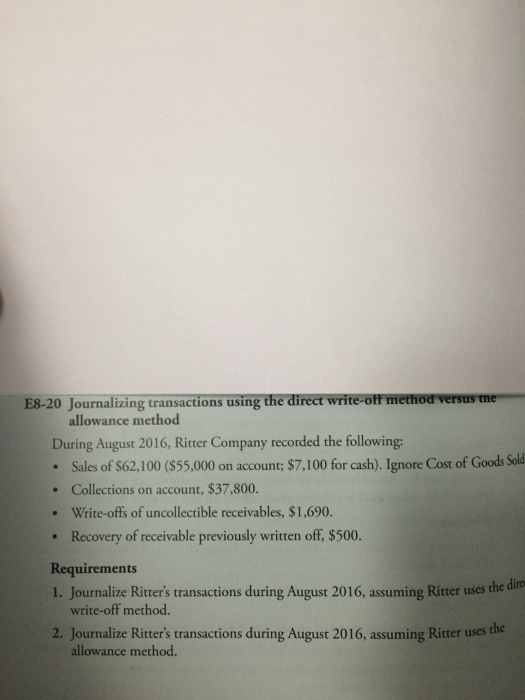

Question: Journalizing transactions using the direct write-off method versus the allowance method During August 2016, Ritter Company recorded the following: Sales of S62,100 ($55,000 on account;

Journalizing transactions using the direct write-off method versus the allowance method During August 2016, Ritter Company recorded the following: Sales of S62,100 ($55,000 on account; $7,100 for cash). Ignore Cost of Goods Sold Collections on account, $37,800. Write-offs of uncollectible receivables, $ 1,690. Recovery of receivable previously written off, $500. Requirements Journalize Ritter's transactions during August 2016, assuming Ritter uses the dirt1 write-off method. Journalize Ritter's transactions during August 2016, assuming Ritter uses the allowance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts