Question: Journalize transactions, post, and prepare a trial balance. (SO 2,4,6,7) GLS Instructions Journalize the April transactions P2-2A Jane Kent is a licensed CPA. During the

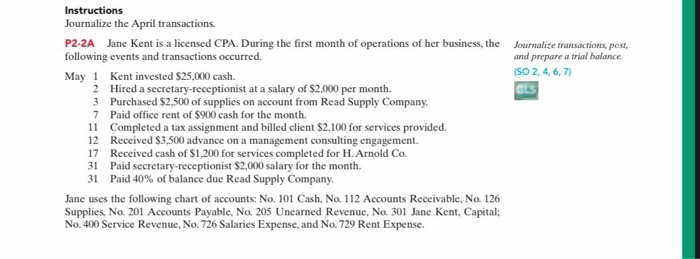

Journalize transactions, post, and prepare a trial balance. (SO 2,4,6,7) GLS Instructions Journalize the April transactions P2-2A Jane Kent is a licensed CPA. During the first month of operations of her business, the following events and transactions occurred. May 1 Kent invested $25,000 cash. 2 Hired a secretary-receptionist at a salary of $2,000 per month. 3 Purchased $2.500 of supplies on account from Read Supply Company, 7 Paid office rent of $900 cash for the month. 11 Completed a tax assignment and billed client $2.100 for services provided. 12 Received $3.500 advance on a management consulting engagement. 17 Received cash of $1.200 for services completed for H. Arnold Co. 31 Paid secretary-receptionist $2.000 salary for the month. 31 Paid 40% of balance due Read Supply Company. Jane uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 205 Unearned Revenue, No. 301 Jane Kent, Capital: No. 400 Service Revenue, No. 726 Salaries Expense, and No. 729 Rent Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts