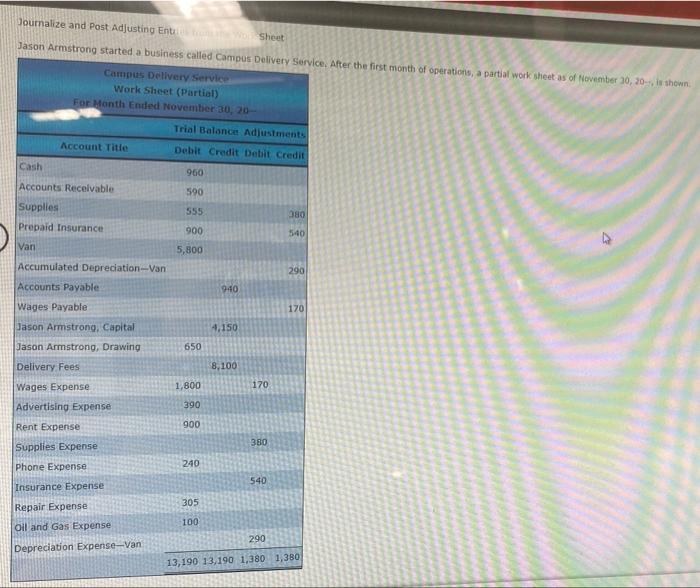

Question: Journalize and Post Adjusting Entert Sheet Jason Armstrong started a business called Campus Delivery Service. After the first month of operations, a partial work sheet

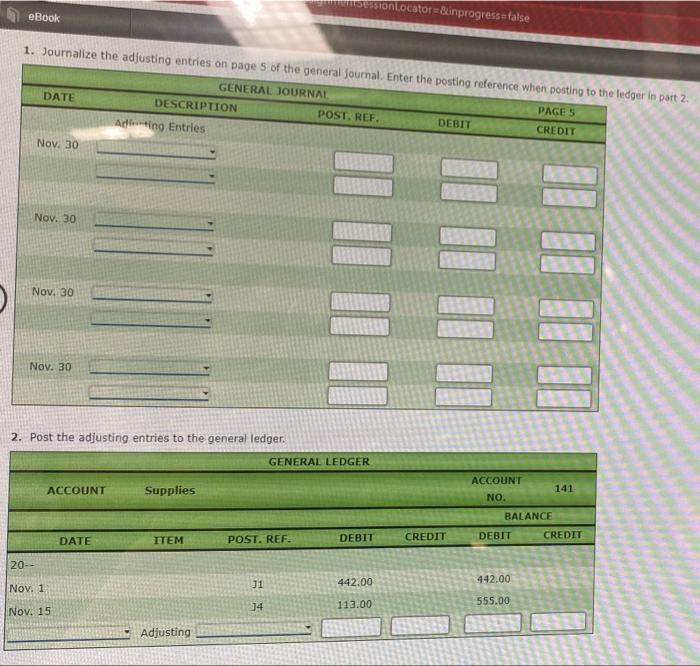

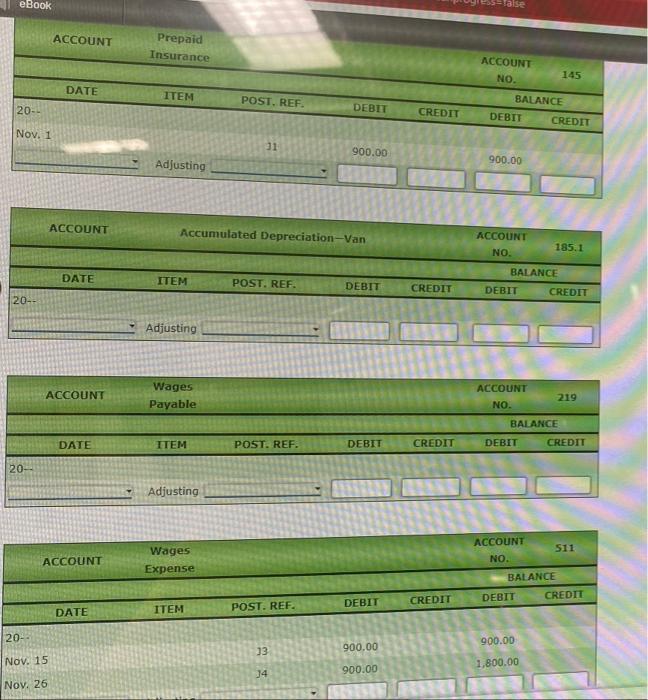

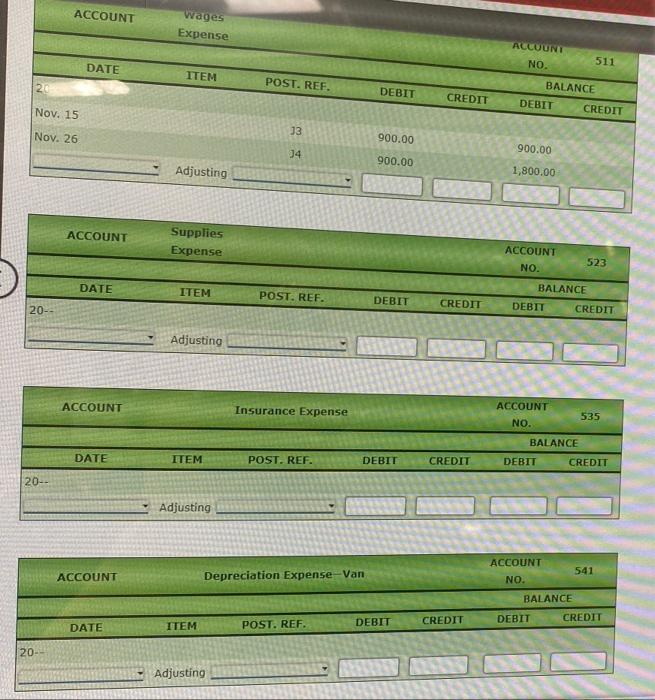

Journalize and Post Adjusting Entert Sheet Jason Armstrong started a business called Campus Delivery Service. After the first month of operations, a partial work sheet as of November 10, 20, is shown Campus Delivery Service Work Sheet (Partial) For Month Ended November 30, 20 Trial Balance Adjustments Account Title Debit Credit Debit Credit Cash 960 Accounts Receivable Supplies 590 555 380 Prepaid Insurance 900 540 Van 5,800 Accumulated Depreciation-Van 290 Accounts Payable 9:40 Wages Payable 170 4.150 Jason Armstrong, Capital Jason Armstrong, Drawing 650 Delivery Fees 8,100 Wages Expense 1,800 170 Advertising Expense 390 Rent Expense 900 380 Supplies Expense Phone Expense 240 540 Insurance Expense 305 Repair Expense Oil and Gas Expense 100 290 Depreciation Expense--Van 13,190 13,190 1,380 1,300 essionlocator=&inprogressfalse eBook 1. Journalize the adjusting entries on page 5 of the general Journal. Enter the posting reference when posting to the ledger in part 2 GENERAL JOURNAL PAGE 5 DATE DESCRIPTION POST. REF. DEBIT CREDIT Aditing Entries Nov. 30 Nov. 30 Nov. 30 Nov. 30 2. Post the adjusting entries to the general ledger. GENERAL LEDGER ACCOUNT Supplies ACCOUNT NO. 141 BALANCE DATE POST. REF. DEBIT DEBIT ITEM CREDIT CREDIT 20-- 442.00 J1 442.00 Nov. 1 J4 113.00 555.00 Nov. 15 Adjusting eBook alse ACCOUNT Prepaid Insurance DATE ACCOUNT 145 NO. BALANCE DEBIT CREDIT ITEM POST. REF. 20- DEBIT CREDIT Nov. 1 31 900.00 Adjusting 900.00 ACCOUNT Accumulated Depreciation-Van ACCOUNT 185.1 NO. BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20- Adjusting ACCOUNT Wages Payable ACCOUNT NO. 219 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20- Adjusting ACCOUNT Wages Expense ACCOUNT 511 NO. BALANCE DEBIT CREDIT DEBIT CREDIT POST. REF. DATE ITEM 20 900.00 900.00 13 Nov. 15 14 900.00 1,800.00 Nov. 26 ACCOUNT Wages Expense ACCOUNT NO. 511 DATE ITEM 2 POST. REF. DEBIT CREDIT BALANCE DEBIT CREDIT Nov. 15 Nov. 26 13 900.00 900.00 14 900.00 Adjusting 1,800.00 ACCOUNT Supplies Expense ACCOUNT NO. 523 DATE BALANCE ITEM POST. REF. DEBIT CREDIT 20 DEBIT CREDIT Adjusting ACCOUNT Insurance Expense ACCOUNT 535 NO. BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20-- Adjusting 541 ACCOUNT ACCOUNT NO. Depreciation Expense - Van BALANCE CREDIT DEBIT DATE DEBIT CREDIT ITEM POST. REF. 20 Adjusting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts