Question: Journalize and post the required adjusting entries. I need help with the adjusted entries. Below is the adjustments needed to be journalized. This is what

- Journalize and post the required adjusting entries. I need help with the adjusted entries.

Below is the adjustments needed to be journalized. This is what I'm needing help with. Everything above it the information leading up.

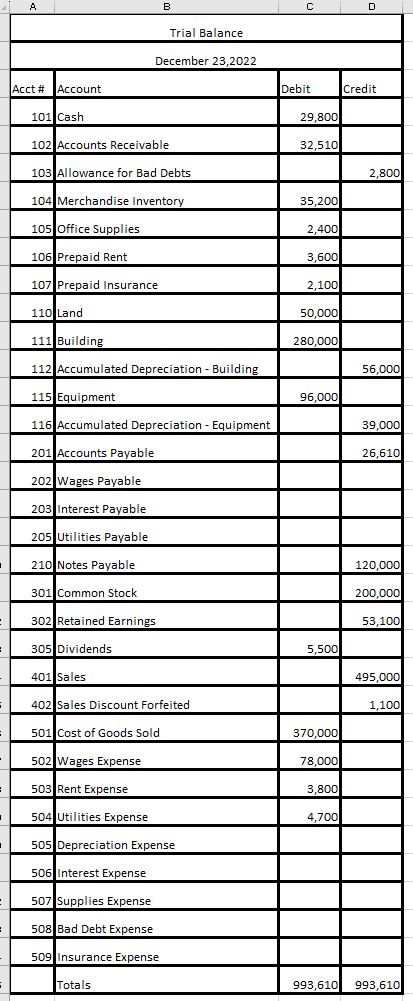

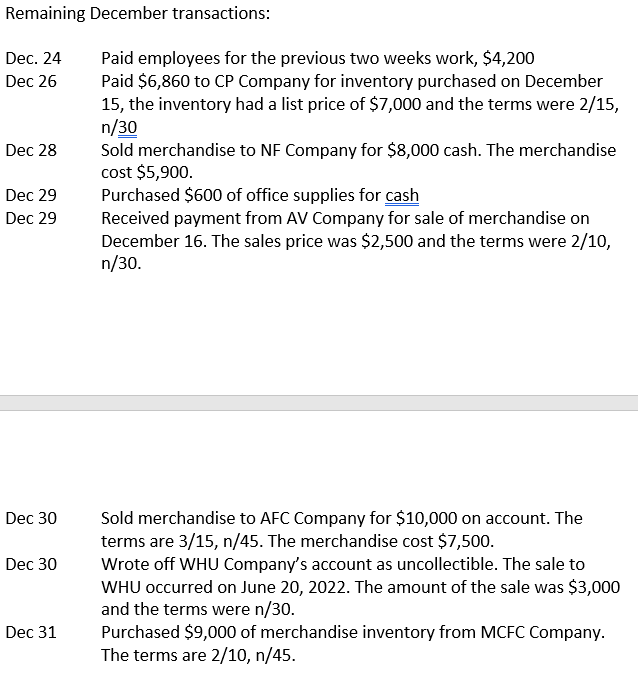

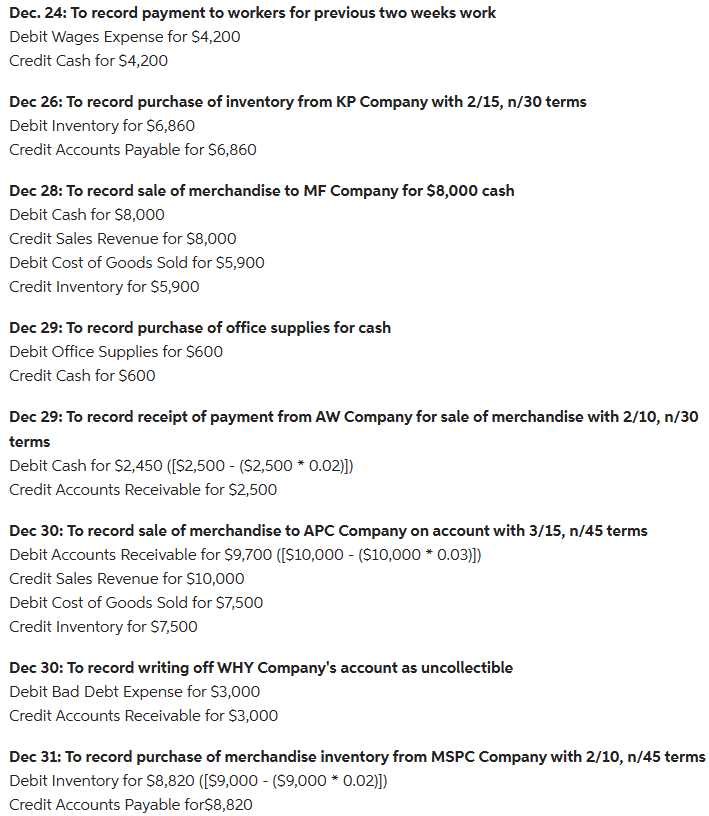

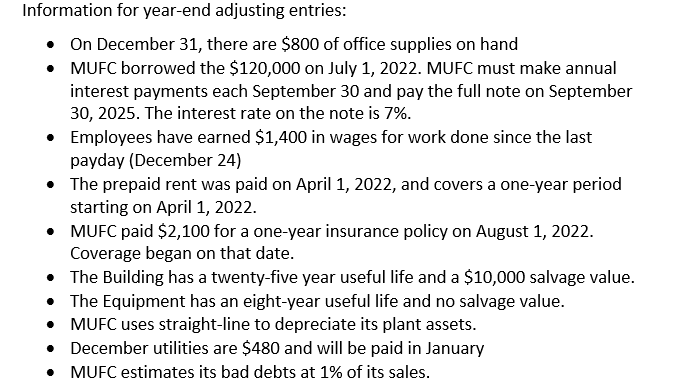

Remaining December transactions: Dec. 24 Paid employees for the previous two weeks work, $4,200 Dec 26 Paid $6,860 to CP Company for inventory purchased on December 15 , the inventory had a list price of $7,000 and the terms were 2/15, n/30 Dec 28 Sold merchandise to NF Company for $8,000 cash. The merchandise cost $5,900. Dec 29 Purchased $600 of office supplies for cash Dec 29 Received payment from AV Company for sale of merchandise on December 16 . The sales price was $2,500 and the terms were 2/10, n/30. Dec 30 Sold merchandise to AFC Company for $10,000 on account. The terms are 3/15,n/45. The merchandise cost $7,500. Dec 30 Wrote off WHU Company's account as uncollectible. The sale to WHU occurred on June 20,2022 . The amount of the sale was $3,000 and the terms were n/30. Dec 31 Purchased $9,000 of merchandise inventory from MCFC Company. The terms are 2/10, n/45. Dec. 24: To record payment to workers for previous two weeks work Debit Wages Expense for $4,200 Credit Cash for $4,200 Dec 26: To record purchase of inventory from KP Company with 2/15, n/30 terms Debit Inventory for $6,860 Credit Accounts Payable for $6,860 Dec 28: To record sale of merchandise to MF Company for $8,000 cash Debit Cash for $8,000 Credit Sales Revenue for $8,000 Debit Cost of Goods Sold for $5,900 Credit Inventory for $5,900 Dec 29: To record purchase of office supplies for cash Debit Office Supplies for $600 Credit Cash for $600 Dec 29: To record receipt of payment from AW Company for sale of merchandise with 2/10, n/30 terms Debit Cash for $2,450([$2,500($2,5000.02)]) Credit Accounts Receivable for $2,500 Dec 30: To record sale of merchandise to APC Company on account with 3/15,n/45 terms Debit Accounts Receivable for $9,700([$10,000 - ($10,0000.03)]) Credit Sales Revenue for $10,000 Debit Cost of Goods Sold for $7,500 Credit Inventory for $7,500 Dec 30: To record writing off WHY Company's account as uncollectible Debit Bad Debt Expense for $3,000 Credit Accounts Receivable for $3,000 Dec 31: To record purchase of merchandise inventory from MSPC Company with 2/10, n/45 term Debit Inventory for $8,820([$9,000($9,0000.02)]) Credit Accounts Payable for $8,820 Intormation for year-end adjusting entries: - On December 31, there are $800 of office supplies on hand - MUFC borrowed the $120,000 on July 1, 2022. MUFC must make annual interest payments each September 30 and pay the full note on September 30,2025 . The interest rate on the note is 7%. - Employees have earned $1,400 in wages for work done since the last payday (December 24) - The prepaid rent was paid on April 1, 2022, and covers a one-year period starting on April 1, 2022. - MUFC paid \$2,100 for a one-year insurance policy on August 1, 2022. Coverage began on that date. - The Building has a twenty-five year useful life and a $10,000 salvage value. - The Equipment has an eight-year useful life and no salvage value. - MUFC uses straight-line to depreciate its plant assets. - December utilities are $480 and will be paid in January - MUFC estimates its bad debts at 1% of its sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts