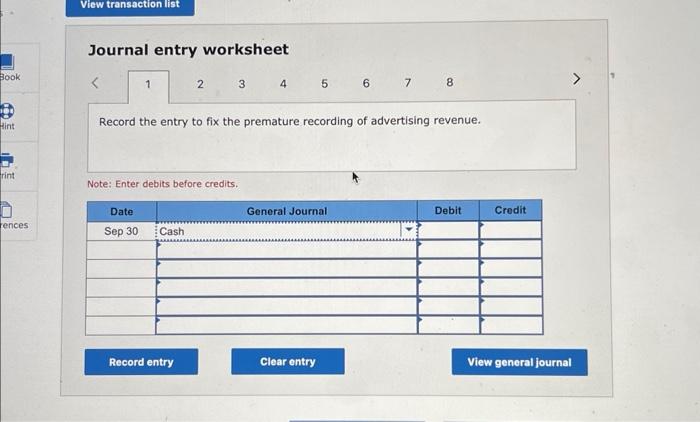

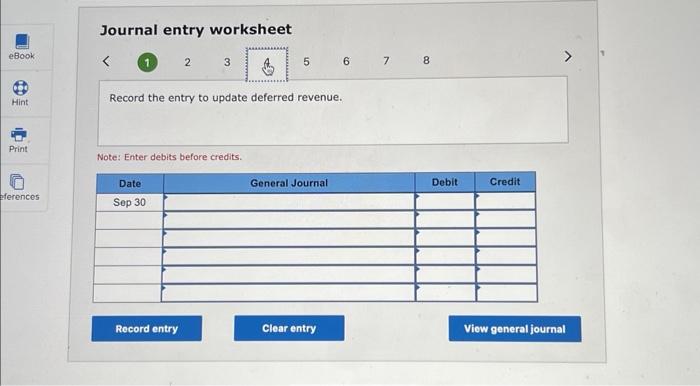

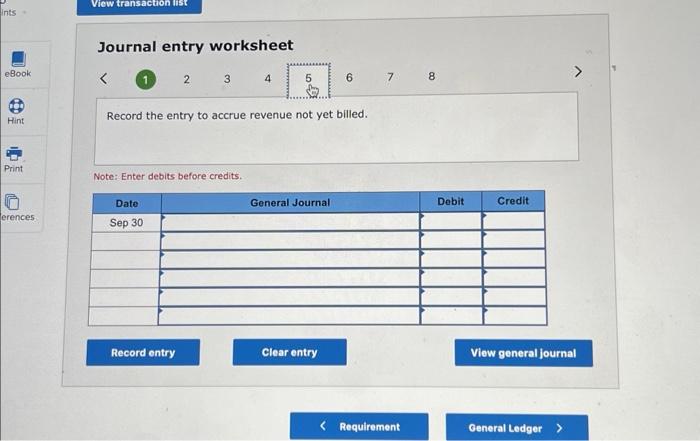

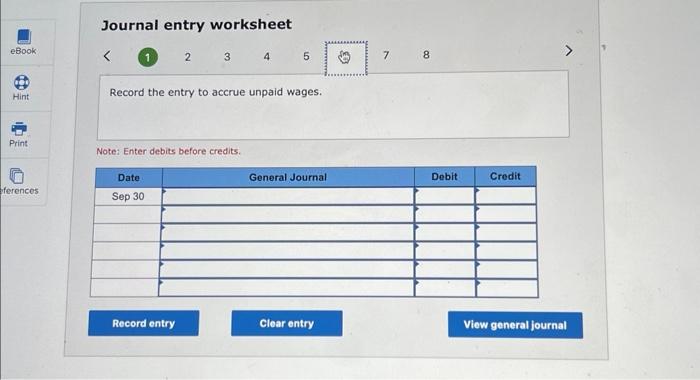

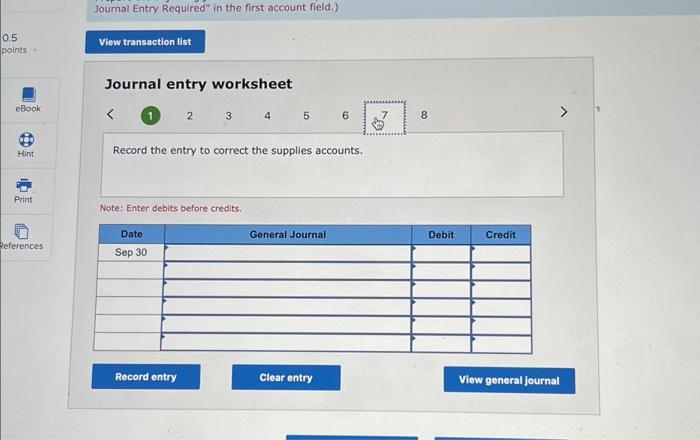

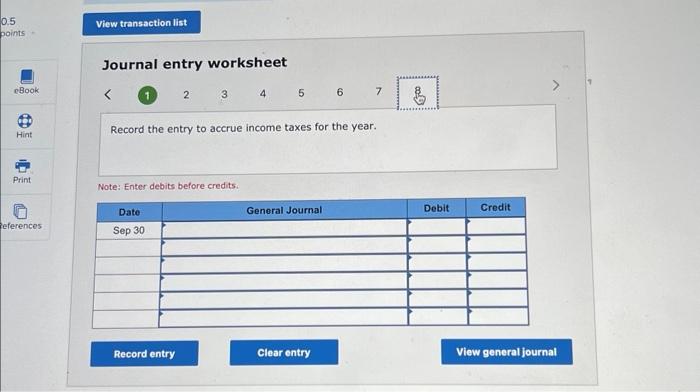

Question: Journal entry worksheet Record the entry to update deferred revenue. Note: Enter debits before credits. Journal entry worksheet 45678 Record the entry to fix the

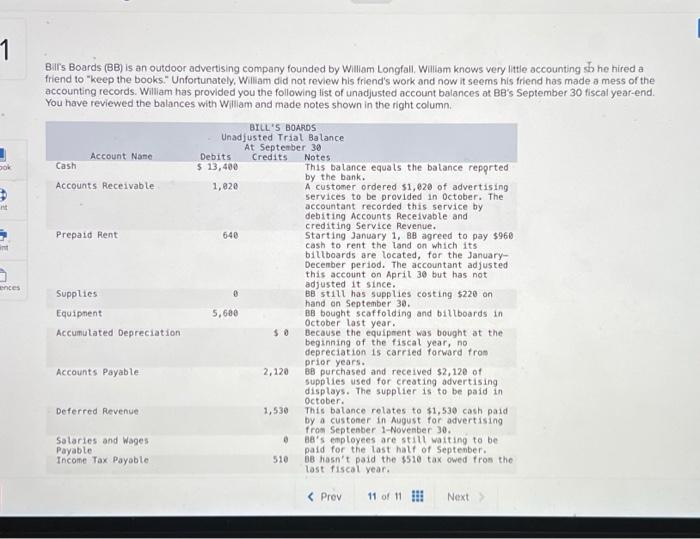

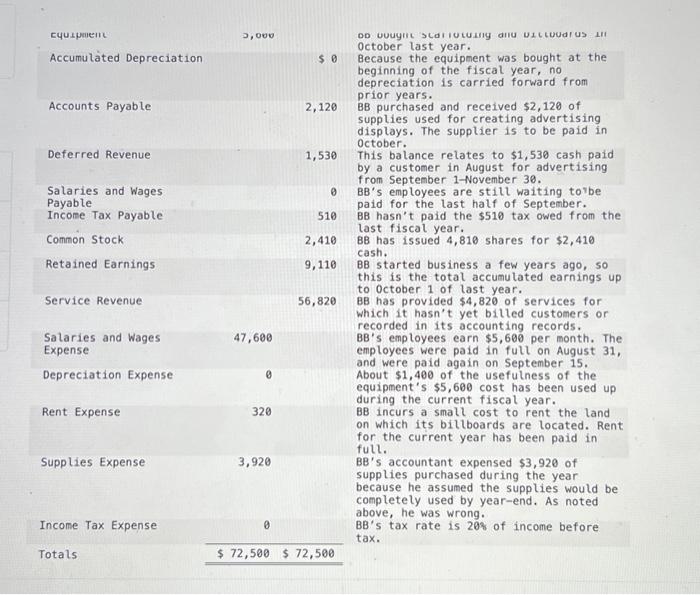

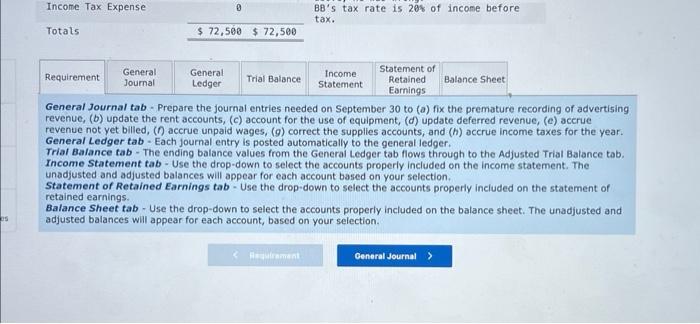

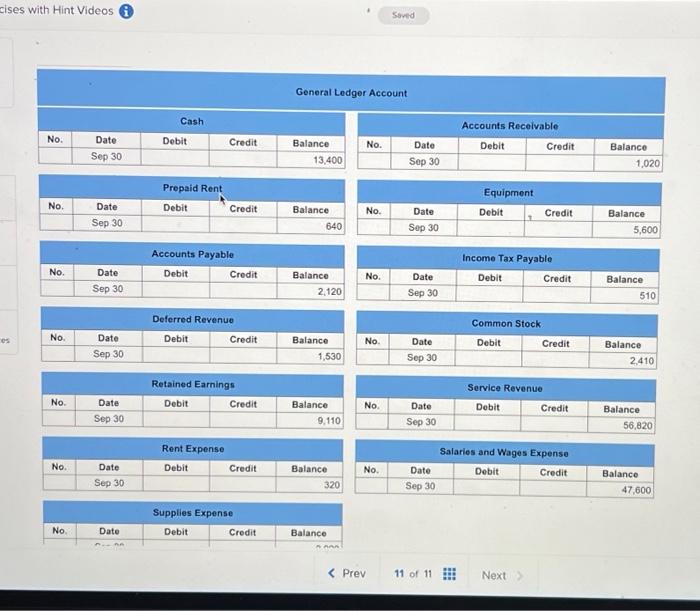

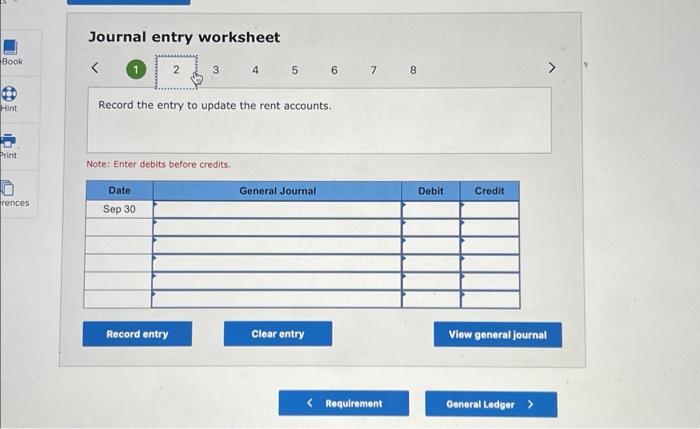

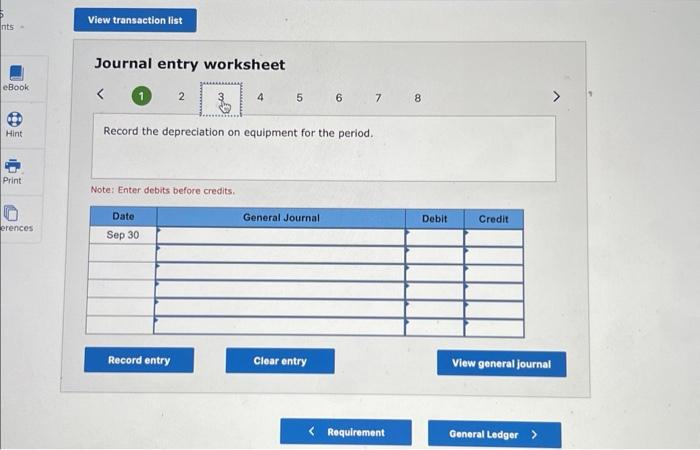

Journal entry worksheet Record the entry to update deferred revenue. Note: Enter debits before credits. Journal entry worksheet 45678 Record the entry to fix the premature recording of advertising revenue. Note: Enter debits before credits. Journal Entry Required" in the first account field.) Journal entry worksheet 23456 Record the entry to correct the supplies accounts. Note: Enter debits before credits. Journal entry worksheet Record the entry to update the rent accounts. Note: Enter debits before credits. Journal entry worksheet 1. 2345 Record the entry to accrue unpaid wages. Note: Enter debits before credits. equspment 2,000 Accumulated Depreciation $0 Accounts Payable 2,120 Deferred Revenue 1,530 Salaries and Wages Payable Incone Tax Payable Common Stock Retained Earnings Service Revenue Salaries and Wages 47,680 Expense Depreciation Expense 6 Rent Expense 320 Supplies Expense 3,920 Income Tax Expense Totals 510 2,410 9,110 56,820 56,820 320 $72,500$72,500 Do vuugir scailutuing ailu uictuvalus 111 October last year. Because the equipment was bought at the beginning of the fiscal year, no depreciation is carried forward from prior years. BB purchased and received $2,120 of supplies used for creating advertising displays. The supplier is to be paid in october. This balance relates to $1,530 cash paid by a customer in August for advertising from September 1-November 30 . BB's employees are still waiting torbe paid for the last half of September. B hasn't paid the $510 tax owed from the last fiscal year. BB has issued 4,810 shares for $2,410 cash. BB started business a few years ago, so this is the total accumulated earnings up to October 1 of last year. BB has provided $4,820 of services for which it hasn't yet billed customers or recorded in its accounting records. BB's employees earn $5,600 per month. The employees were paid in futl on August 31 , and were paid again on September 15. About $1,400 of the usefulness of the equipment's $5,600 cost has been used up during the current fiscal year. BB incurs a small cost to rent the land on which its biltboards are located. Rent for the current year has been paid in full. BB's accountant expensed $3,920 of supplies purchased during the year because he assumed the supplies would be completely used by year-end. As noted above, he was wrong. BB's tax rate is 208 of income before tax. Birs Boards (BB) is an outdoor advertising company founded by William Longfall. William knows very little accounting \$b he hired a friend to "keep the books." Unfortunately, William did not review his friend's work and now it seems his friend has made a mess of the accounting records. William has provided you the following list of unadjusted account balances at BB's September 30 fiscal year-end. You have reviewed the balances with Willam and made notes shown in the right column. Journal entry worksheet 1234567 Record the entry to accrue income taxes for the year. Note: Enter debits before credits. cises with Hint Videos (i) Journal entry worksheet 567 Record the depreciation on equipment for the period. Note: Enter debits before credits. Income Tax Expense Totals $72,560$72,500 B8's tax rate is 20% of income before tax. General Journal tab - Prepare the journal entries needed on September 30 to (a) fix the premature recording of advertising revenue, (b) update the rent accounts, (c) account for the use of equipment, (d) update deferred revenue, (e) accrue revenue not yet billed, ( ) accrue unpaid wages, (g) correct the supplies accounts, and (h) accrue income taxes for the year. General Ledger tab. Each journal entry is posted automatically to the general ledger. Triat Balance tab - The ending balance values from the General Ledger tab flows through to the Adjusted Trial Balance tab. Income Statement tab - Use the drop-down to select the accounts properly included on the income statement. The unadjusted and adjusted balances will appear for each account based on your selection. Statement of Retained Earnings tab - Use the drop-down to select the accounts properiy included on the statement of retained earnings. Balance Sheet tab - Use the drop-down to select the accounts properly included on the balance sheet. The unadjusted and adjusted balances will appear for each account, based on your selection. Journal entry worksheet Record the entry to update deferred revenue. Note: Enter debits before credits. Journal entry worksheet 45678 Record the entry to fix the premature recording of advertising revenue. Note: Enter debits before credits. Journal Entry Required" in the first account field.) Journal entry worksheet 23456 Record the entry to correct the supplies accounts. Note: Enter debits before credits. Journal entry worksheet Record the entry to update the rent accounts. Note: Enter debits before credits. Journal entry worksheet 1. 2345 Record the entry to accrue unpaid wages. Note: Enter debits before credits. equspment 2,000 Accumulated Depreciation $0 Accounts Payable 2,120 Deferred Revenue 1,530 Salaries and Wages Payable Incone Tax Payable Common Stock Retained Earnings Service Revenue Salaries and Wages 47,680 Expense Depreciation Expense 6 Rent Expense 320 Supplies Expense 3,920 Income Tax Expense Totals 510 2,410 9,110 56,820 56,820 320 $72,500$72,500 Do vuugir scailutuing ailu uictuvalus 111 October last year. Because the equipment was bought at the beginning of the fiscal year, no depreciation is carried forward from prior years. BB purchased and received $2,120 of supplies used for creating advertising displays. The supplier is to be paid in october. This balance relates to $1,530 cash paid by a customer in August for advertising from September 1-November 30 . BB's employees are still waiting torbe paid for the last half of September. B hasn't paid the $510 tax owed from the last fiscal year. BB has issued 4,810 shares for $2,410 cash. BB started business a few years ago, so this is the total accumulated earnings up to October 1 of last year. BB has provided $4,820 of services for which it hasn't yet billed customers or recorded in its accounting records. BB's employees earn $5,600 per month. The employees were paid in futl on August 31 , and were paid again on September 15. About $1,400 of the usefulness of the equipment's $5,600 cost has been used up during the current fiscal year. BB incurs a small cost to rent the land on which its biltboards are located. Rent for the current year has been paid in full. BB's accountant expensed $3,920 of supplies purchased during the year because he assumed the supplies would be completely used by year-end. As noted above, he was wrong. BB's tax rate is 208 of income before tax. Birs Boards (BB) is an outdoor advertising company founded by William Longfall. William knows very little accounting \$b he hired a friend to "keep the books." Unfortunately, William did not review his friend's work and now it seems his friend has made a mess of the accounting records. William has provided you the following list of unadjusted account balances at BB's September 30 fiscal year-end. You have reviewed the balances with Willam and made notes shown in the right column. Journal entry worksheet 1234567 Record the entry to accrue income taxes for the year. Note: Enter debits before credits. cises with Hint Videos (i) Journal entry worksheet 567 Record the depreciation on equipment for the period. Note: Enter debits before credits. Income Tax Expense Totals $72,560$72,500 B8's tax rate is 20% of income before tax. General Journal tab - Prepare the journal entries needed on September 30 to (a) fix the premature recording of advertising revenue, (b) update the rent accounts, (c) account for the use of equipment, (d) update deferred revenue, (e) accrue revenue not yet billed, ( ) accrue unpaid wages, (g) correct the supplies accounts, and (h) accrue income taxes for the year. General Ledger tab. Each journal entry is posted automatically to the general ledger. Triat Balance tab - The ending balance values from the General Ledger tab flows through to the Adjusted Trial Balance tab. Income Statement tab - Use the drop-down to select the accounts properly included on the income statement. The unadjusted and adjusted balances will appear for each account based on your selection. Statement of Retained Earnings tab - Use the drop-down to select the accounts properiy included on the statement of retained earnings. Balance Sheet tab - Use the drop-down to select the accounts properly included on the balance sheet. The unadjusted and adjusted balances will appear for each account, based on your selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts