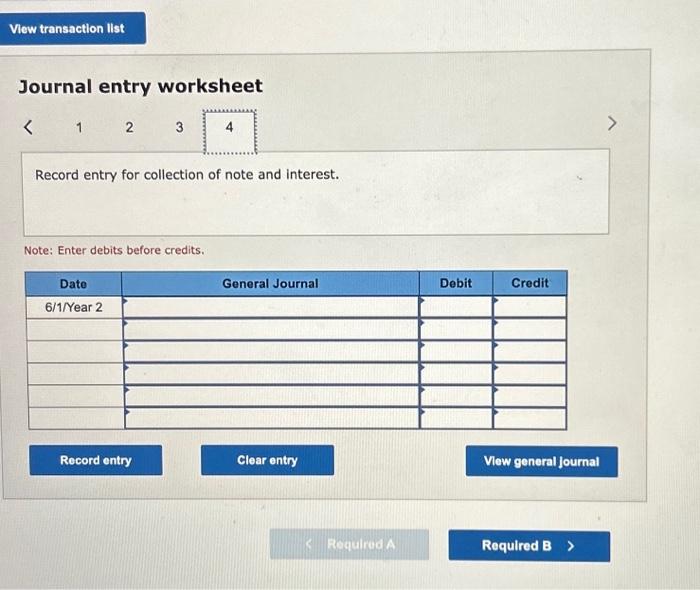

Question: Journal entry worksheet Record entry for collection of note and interest. Note: Enter debits before credits. Required a. Record these general journal entries for Rainey

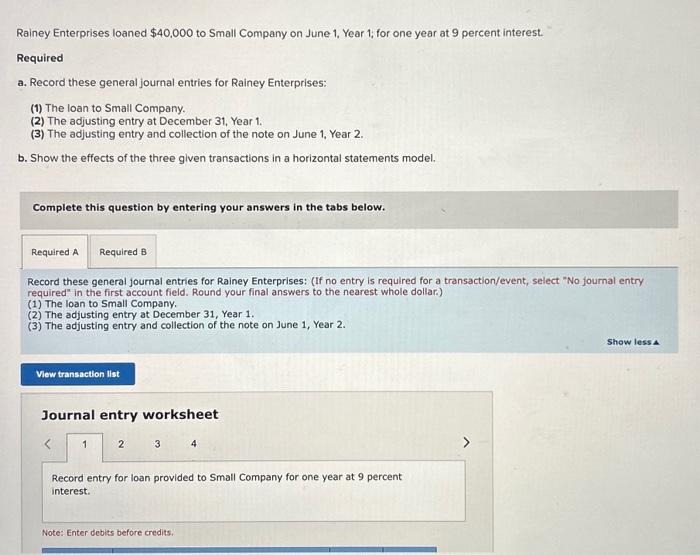

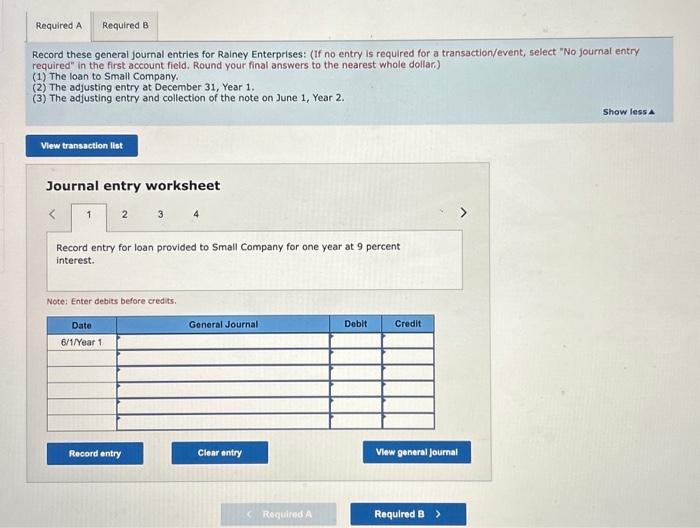

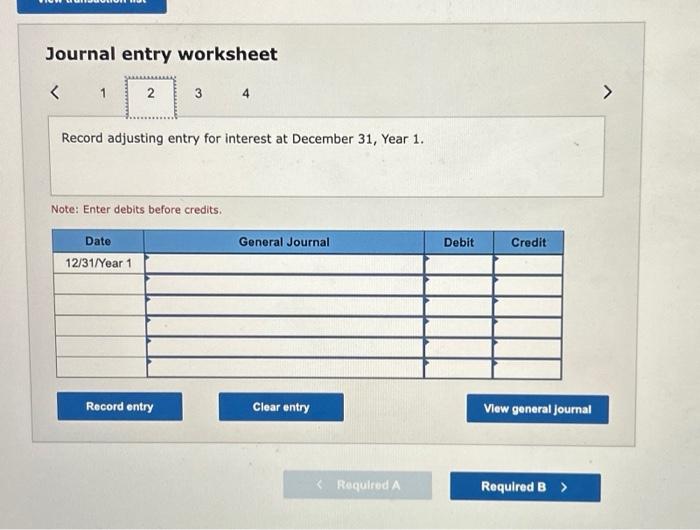

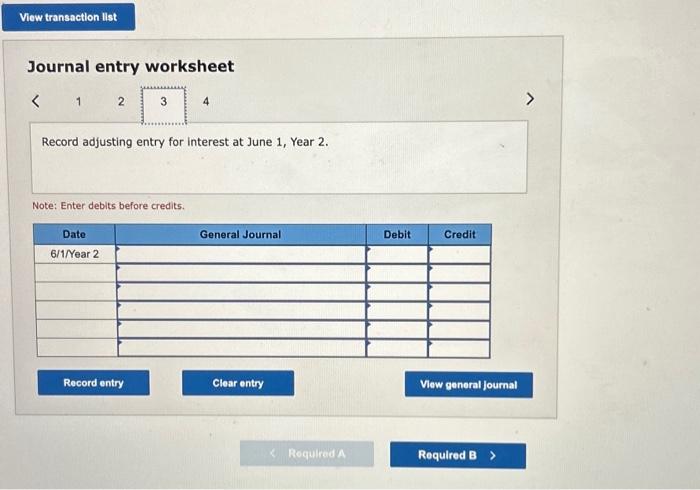

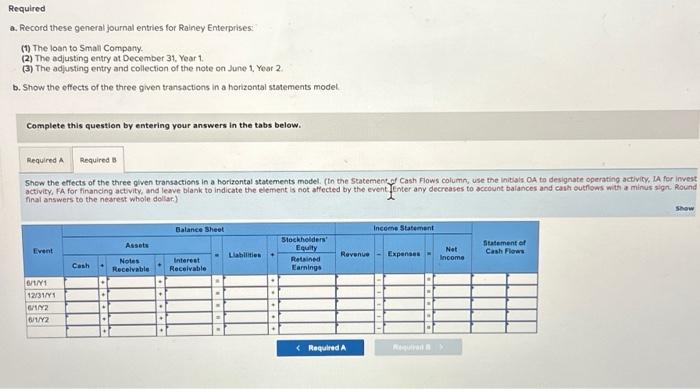

Journal entry worksheet Record entry for collection of note and interest. Note: Enter debits before credits. Required a. Record these general journal entries for Rainey Enterprises: (1) The loan to Smail Compary. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Yoar 2. b. Show the effects of the three given transactions in a horizontal statements model. Complete this question by entering your answers in the tabs below. Show the effects of the three given transactions in a horizontal statements model. (th the statemenc of Cash Flows column, use the initisis OA to designate operating activity, IA for invest nral answers to the nearest whole dollar.) Rainey Enterprises loaned $40,000 to Small Company on June 1, Year 1; for one year at 9 percent interest. Required a. Record these general journal entries for Rainey Enterprises: (1) The loan to Small Company. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. b. Show the effects of the three given transactions in a horizontal statements model. Complete this question by entering your answers in the tabs below. Record these general journal entries for Rainey Enterprises: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar.) (1) The loan to Small Company. (2) The adjusting entry at December 31 , Year 1. (3) The adjusting entry and collection of the note on June 1 , Year 2. Journal entry worksheet Record entry for loan provided to Small Company for one year at 9 percent interest. Note: Enter debits before credits. Record these general journal entries for Rainey Enterprises: (If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Round your final answers to the nearest whole dollar.) (1) The loan to Small Company. (2) The adjusting entry at December 31 , Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. Show less A Journal entry worksheet Record entry for loan provided to Small Company for one year at 9 percent interest. Note: Enter debits before credits. Journal entry worksheet Record adjusting entry for interest at December 31, Year 1. Note: Enter debits before credits. Journal entry worksheet Record adjusting entry for interest at June 1, Year 2. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts