Question: journalize and post closing entries and complete the closing process On August 1, 2022, the following were the account balances of Sarasota Repair Services. Cash

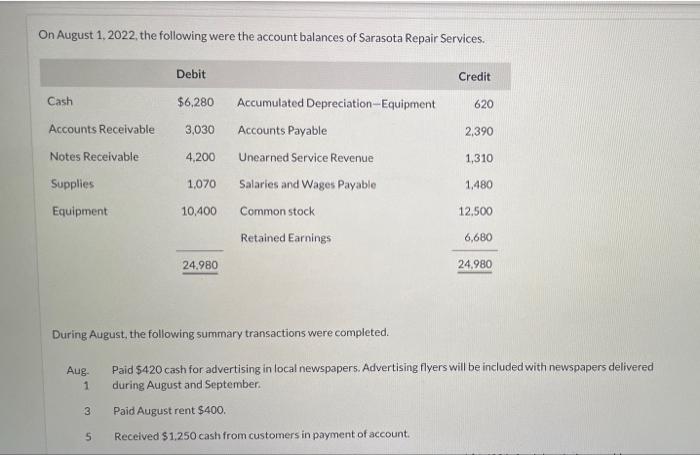

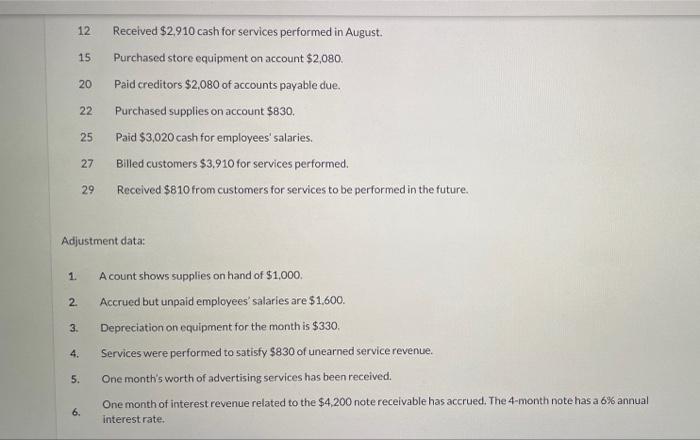

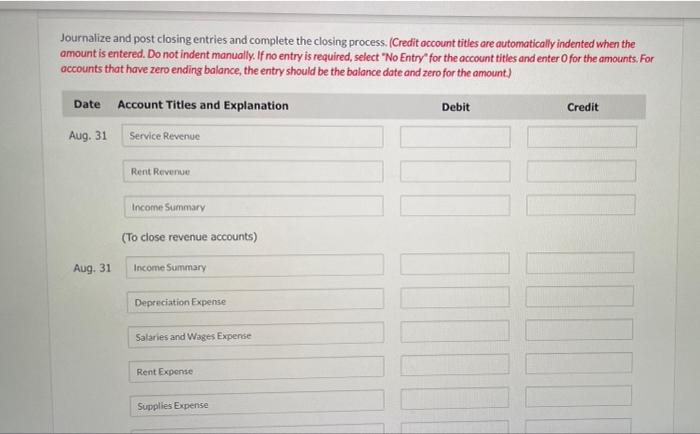

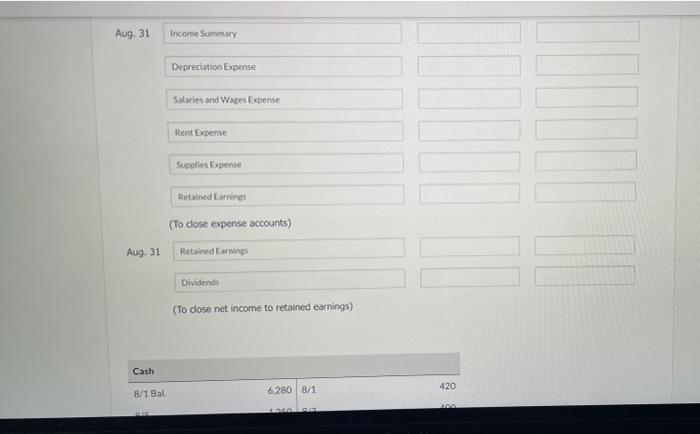

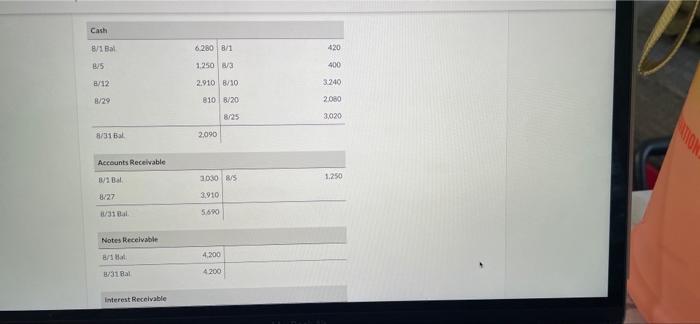

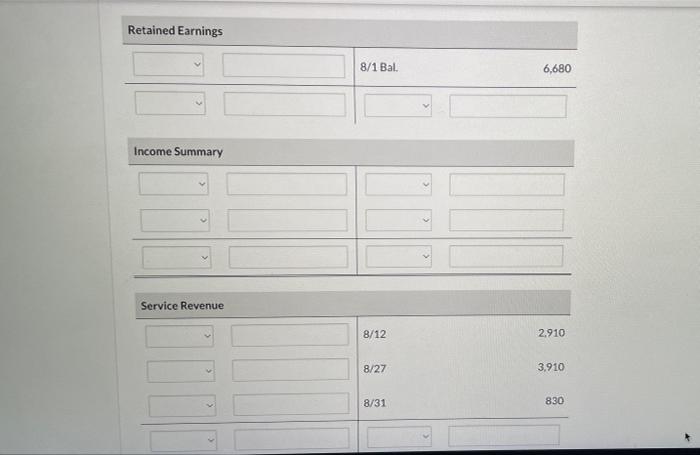

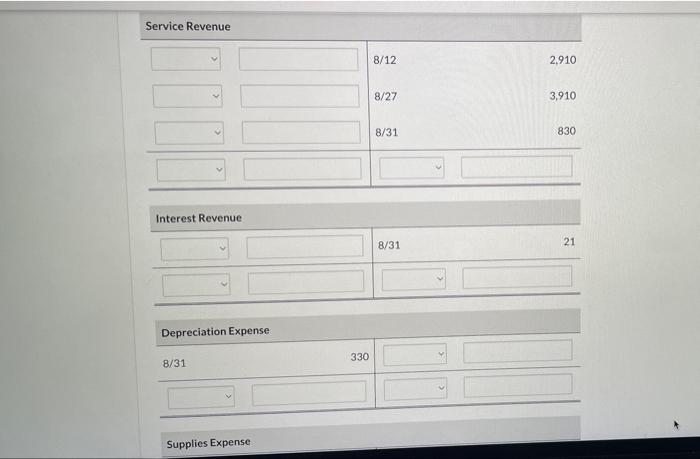

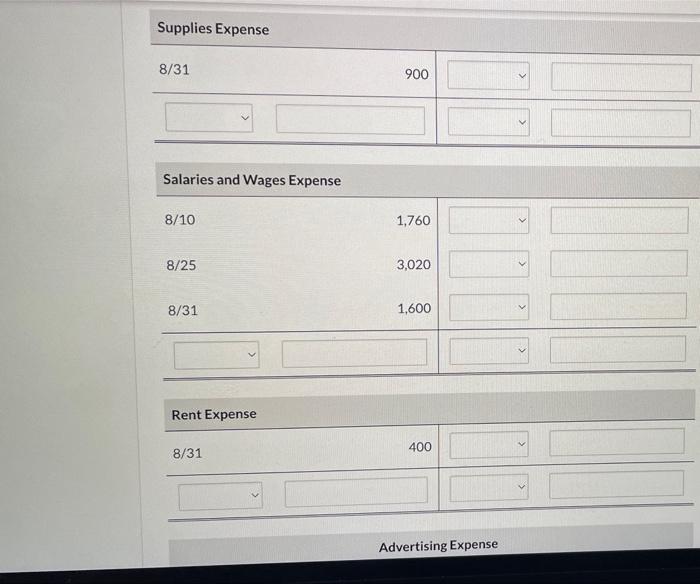

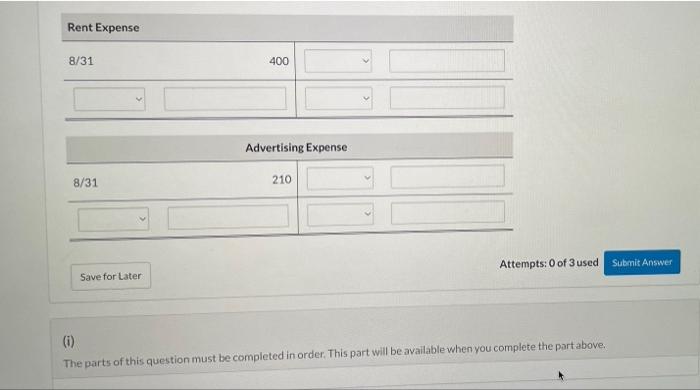

On August 1, 2022, the following were the account balances of Sarasota Repair Services. Cash Accounts Receivable Notes Receivable Supplies Equipment Aug. 1 3 Debit 5 $6,280 3,030 4,200 1,070 10,400 During August, the following summary transactions were completed. 24.980 Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Common stock Retained Earnings Credit 620 2,390 1,310 1,480 12.500 6,680 24,980 Paid $420 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. Paid August rent $400. Received $1.250 cash from customers in payment of account. 12 1. 2 15 222 20 3. Adjustment data: 4. 25 5. 6. 27 29 Received $2,910 cash for services performed in August. Purchased store equipment on account $2,080. Paid creditors $2,080 of accounts payable due. Purchased supplies on account $830. Paid $3,020 cash for employees' salaries. Billed customers $3,910 for services performed. Received $810 from customers for services to be performed in the future. A count shows supplies on hand of $1,000. Accrued but unpaid employees' salaries are $1,600. Depreciation on equipment for the month is $330. Services were performed to satisfy $830 of unearned service revenue. One month's worth of advertising services has been received. One month of interest revenue related to the $4,200 note receivable has accrued. The 4-month note has a 6% annual interest rate. Journalize and post closing entries and complete the closing process. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. For accounts that have zero ending balance, the entry should be the balance date and zero for the amount.) Date Account Titles and Explanation Aug. 31 Aug. 31 Service Revenue Rent Revenue Income Summary (To close revenue accounts) Income Summary Depreciation Expense Salaries and Wages Expense Rent Expense Supplies Expense Debit Credit 0000 Aug. 31 Aug. 31 Cash 8/1 Bal Income Summary Depreciation Expense Salaries and Wages Expense Rent Expense Supplies Expense Retained Earnings (To close expense accounts) Retained Earnings Dividends (To close net income to retained earnings) 6,280 8/1 1.250 212 01 000 420 11 Cash 8/1 Bal B/5 8/12 8/29 8/31 Bal Accounts Receivable 8/2 Bal 8/27 8/31 Bal Notes Receivable 8/1 Bal 8/31 Bal Interest Receivable 6.280 8/1 1.250 8/3 2.910 8/10 810 8/20 8/25 2,090 3030 8/5 3,910 5,690 4,200 4.200 420 400 3.240 2,080 3,020 1.250 NATION Retained Earnings Income Summary Service Revenue 8/1 Bal. 8/12 8/27 8/31 6,680 2,910 3,910 830 Service Revenue Interest Revenue Depreciation Expense 8/31 Supplies Expense 330 8/12 8/27 8/31 8/31 2,910 3,910 830 21 Supplies Expense 8/31 Salaries and Wages Expense 8/10 8/25 8/31 Rent Expense 8/31 900 1,760 3,020 1,600 400 Advertising Expense Rent Expense 8/31 8/31 Save for Later: 400 Advertising Expense 210 Attempts: 0 of 3 used (i) The parts of this question must be completed in order. This part will be available when you complete the part above. Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts