Question: Journalize the transactions of Lambert Engineering. Include an explanation with each journal entry. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Equipment; Accounts Payable;

Journalize the transactions of Lambert Engineering. Include an explanation with each journal entry. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Equipment; Accounts Payable; Notes Payable; Lambert, Capital; Lambert, Withdrawals; Service Revenue; and Utilities Expense.

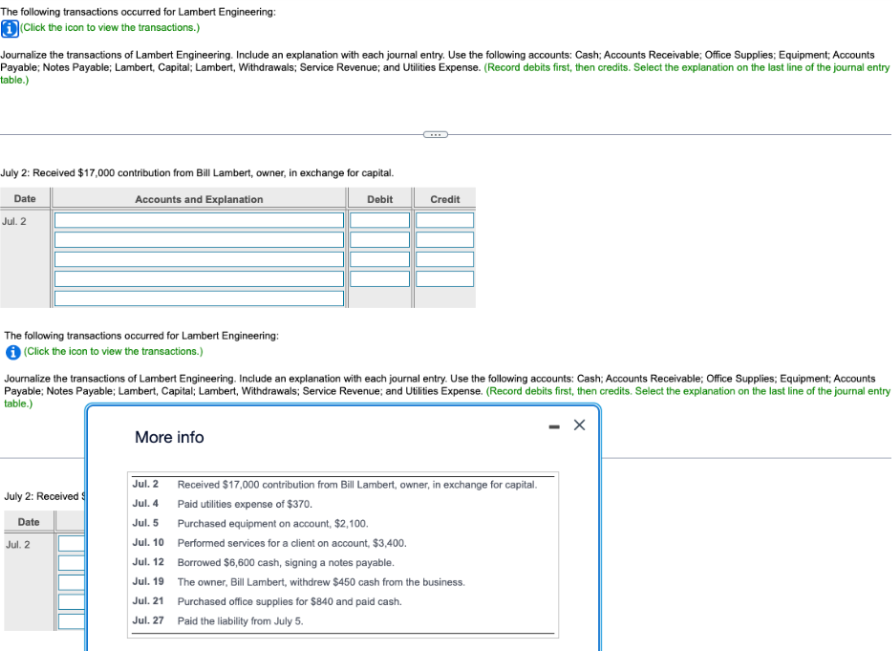

The following transactions occurred for Lambert Engineering: (Click the icon to view the transactions.) Journalize the transactions of Lambert Engineering. Include an explanation with each journal entry. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Equipment; Accounts Payable; Notes Payable; Lambert, Capital; Lambert, Withdrawals; Service Revenue; and Utilities Expense. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) July 2: Received $17,000 contribution from Bill Lambert, owner, in exchange for capital. The following transactions occurred for Lambert Engineering: (Click the icon to view the transactions.) Journalize the transactions of Lambert Engineering. Include an explanation with each journal entry. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Equipment; Accounts Payable; Notes Payable; Lambert, Capital; Lambert, Withdrawals; Service Revenue; and Utilities Expense. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) More info \begin{tabular}{ll} \hline Jul. 2 & Received $17,000 contribution from Bill Lambert, owner, in exchange for capital. \\ Jul. 4 & Paid utilities expense of $370. \\ Jul. 5 & Purchased equipment on account, $2,100. \\ Jul. 10 & Performed services for a client on account, $3,400. \\ Jul. 12 & Borrowed $6,600 cash, signing a notes payable. \\ Jul. 19 & The owner, Bill Lambert, withdrew $450 cash from the business. \\ Jul. 21 & Purchased office supplies for $840 and paid cash. \\ Jul. 27 & Paid the liability from July 5. \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts