Question: Journalize the adjusting entry needed on December 31, 2020 the companys year end, for each of the following independent cases. Adjusting entries are only made

Journalize the adjusting entry needed on December 31, 2020 the companys year end, for each of the following independent cases. Adjusting entries are only made on December 31 in this company.

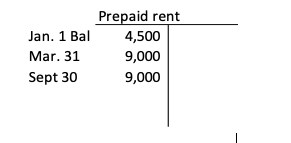

- Details of the Prepaid Rent Expense account are shown:

The company pays office rent semi-annually on March 31 and September 30. At December 31, part of the last payment is still available to cover January to march of the next year. No rent expense has been recorded for the year yet.

b. The company pays its employees each Friday. The amount of the weekly payroll is $12,500 for a five day work week. December 31 is on a Wednesday, the employees will be paid on Friday, January 2.

c. The company purchased equipment on March 1, 2020 for $120,000. The equipment has a useful life of 5 years and a residual value of $0. No depreciation has been recorded yet this year.

d. On May 1 the company received $36,000 for services to be provided from May 1, 2020 to April 30, 2021. The company provided its services from May 1-December 31, 2020.

e. The company provided services valued at $15,000 for a customer in December but has not yet sent out a bill or received any cash.

f. The beginning balance of Supplies on January 1, 2020 was $6,400. During 2019 the company purchased supplies costing $18,200. On December 31, 2020, there were $8,000 worth of supplies remaining.

Prepaid rent Jan. 1 Bal 4,500 Mar. 31 9,000 Sept 30 9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts