Question: J&s Trucking - ALL ENTRIES FOR J&S ONLY) KEY for Accounting Component Assets = A Journal Entry - JE Liabilities - Stockholders' Equity = SE

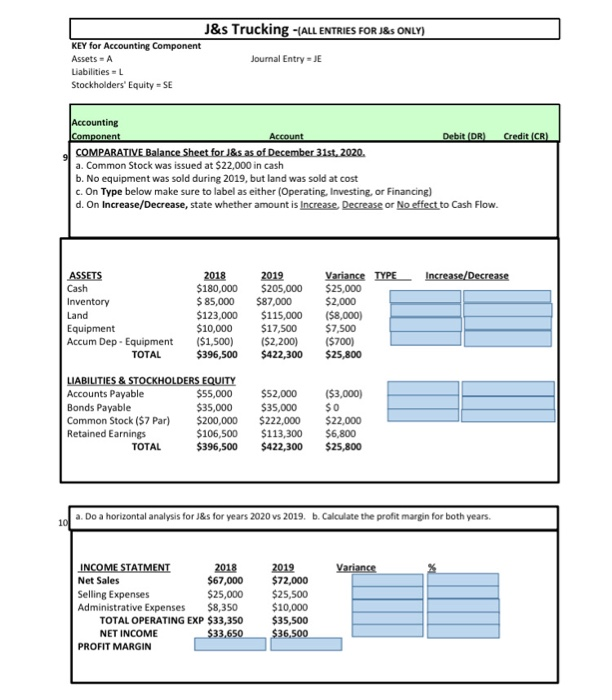

J&s Trucking - ALL ENTRIES FOR J&S ONLY) KEY for Accounting Component Assets = A Journal Entry - JE Liabilities - Stockholders' Equity = SE Accounting Component Account Debit (DR) Credit (CR) COMPARATIVE Balance Sheet for J&s as of December 31st.2020. a. Common Stock was issued at $22,000 in cash b. No equipment was sold during 2019, but land was sold at cost c. On Type below make sure to label as either (Operating, Investing, or Financing) d. On Increase/Decrease, state whether amount is increase Decrease or No effect to Cash Flow. Increase/Decrease ASSETS 2018 Cash $180,000 Inventory $ 85,000 Land $123,000 Equipment $10,000 Accum Dep - Equipment ($1,500) TOTAL $396,500 LIABILITIES & STOCKHOLDERS EQUITY Accounts Payable $55,000 Bonds Payable $35,000 Common Stock ($7 Par) $200,000 Retained Earnings $106,500 TOTAL $396,500 2019 $205,000 $87,000 $115,000 $17,500 ($2,200) $422,300 Variance TYPE $25,000 $2,000 ($8,000) $7,500 ($700) $25,800 $52,000 $35,000 $222,000 $113,300 $422,300 ($3,000) $0 $22,000 $6,800 $25,800 a. Do a horizontal analysis for J&s for years 2020 vs 2019. b. Calculate the profit margin for both years. Variance INCOME STATMENT 2018 Net Sales $67,000 Selling Expenses $25,000 Administrative Expenses $8,350 TOTAL OPERATING EXP $33,350 NET INCOME $33,650 PROFIT MARGIN 2019 $72,000 $25,500 $10,000 $35,500 $36,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts