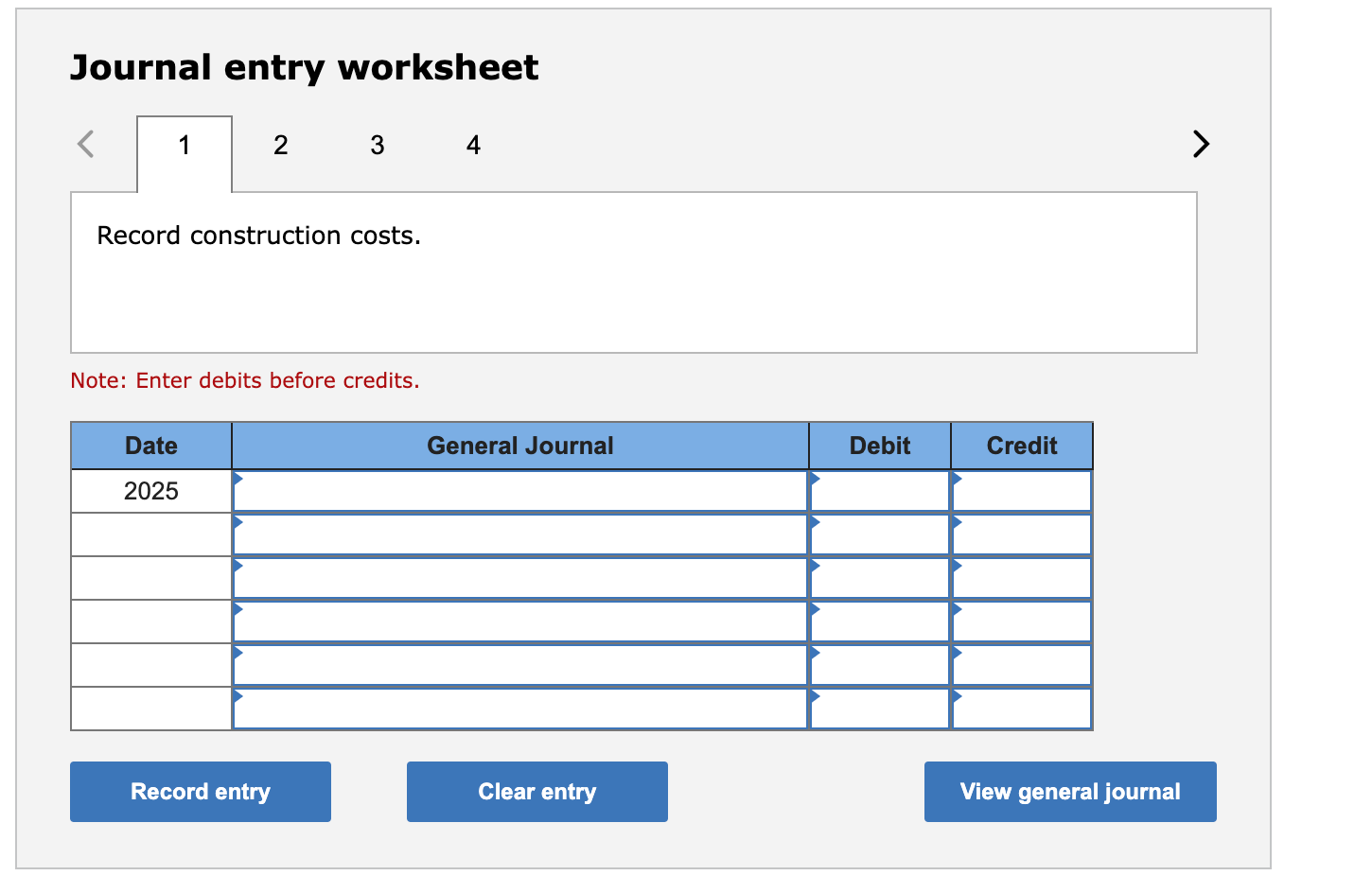

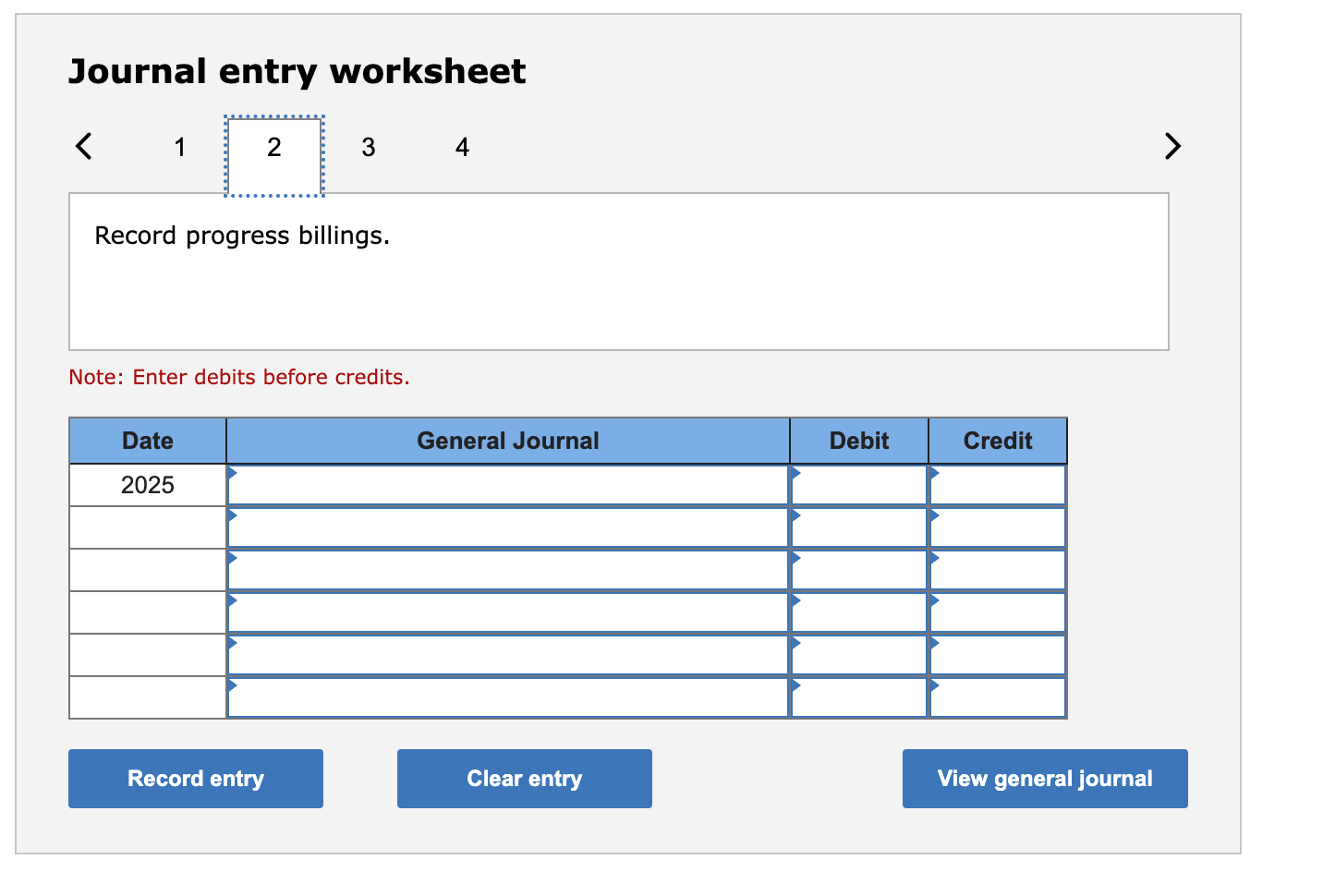

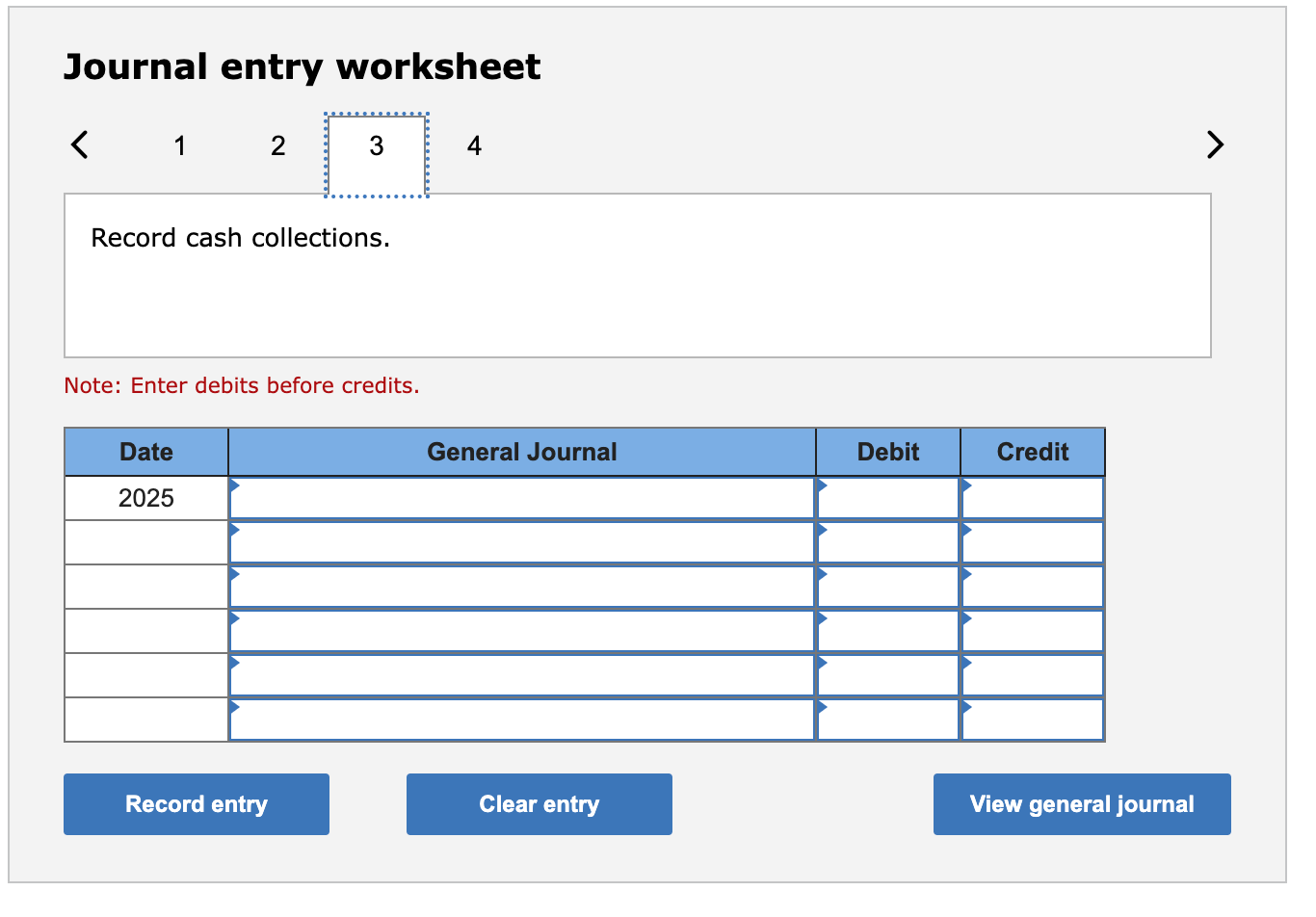

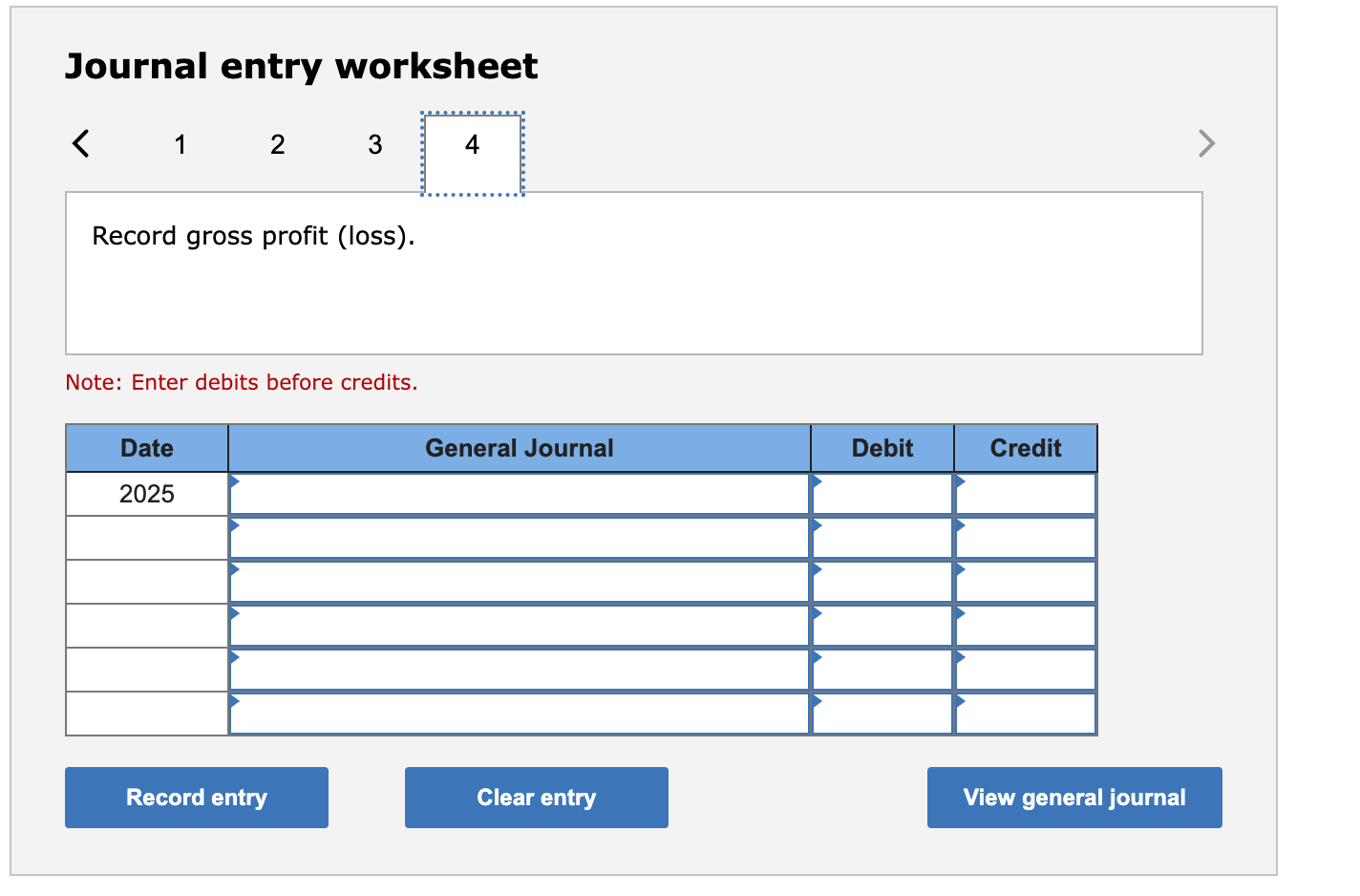

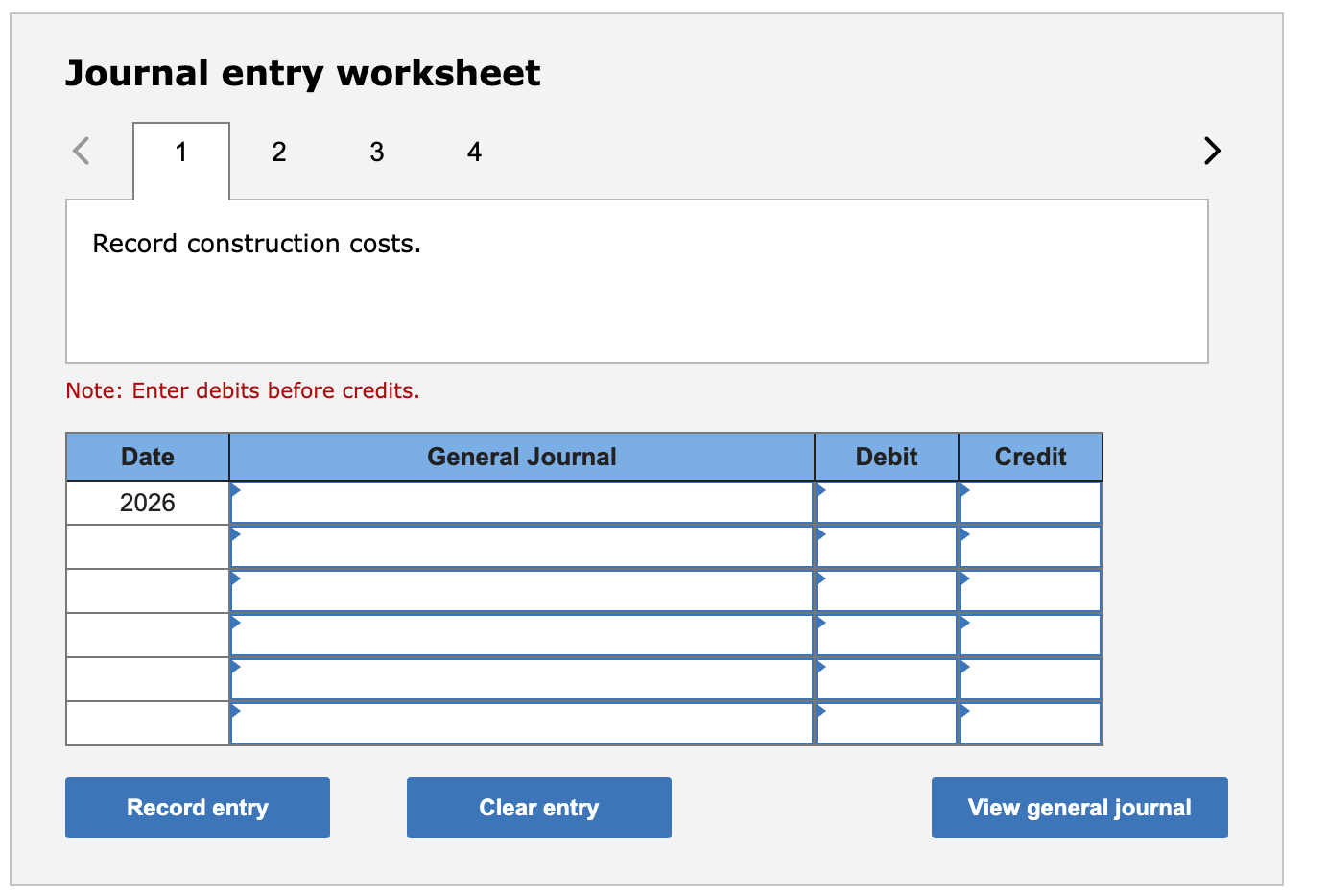

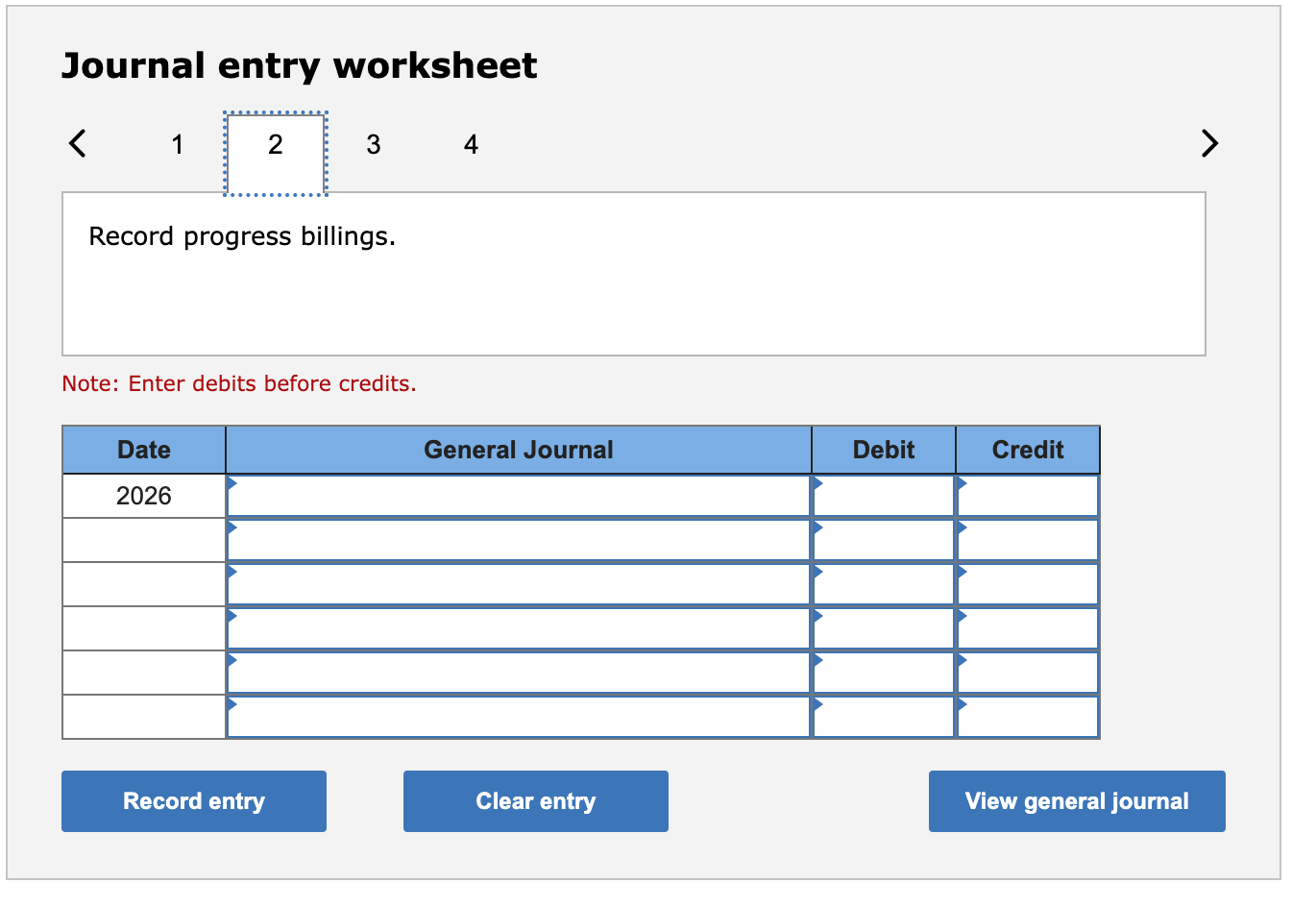

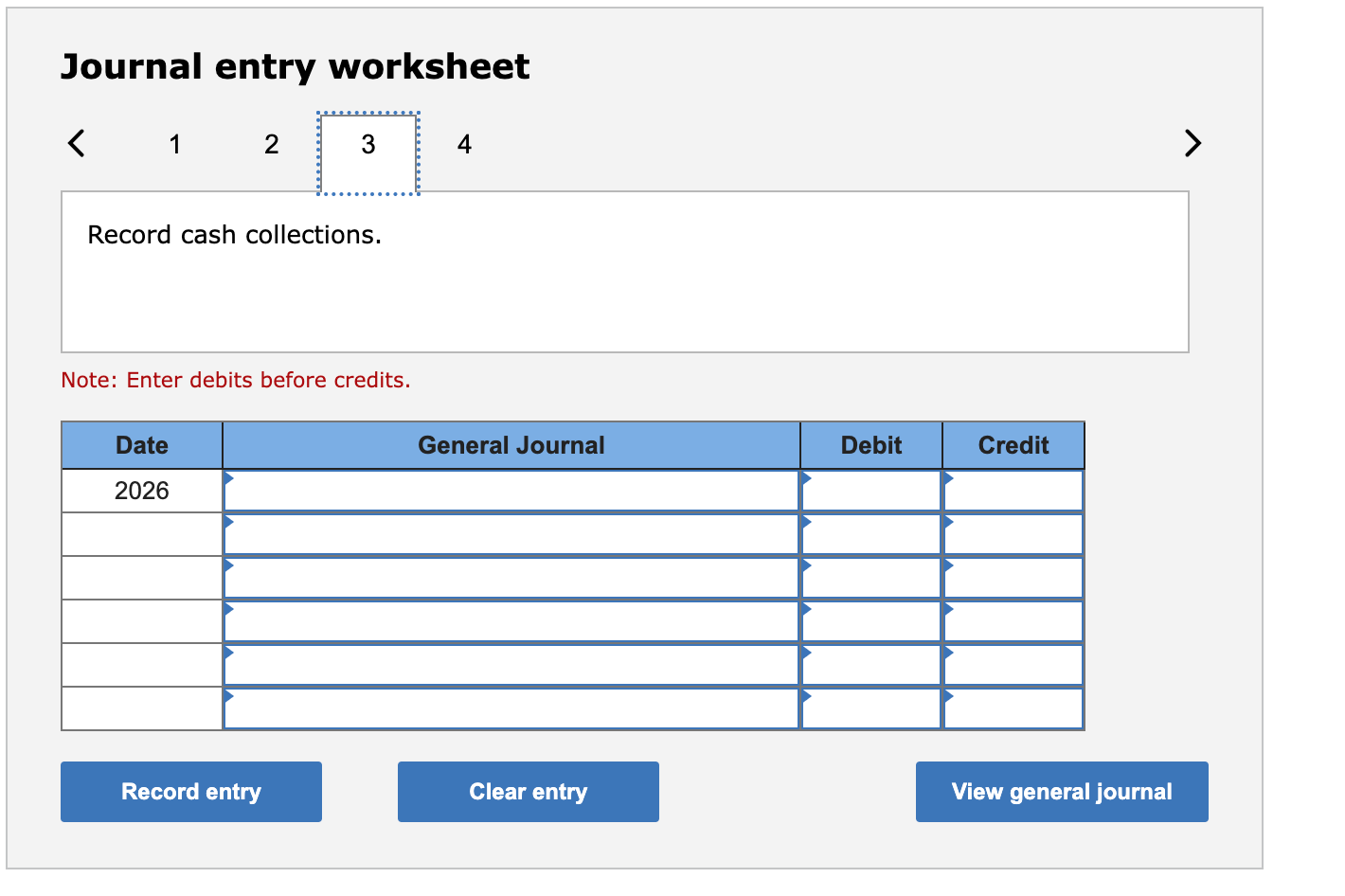

Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026 . Information related to the contract is as follows: Westgate recognizes revenue over time according to percentage of completion. -a. In the journal below, complete the necessary journal entries for the year 2024 (credit "Cash, Materials, etc." for construction costs curred). -b. In the journal below, complete the necessary journal entries for the year 2025 (credit "Cash, Materials, etc." for construction costs curred). -c. In the journal below, complete the necessary journal entries for the year 2026 (credit "Cash, Materials, etc." for construction costs curred). Required information [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026 . Information related to the contract is as follows: Westgate recognizes revenue over time according to percentage of completion. Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. Note: Do not round intermediate calculations. Loss amounts should be indicated with a minus sign. Journal entry worksheet 1 Record gross profit (loss). Note: Enter debits before credits. Journal entry worksheet 4 Note: Enter debits before credits. Journal entry worksheet Record gross profit (loss). Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record cash collections. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts