Question: Journalize the adjusting entries Prepare a ledger using t accounts Prepare an adjusted trial balance Prepare an income statement Prepare a retained earnings statement Classified

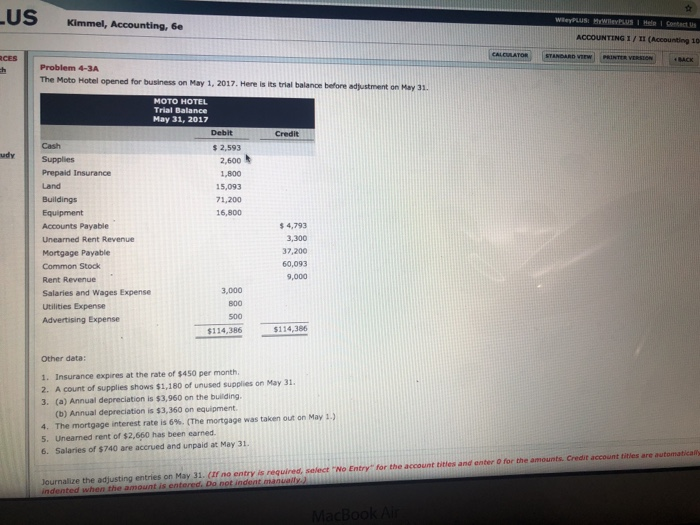

US Kimmel, Accounting, Ge ACCOUNTING I/ II (Accounting 10 CES STANDARD VIEW Problem 4-3A The Moto Hotel opened for business on May 1, 2017. Here is its trial balance before adjust MOTO HOTEL Trial Balance May 31, 2017 Debit s 2,593 2,600 1,800 15,093 71,200 16,800 udy Supplies Prepaid Insurance Land Accounts Payable Unearned Rent Revenue Mortgage Payable Common Stock Rent Revenue Salaries and Wages Expense Utilities Expense Advertising Expense 4,793 3,300 37,200 60,093 9,000 3,000 800 500 114,386 $114,386 Other data: 1. Insurance expires at the rate of $450 per month 3. (a) Annual depreciation is $3,960 on the building. 2. A count of supplies shows $1,180 of unused supplies on May 31 (b) Annual depreciation is $3,360 on equipment 4, The mortgage interest rate is 6%. (The mortgage was taken out on May 1.) 5. Unearned rent of $2,660 has been 6. Salaries of $740 are accrued and unpaid at May 31. earned. Journalize the adjusting entries on May 31. (rn enry is required, select No Enty- for the account tes and enter o for the amounts. Credit account titles are automaticanh indented when the amount is entered, Do not indent manually)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts