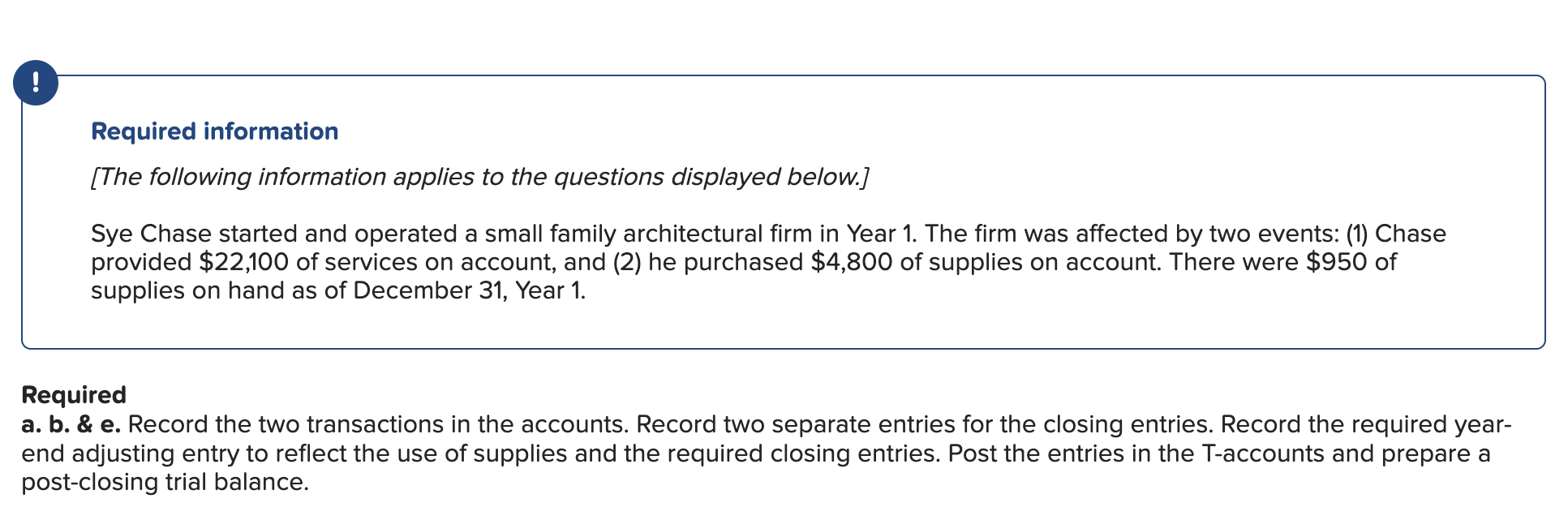

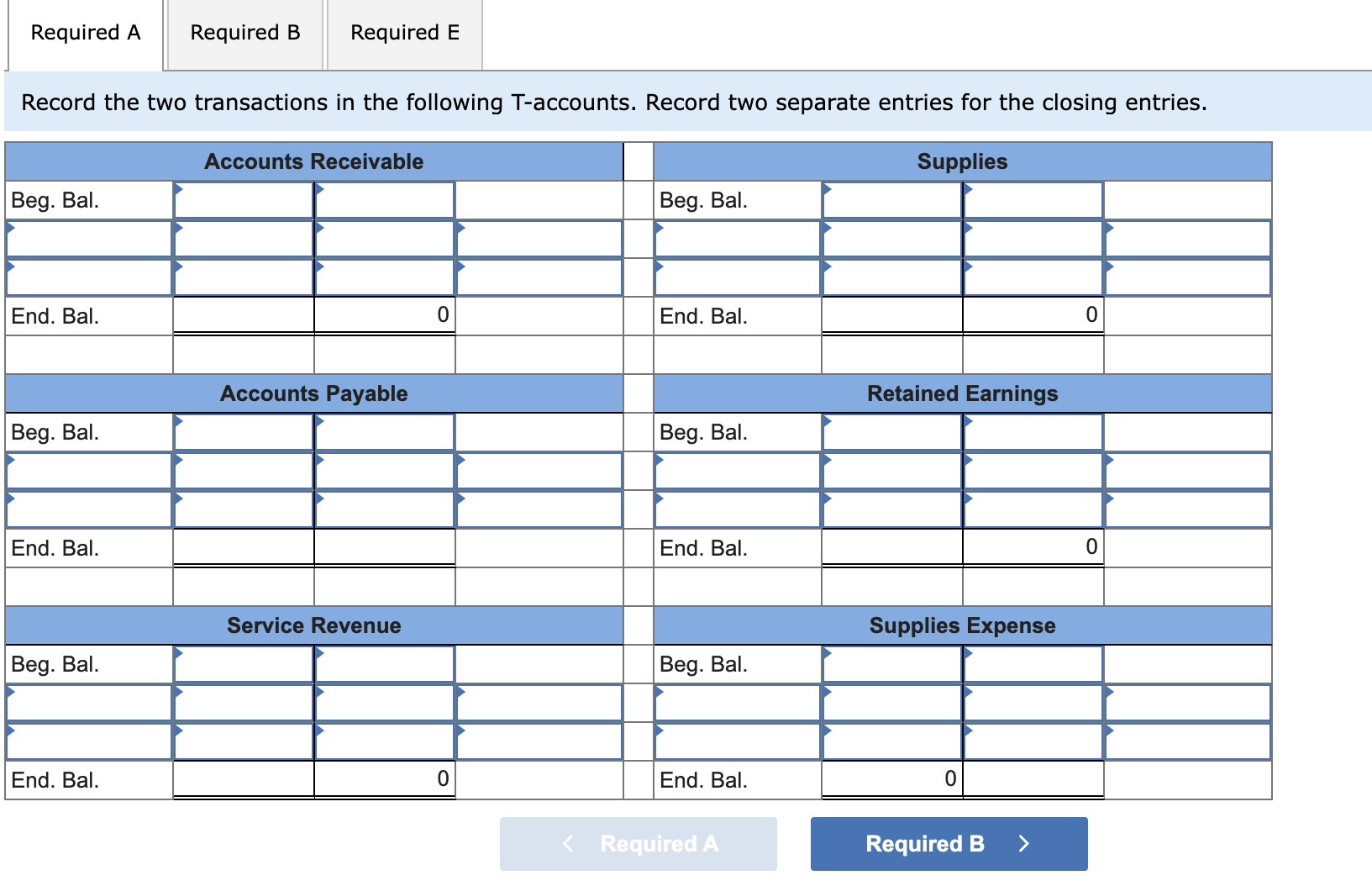

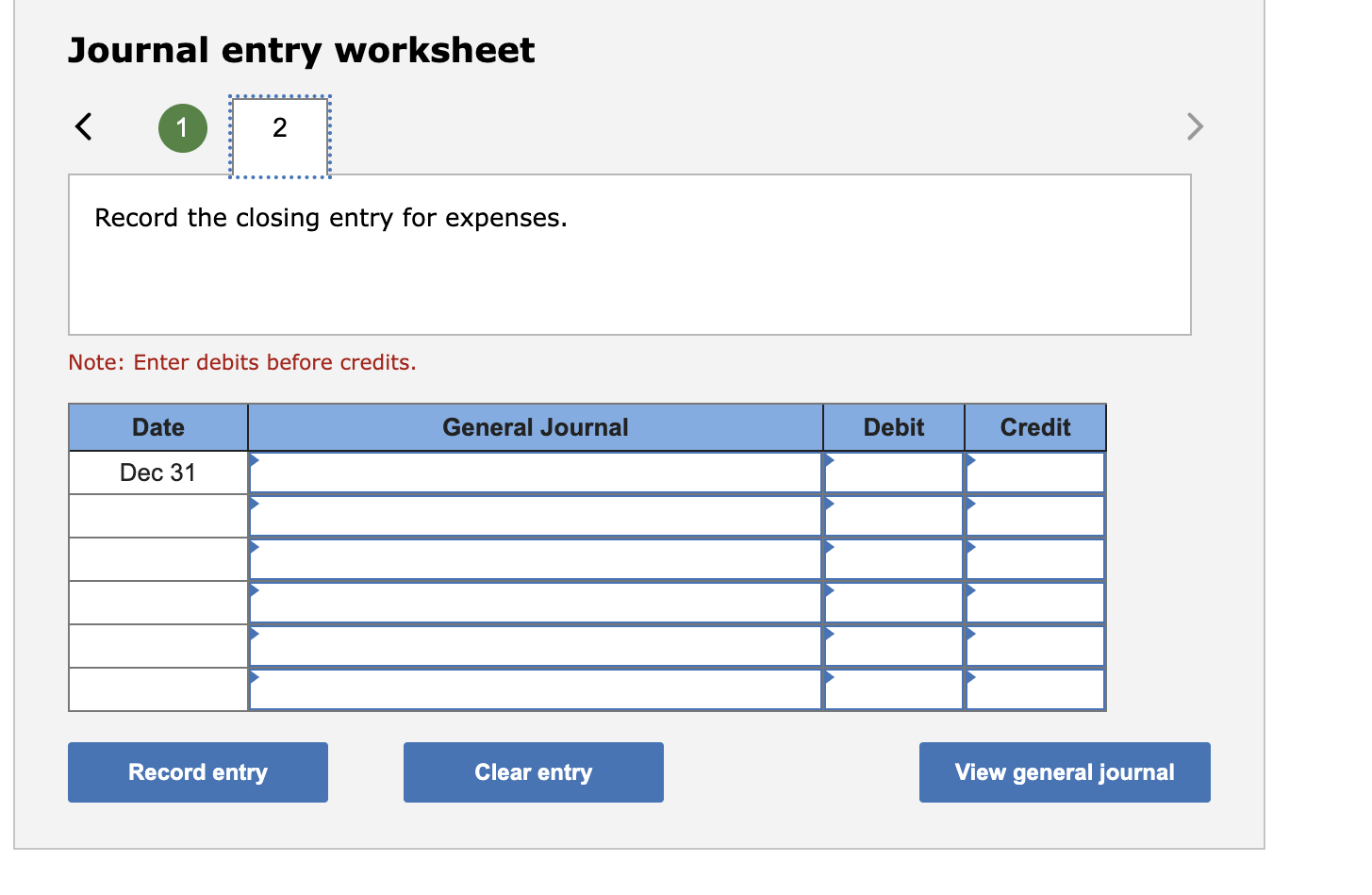

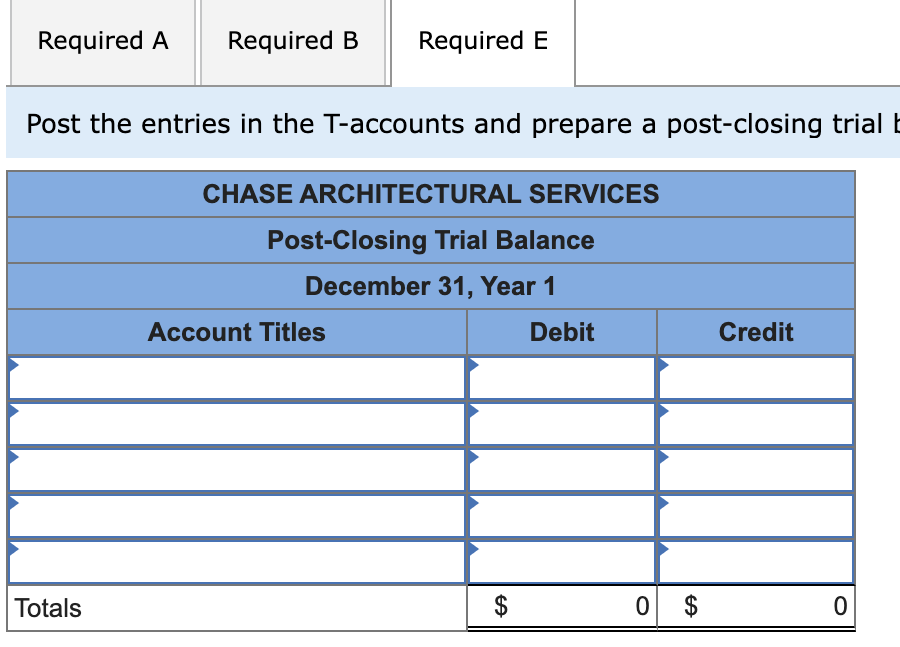

Question: Journal entry worksheet Record the closing entry for expenses. Note: Enter debits before credits. Post the entries in the T-accounts and prepare a post-closing trial

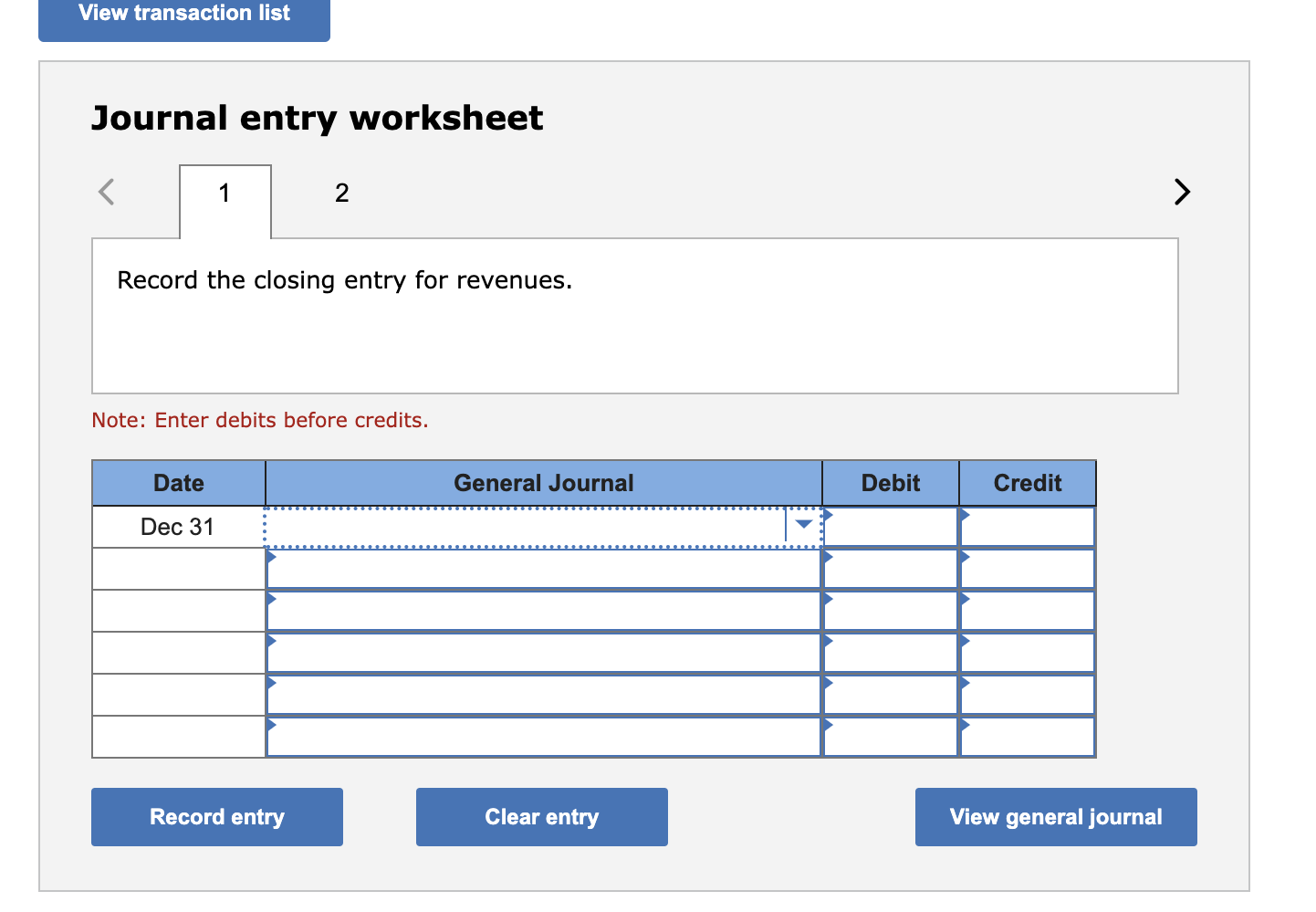

Journal entry worksheet Record the closing entry for expenses. Note: Enter debits before credits. Post the entries in the T-accounts and prepare a post-closing trial Journal entry worksheet Note: Enter debits before credits. Record the two transactions in the following T-accounts. Record two separate entries for the closing entries. Required information [The following information applies to the questions displayed below.] Sye Chase started and operated a small family architectural firm in Year 1. The firm was affected by two events: (1) Chase provided $22,100 of services on account, and (2) he purchased $4,800 of supplies on account. There were $950 of supplies on hand as of December 31, Year 1. Required a. b. \& e. Record the two transactions in the accounts. Record two separate entries for the closing entries. Record the required yearend adjusting entry to reflect the use of supplies and the required closing entries. Post the entries in the T-accounts and prepare a oost-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts