Question: JR ' s is preparing to start a new project in an industry that differs significantly from its cyrrent operations. JR ' s has searched

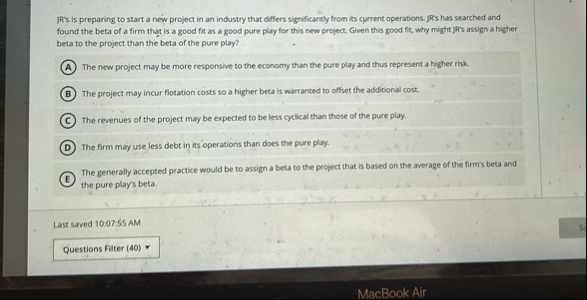

JRs is preparing to start a new project in an industry that differs significantly from its cyrrent operations. JRs has searched and found the beta of a firm that is a good fit as a good pure play for this new project, Given this good fic, why might jRs assign a higher beta to the project than the beta of the pure play?

The new project may be more responsive to the economy than the pure play and thus represent a higher risk.

The project may incur flotation costs so a higher beta is warranted to offset the additional cost.

The revenues of the project may be expected to be less cyclical than those of the pure play.

The firm may use less debt in its operations than does the pure play.

The generally accepted practice would be to assign a beta to the profect that is based on the average of the firm's beta and the pure play's beta.

Last saved : AM

MacBook Air

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock