Question: .................. Joyce passed away on January 3 while on an extended holiday cruise celebrating a_yry_ successful, and most protable, previous year. Joyce was the chief

..................

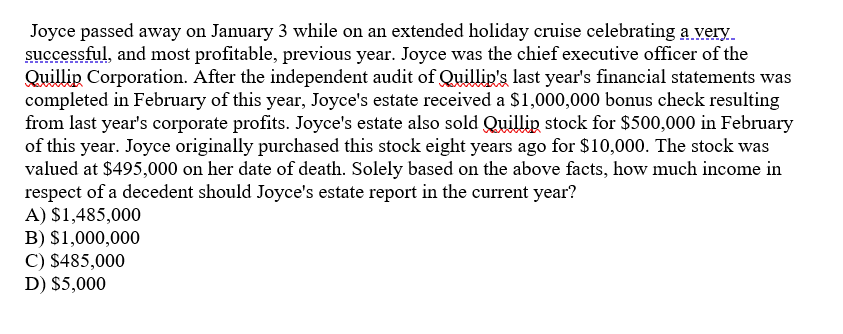

Joyce passed away on January 3 while on an extended holiday cruise celebrating a_yry_ successful, and most protable, previous year. Joyce was the chief executive ofcer of the Mir; Corporation. After the independent audit of 521.141.1093 last year's nancial statements was completed in February of this year, Joyce's estate received a $1,000,000 bonus check resulting from last year's corporate prots. Joyce's estate also sold Mm stock for $500,000 in February of this year. Joyce originally purchased this stock eight years ago for $10,000. The stock was valued at $495,000 on her date of death. Solely based on the above facts, how much income in respect of a decedent should Joyce's estate report in the current year? A) $1,485,000 B) $1,000,000 (3) $485,000 D) $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts