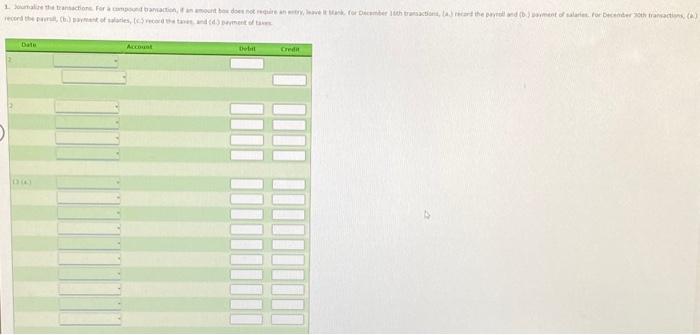

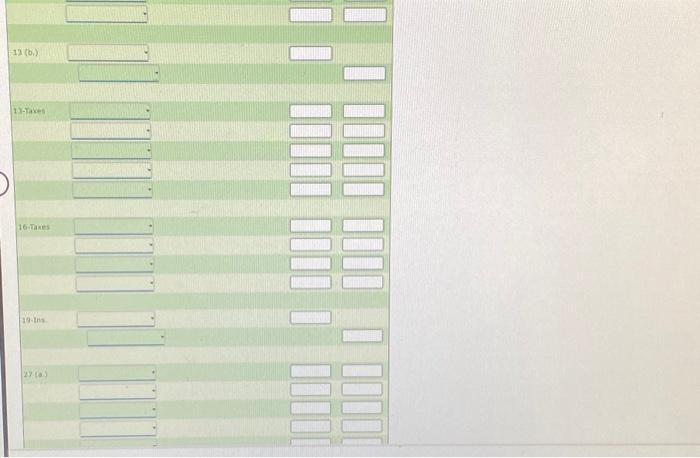

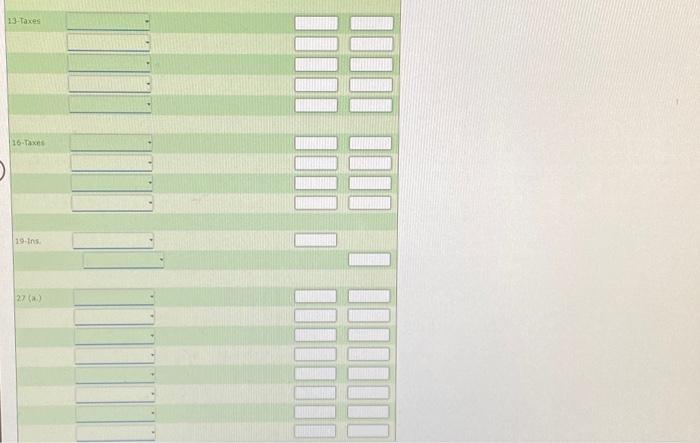

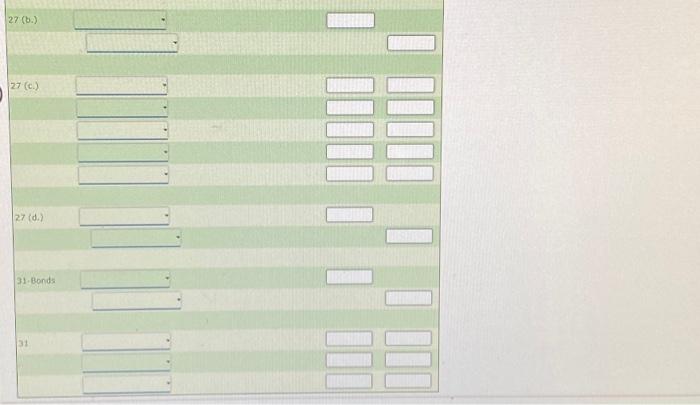

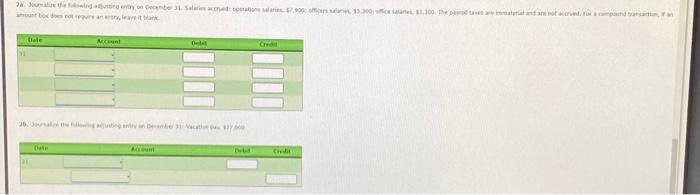

Question: Journalize the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. For December 16th transactions, (a.) record

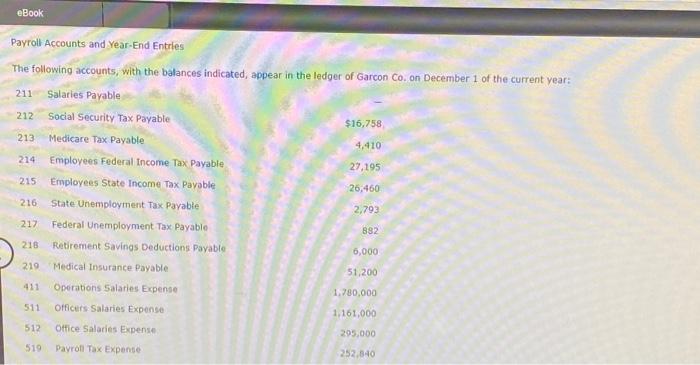

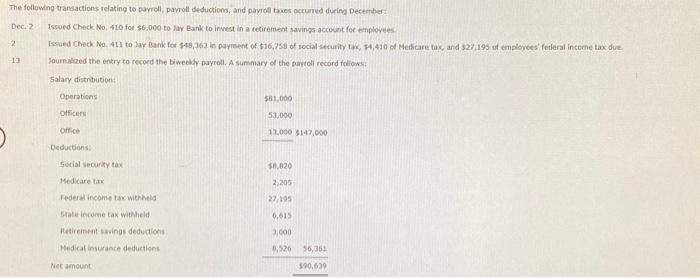

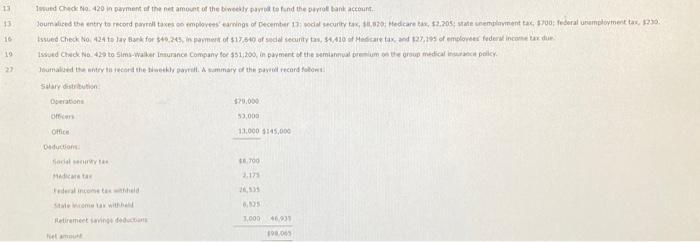

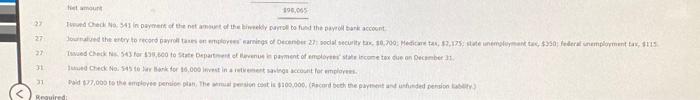

he following transactions relating to parroll, pavroll deductions, and pavrol twer cccurred during December: Dec. 2 Issoed Check No, 410 for $6,000 to Jar Bank to invet in a retirement savinga account for employees. Zournibized the entry to record the biweebly payroll. A summary of the parroli recard foliows: Payroll Accounts and Year-End Entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: Het amount 190,055 selary ditubution. Detration: orfinn 170.050: Office 53,003 Doduction: Ifadal morror Ine 13,000145,000 nedicaletar sale Wheme unhiund Net anbies. te. 700 din ingis 1000051,0004007 he following transactions relating to parroll, pavroll deductions, and pavrol twer cccurred during December: Dec. 2 Issoed Check No, 410 for $6,000 to Jar Bank to invet in a retirement savinga account for employees. Zournibized the entry to record the biweebly payroll. A summary of the parroli recard foliows: Payroll Accounts and Year-End Entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: Het amount 190,055 selary ditubution. Detration: orfinn 170.050: Office 53,003 Doduction: Ifadal morror Ine 13,000145,000 nedicaletar sale Wheme unhiund Net anbies. te. 700 din ingis 1000051,0004007

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts