Question: Journalizing Employee Payroll After computing the net and gross pay for each employee, prepare the journal entry to record the employee payroll. Date Accounts and

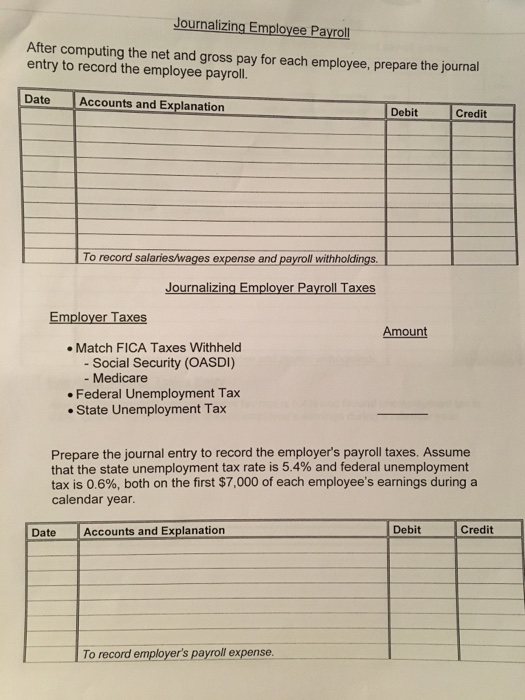

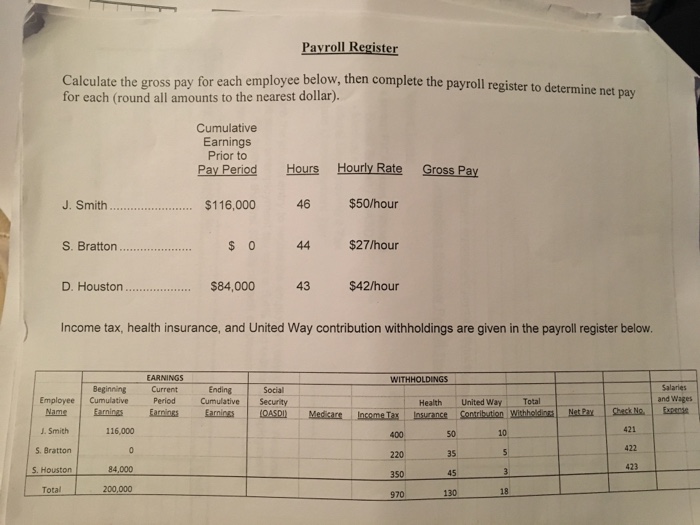

Journalizing Employee Payroll After computing the net and gross pay for each employee, prepare the journal entry to record the employee payroll. Date Accounts and Explanation Debit Credit To record salariesMwages expense and payroll withholdings. Journalizing Employer Payroll Taxes Employer Taxes Amount Match FICA Taxes Withheld Social Security (OASDI) Medicare Federal Unemployment Tax State Unemployment Tax Prepare the journal entry to record the employer's payroll taxes. Assume that the state unemployment tax rate is 5.4% and federal unemployment tax is 0.6%, both on the first $7,000 of each employee's earnings during a calendar year Date Accounts and Explanation Debit Credit To record employers payroll expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts