Question: Journalize these transactions for Dan's Dependable Delivery. Then post to the partial ledger in Part 2 . FYI: Burgundy transactions are notes receivable transactions and

Journalize these transactions for Dan's Dependable Delivery. Then post to the partial ledger in Part

FYI: Burgundy transactions are notes receivable transactions and black transactions are bad debt transactions. Journalizing is done in chronological order.

Oct

Receive $ cash from Jazz Jones, a client, and invoiced the remainder $ due in days. This is a service business. The revenue account is service revenue.

Oct

Write off three long overdue accounts receivable from on account clients: Kathy Carmichael $ Carl Canover $ and

Daisy Williams $ You use the GAAP compliant allowance method to write off accounts.

Nov

Received a one month $APR note receivable from Colin Arnolds, an accounts receivable client.

Nov

Receive the amount due on account from client, Jazz Jones October sale

Dec

Collect payment from Colin Arnolds for the maturity value of the November note receivable.

Dec

Receive a day $ APR note receivable on account from Allied Amusement for the sale of travel services.

Dec

Receive $ from client Daisy Williams. This account was written off on October Make a journal entry to

reinstate the account and a journal entry to record the $ cash payment.

Dec

The fiscal year ends. Make the journal entry for accrued interest on the December note receivable from Allied Amusement.

Dec

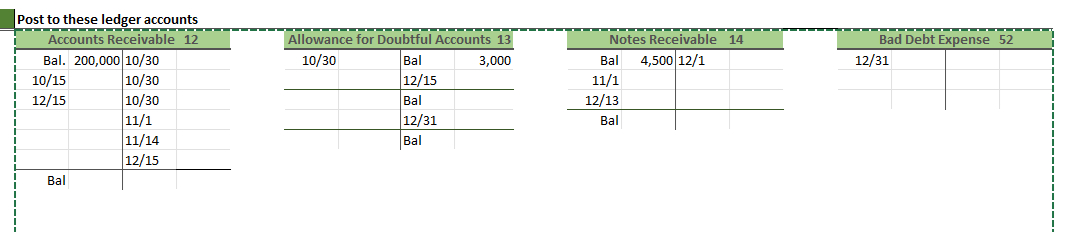

Post the journal entries to the taccounts below and find the balances. HINT: This is not a journal entry

Dec

You complete an aging of accounts receivable and estimate $ will be uncollectable in the following year. Journalize the

adjusting entry. HINT: taccount balances must be calculated before you make this entry.

Dec

What if you estimate the uncollectable accounts based on credit sales instead of aging of accounts receivable. Given the following

information journalize this adjusting entry. During the year there was $ in credit sales. Based on the previous years, the

uncollectable amount is of credit sales. Record this entry, but DO NOT post it to the taccounts.

NOTE: In the business world, you would make only one of these last two transactions, not both.

Post to these ledger accounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock