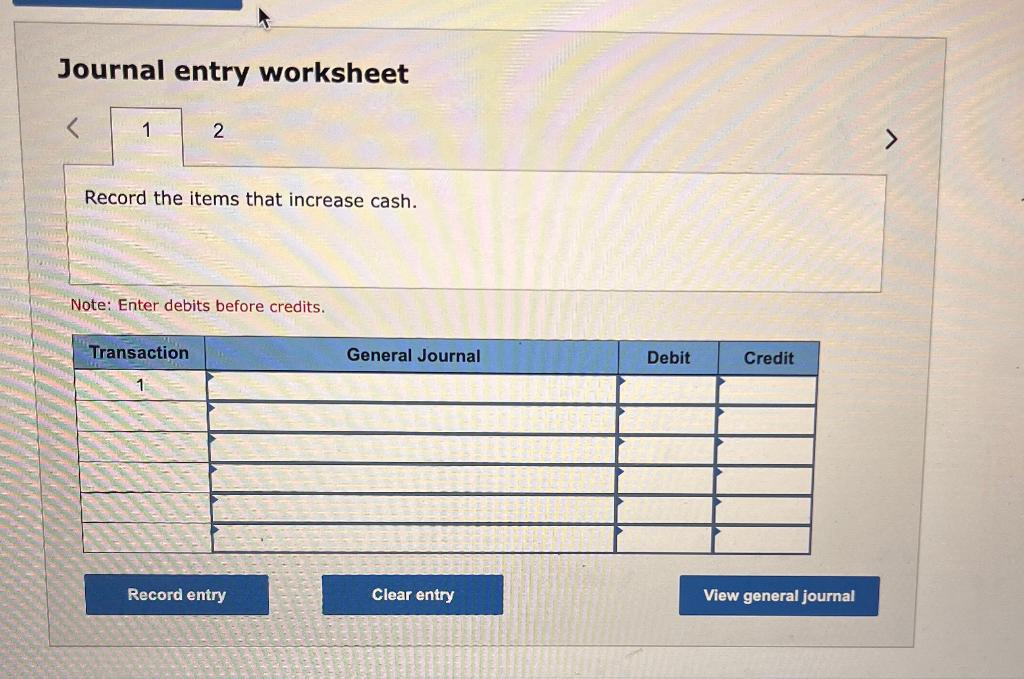

Question: Journal entry worksheet Record the items that increase cash. Note: Enter debits before credits. Madison Company's cash ledger reports the following for the month ending

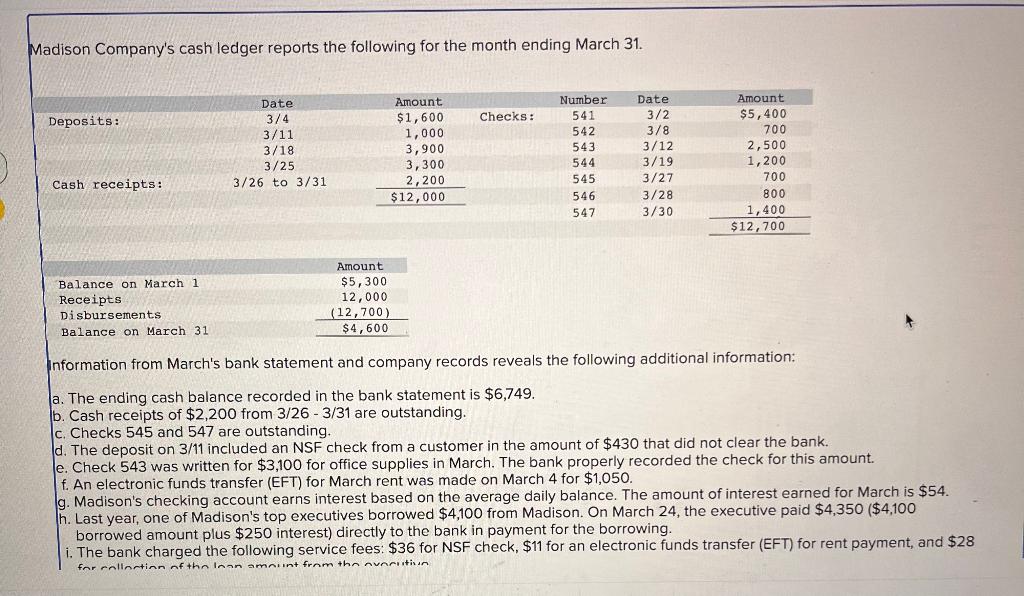

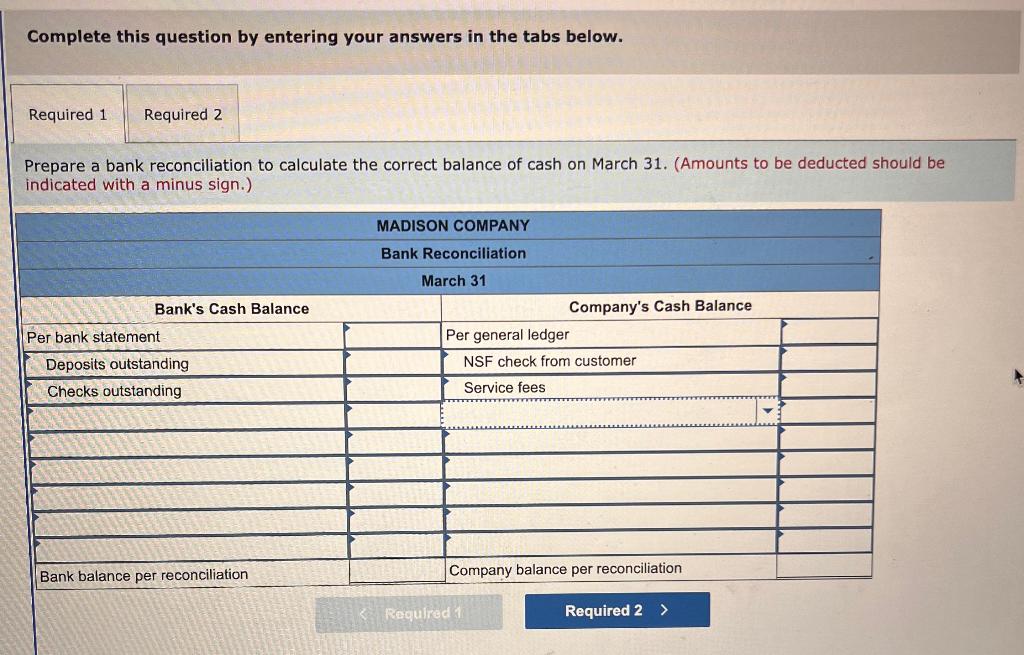

Journal entry worksheet Record the items that increase cash. Note: Enter debits before credits. Madison Company's cash ledger reports the following for the month ending March 31. Information from March's bank statement and company records reveals the following additional information: a. The ending cash balance recorded in the bank statement is $6,749. b. Cash receipts of $2,200 from 3/263/31 are outstanding. c. Checks 545 and 547 are outstanding. d. The deposit on 3/11 included an NSF check from a customer in the amount of $430 that did not clear the bank. e. Check 543 was written for $3,100 for office supplies in March. The bank properly recorded the check for this amount. f. An electronic funds transfer (EFT) for March rent was made on March 4 for $1,050. g. Madison's checking account earns interest based on the average daily balance. The amount of interest earned for March is $54. h. Last year, one of Madison's top executives borrowed $4,100 from Madison. On March 24 , the executive paid $4,350($4,100 borrowed amount plus $250 interest) directly to the bank in payment for the borrowing. i. The bank charged the following service fees: $36 for NSF check, $11 for an electronic funds transfer (EFT) for rent payment, and $28 Complete this question by entering your answers in the tabs below. Prepare a bank reconciliation to calculate the correct balance of cash on March 31. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts