Question: journalize precise please Exercise 3 Journalize the following transactions: 1. In early January 2014 Coffee Supreme Inc. purchased a packaging machine at a cost of

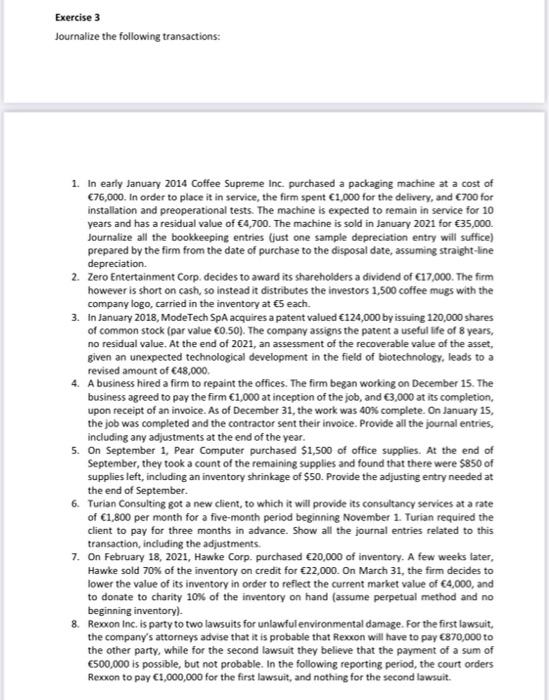

Exercise 3 Journalize the following transactions: 1. In early January 2014 Coffee Supreme Inc. purchased a packaging machine at a cost of 76,000. In order to place it in service, the firm spent 1,000 for the delivery, and 700 for installation and preoperational tests. The machine is expected to remain in service for 10 years and has a residual value of 4,700. The machine is sold in January 2021 for 35,000. Journalize all the bookkeeping entries (just one sample depreciation entry will suffice) prepared by the firm from the date of purchase to the disposal date, assuming straight-line depreciation. 2. Zero Entertainment Corp. decides to award its shareholders a dividend of 17,000. The firm however is short on cash, so instead it distributes the investors 1,500 coffee mugs with the company logo, carried in the inventory at 5 each. 3. In January 2018, ModeTech SpA acquires a patent valued 124,000 by issuing 120,000 shares of common stock (par value 0.50). The company assigns the patent a useful life of 8 years, no residual value. At the end of 2021, an assessment of the recoverable value of the asset, given an unexpected technological development in the field of biotechnology, leads to a revised amount of 48,000 4. A business hired a firm to repaint the offices. The firm began working on December 15. The business agreed to pay the firm 1,000 at inception of the job, and 3,000 at its completion, upon receipt of an invoice. As of December 31, the work was 40% complete. On January 15, the job was completed and the contractor sent their invoice. Provide all the journal entries, including any adjustments at the end of the year. 5. On September 1, Pear Computer purchased $1,500 of office supplies. At the end of September, they took a count of the remaining supplies and found that there were $850 of supplies left, including an inventory shrinkage of $50. Provide the adjusting entry needed at the end of September 6. Turian Consulting got a new client, to which it will provide its consultancy services at a rate of 1,800 per month for a five-month period beginning November 1. Turian required the client to pay for three months in advance. Show all the journal entries related to this transaction, including the adjustments. 7. On February 18, 2021, Hawke Corp purchased 20,000 of inventory. A few weeks later, Hawke sold 70% of the inventory on credit for 22,000. On March 31, the firm decides to lower the value of its inventory in order to reflect the current market value of 4,000, and to donate to charity 10% of the inventory on hand (assume perpetual method and no beginning inventory) 8. Rexxon Inc. is party to two lawsuits for unlawful environmental damage. For the first lawsuit, the company's attorneys advise that it is probable that Rexxon will have to pay 870,000 to the other party, while for the second lawsuit they believe that the payment of a sum of 500,000 is possible, but not probable. In the following reporting period, the court orders Rexxon to pay 1,000,000 for the first lawsuit, and nothing for the second lawsuit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts