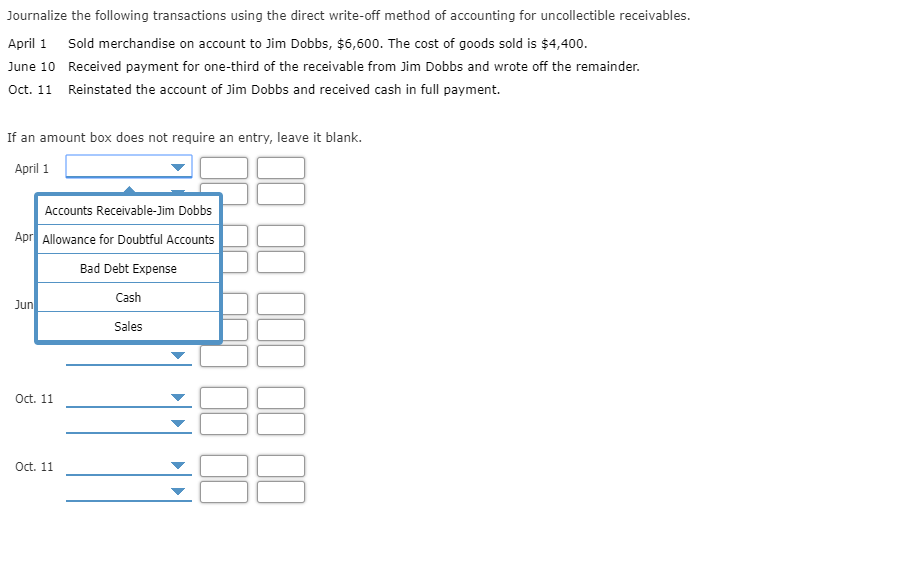

Question: Journalize the following transactions using the direct write-off method of accounting for uncollectible receivables. April 1 Sold merchandise on account to Jim Dobbs, $6,600. The

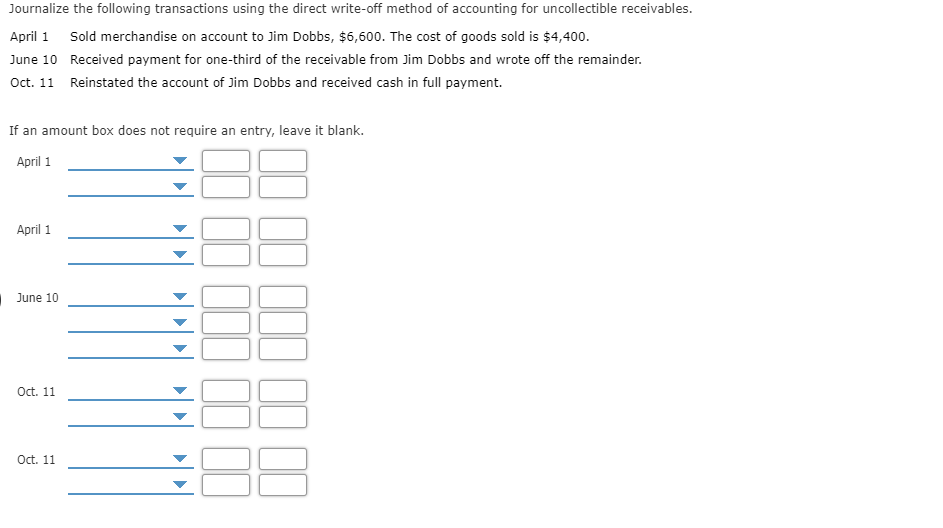

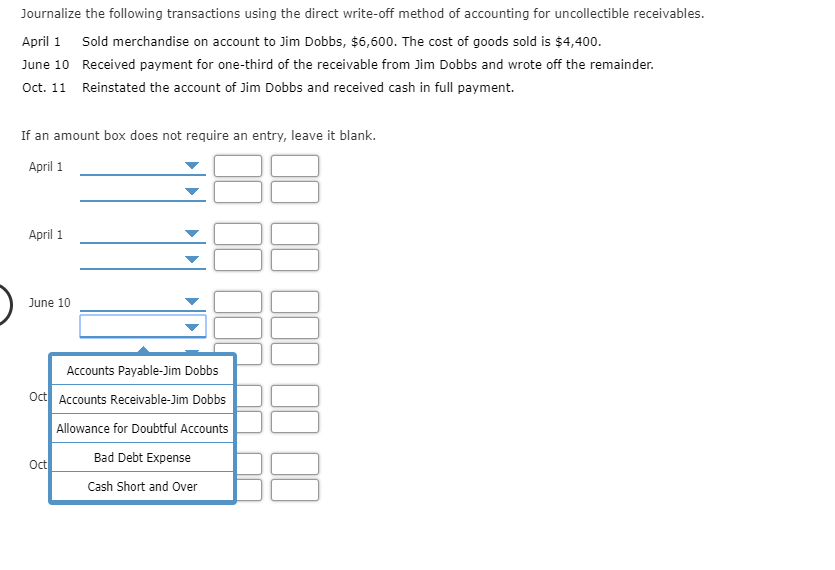

Journalize the following transactions using the direct write-off method of accounting for uncollectible receivables. April 1 Sold merchandise on account to Jim Dobbs, $6,600. The cost of goods sold is $4,400. June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs and received cash in full payment. If an amount box does not require an entry, leave it blank. April 1 Accounts Receivable-Jim Dobbs Apr Allowance for Doubtful Accounts Bad Debt Expense Jun Cash Sales Oct. 11 Oct. 11 Journalize the following transactions using the direct write-off method of accounting for uncollectible receivables. April 1 Sold merchandise on account to Jim Dobbs, $6,600. The cost of goods sold is $4,400. June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs and received cash in full payment. If an amount box does not require an entry, leave it blank. April 1 April 1 June 10 Oct. 11 Oct. 11 Journalize the following transactions using the direct write-off method of accounting for uncollectible receivables, April 1 Sold merchandise on account to Jim Dobbs, $6,600. The cost of goods sold is $4,400. June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs and received cash in full payment. If an amount box does not require an entry, leave it blank. April 1 April 1 April 1 - June 10 Accounts Payable Jim Dobbs Accounts Receivable-Jim Dobbs Oct Allowance for Doubtful Accounts Oct Bad Debt Expense Cash Short and Over

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts