Question: J.R. will sell 100,000 pounds of hogs to Garven Corp tomorrow. Garven Corp will pay J.R. at the end of the year. There is a

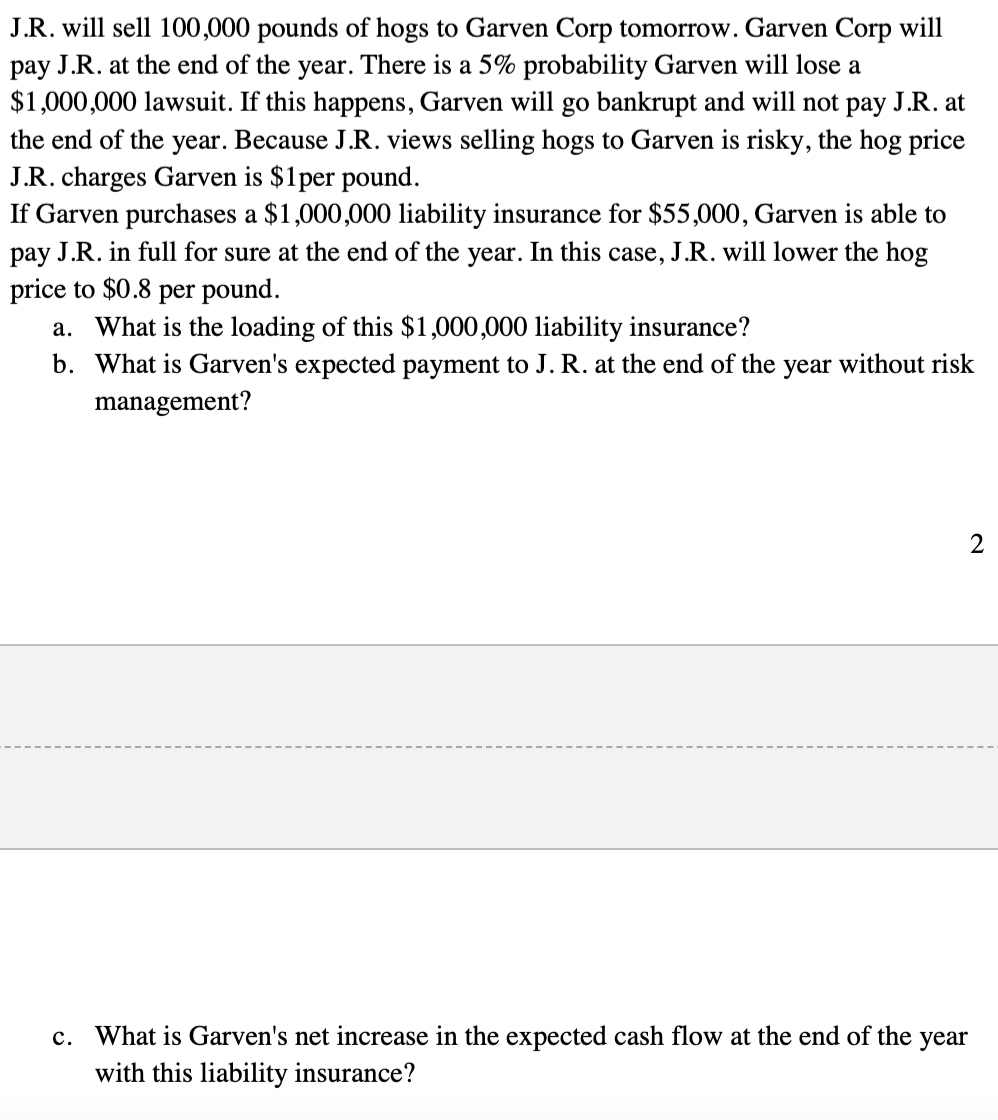

J.R. will sell 100,000 pounds of hogs to Garven Corp tomorrow. Garven Corp will pay J.R. at the end of the year. There is a 5% probability Garven will lose a $1,000,000 lawsuit. If this happens, Garven will go bankrupt and will not pay J.R. at the end of the year. Because J.R. views selling hogs to Garven is risky, the hog price J.R. charges Garven is $1per pound. If Garven purchases a $1,000,000 liability insurance for $55,000, Garven is able to pay J.R. in full for sure at the end of the year. In this case, J.R. will lower the hog price to $0.8 per pound. a. What is the loading of this $1,000,000 liability insurance? b. What is Garven's expected payment to J. R. at the end of the year without risk management? 2 c. What is Garven's net increase in the expected cash flow at the end of the year with this liability insurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts