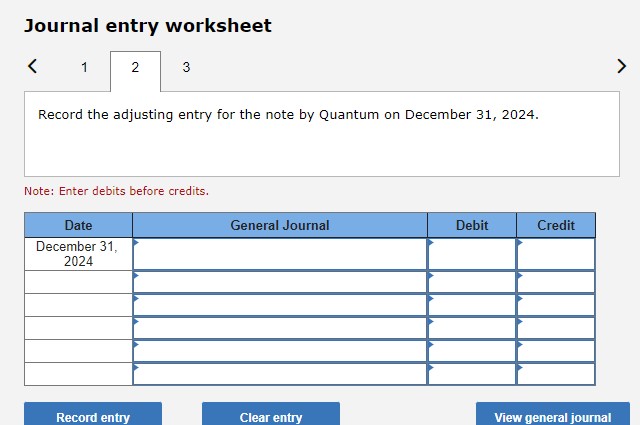

Question: Journal entry worksheet Record the adjusting entry for the note by Quantum on December 31, 2024. Note: Enter debits before credits. Journal entry worksheet Record

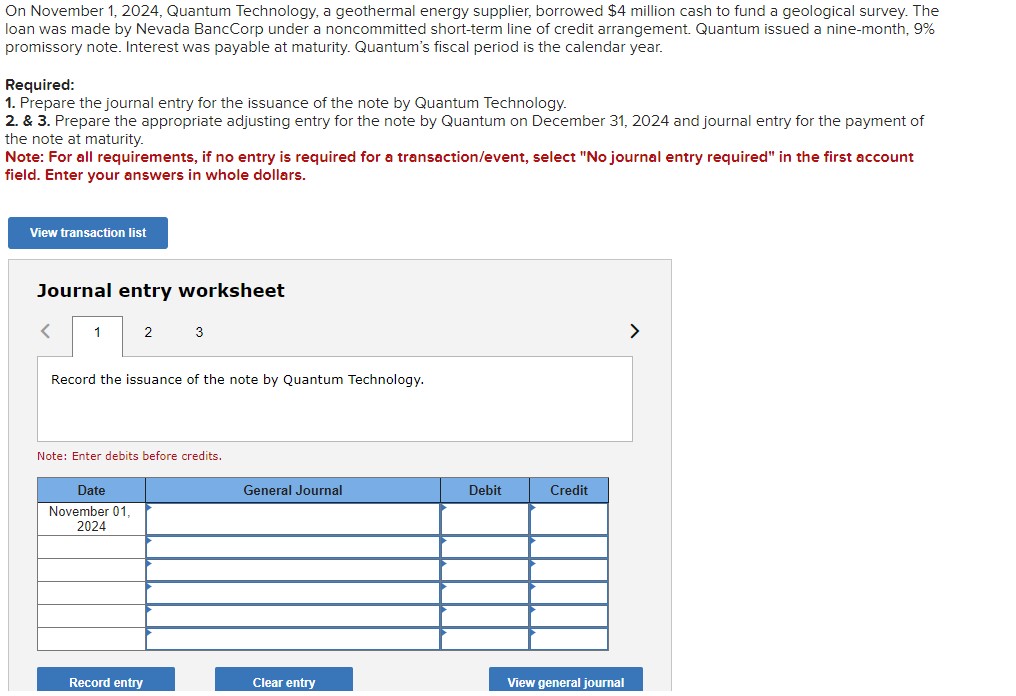

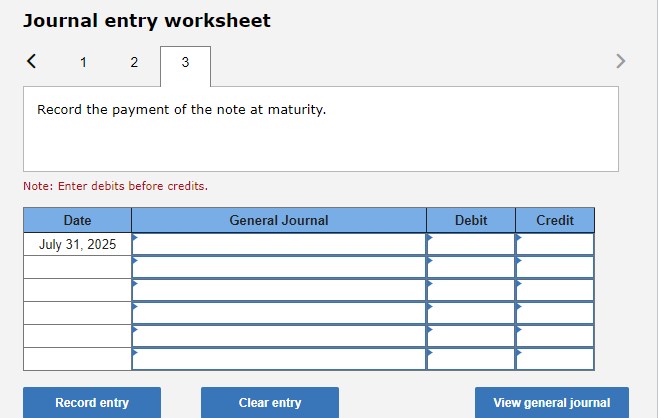

Journal entry worksheet Record the adjusting entry for the note by Quantum on December 31, 2024. Note: Enter debits before credits. Journal entry worksheet Record the payment of the note at maturity. Note: Enter debits before credits. On November 1, 2024, Quantum Technology, a geothermal energy supplier, borrowed $4 million cash to fund a geological survey. The loan was made by Nevada BancCorp under a noncommitted short-term line of credit arrangement. Quantum issued a nine-month, 9% promissory note. Interest was payable at maturity. Quantum's fiscal period is the calendar year. Required: 1. Prepare the journal entry for the issuance of the note by Quantum Technology. 2. \& 3. Prepare the appropriate adjusting entry for the note by Quantum on December 31, 2024 and journal entry for the payment of the note at maturity. Note: For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars. Journal entry worksheet Record the issuance of the note by Quantum Technology. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts