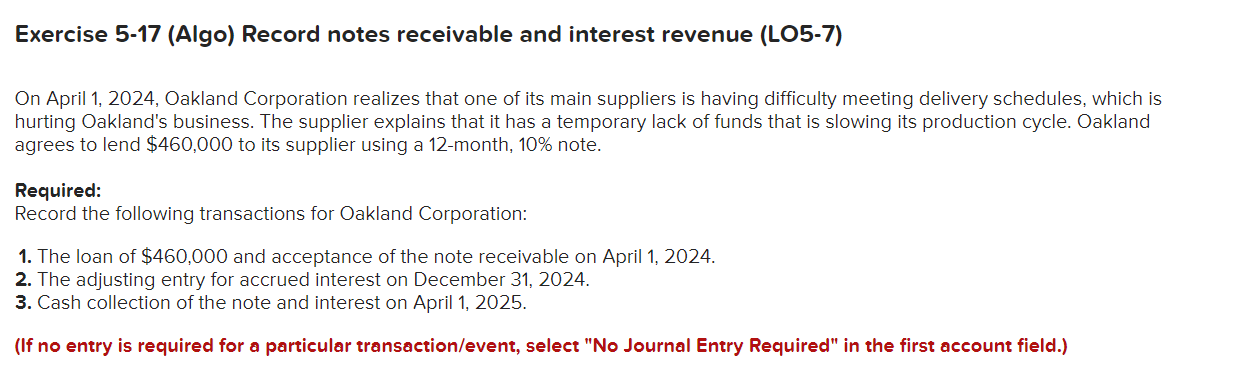

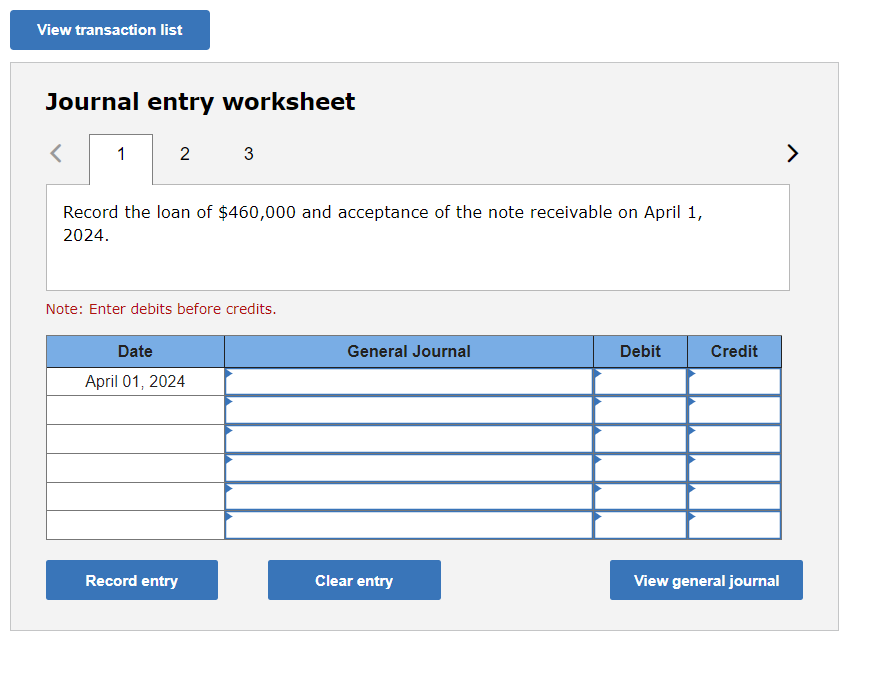

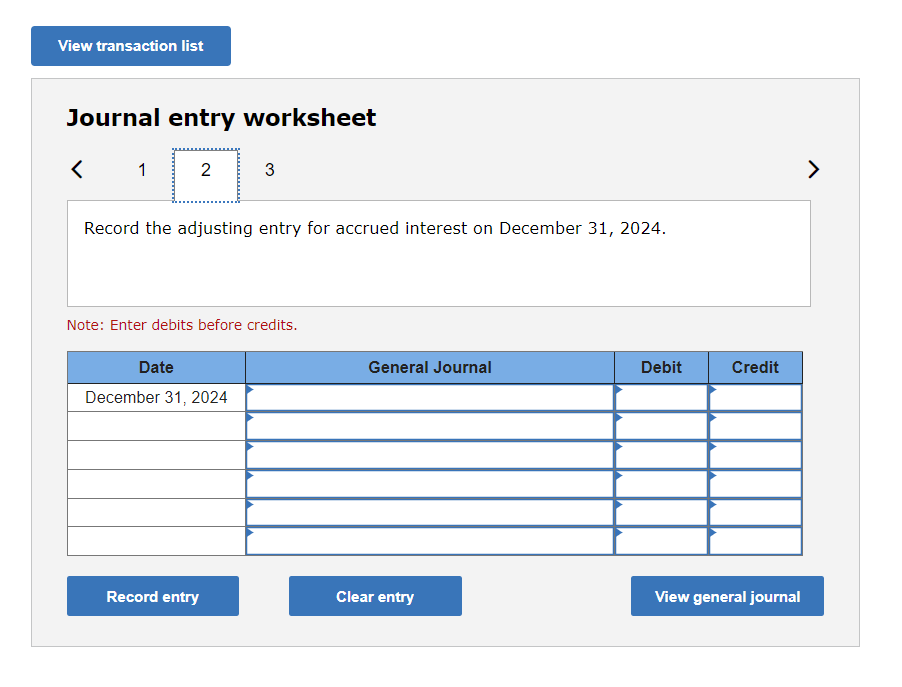

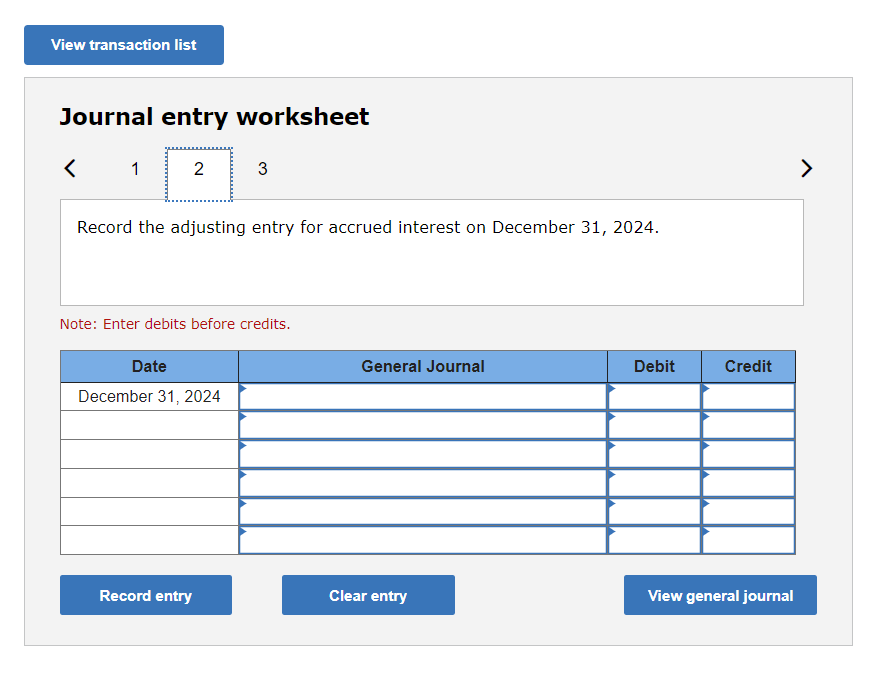

Question: Journal entry worksheet Record the adjusting entry for accrued interest on December 31, 2024. Note: Enter debits before credits. Journal entry worksheet Record the loan

Journal entry worksheet Record the adjusting entry for accrued interest on December 31, 2024. Note: Enter debits before credits. Journal entry worksheet Record the loan of $460,000 and acceptance of the note receivable on April 1, 2024. Note: Enter debits before credits. Exercise 5-17 (Algo) Record notes receivable and interest revenue (LO5-7) On April 1, 2024, Oakland Corporation realizes that one of its main suppliers is having difficulty meeting delivery schedules, which is hurting Oakland's business. The supplier explains that it has a temporary lack of funds that is slowing its production cycle. Oakland agrees to lend $460,000 to its supplier using a 12 -month, 10% note. Required: Record the following transactions for Oakland Corporation: 1. The loan of $460,000 and acceptance of the note receivable on April 1, 2024. 2. The adjusting entry for accrued interest on December 31, 2024. 3. Cash collection of the note and interest on April 1, 2025. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the adjusting entry for accrued interest on December 31, 2024. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts