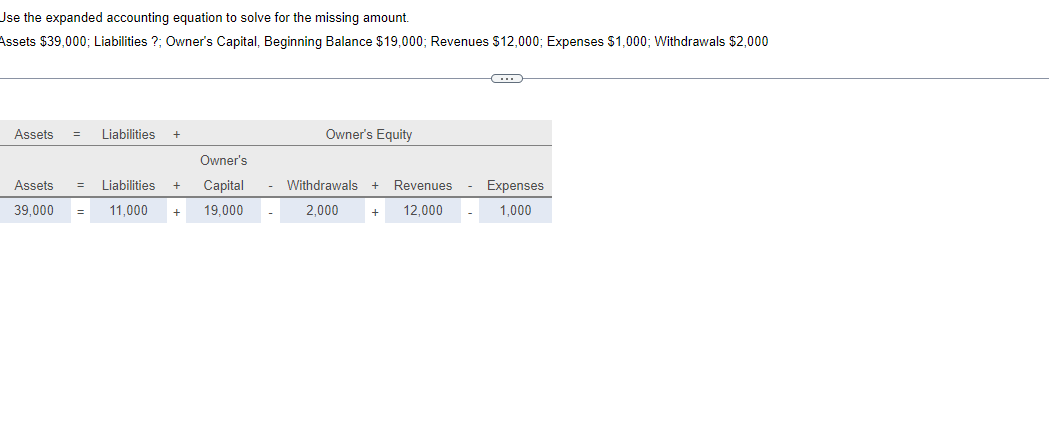

Question: Jse the expanded accounting equation to solve for the missing amount. Assets $39,000; Liabilities ?; Owner's Capital, Beginning Balance $19,000; Revenues $12,000; Expenses $1,000; Withdrawals

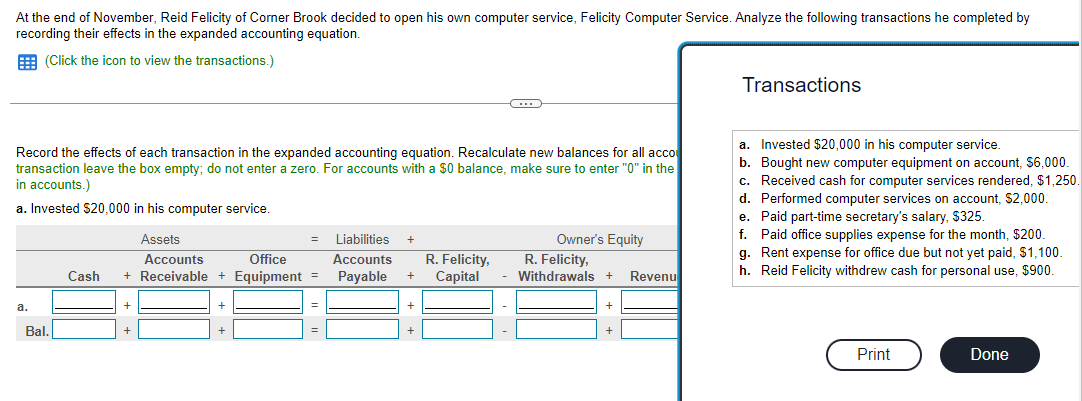

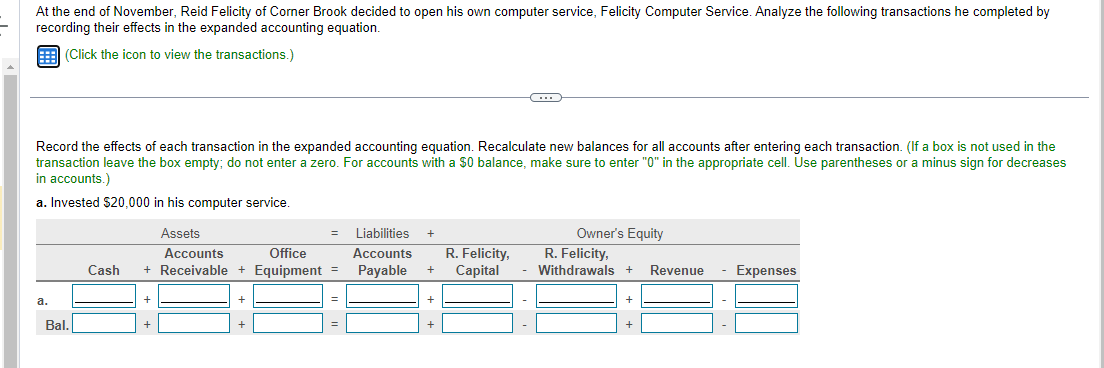

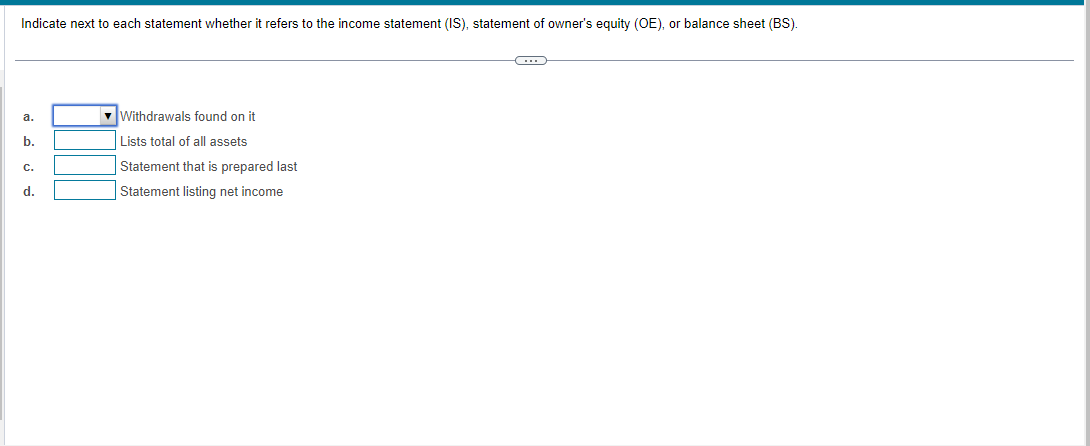

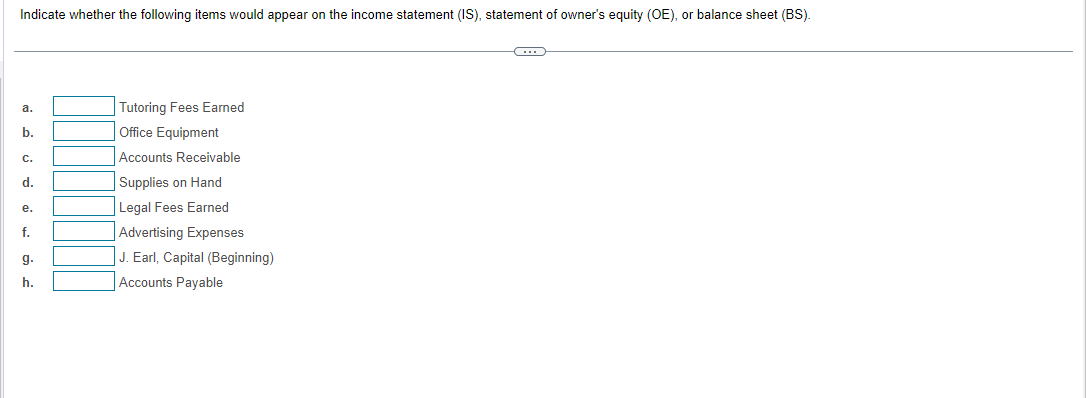

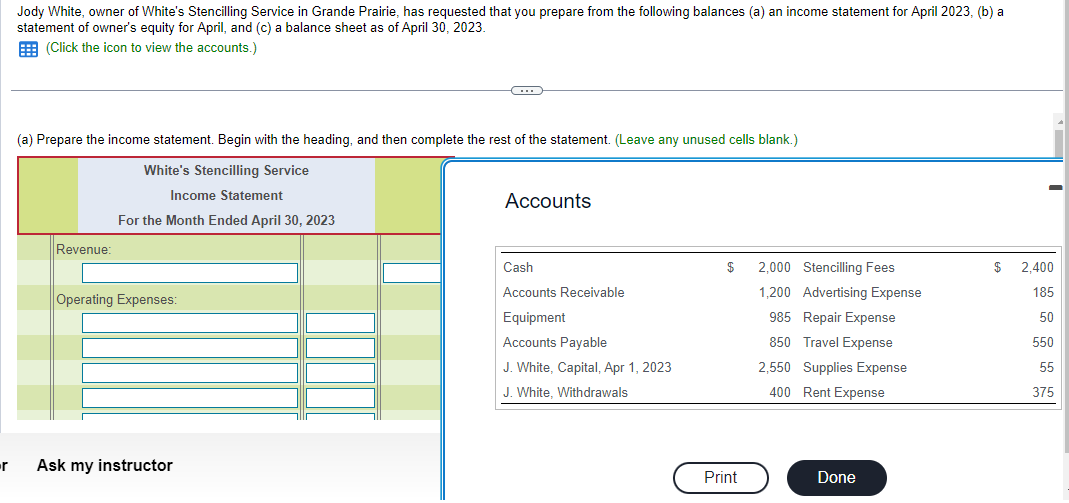

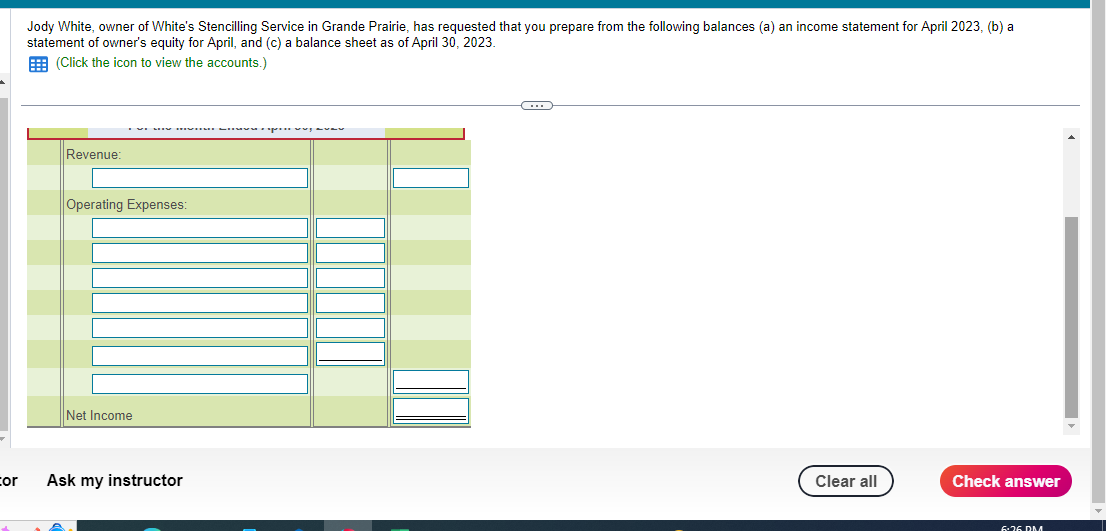

Jse the expanded accounting equation to solve for the missing amount. Assets $39,000; Liabilities ?; Owner's Capital, Beginning Balance $19,000; Revenues $12,000; Expenses $1,000; Withdrawals $2,000 Record the effects of each transaction in the expanded accounting equation. Recalculate new balances for all acco transaction leave the box empty; do not enter a zero. For accounts with a $0 balance, make sure to enter "0" in the in accounts.) a. Invested $20,000 in his computer service. a. Invested $20,000 in his computer service. b. Bought new computer equipment on account, $6,000. c. Received cash for computer services rendered, $1,250. d. Performed computer services on account, $2,000. e. Paid part-time secretary's salary, $325. f. Paid office supplies expense for the month, $200. g. Rent expense for office due but not yet paid, $1,100. h. Reid Felicity withdrew cash for personal use, $900. At the end of November, Reid Felicity of Corner Brook decided to open his own computer service, Felicity Computer Service. Analyze the following transactions he completed by recording their effects in the expanded accounting equation. (Click the icon to view the transactions.) Record the effects of each transaction in the expanded accounting equation. Recalculate new balances for all accounts after entering each transaction. (If a box is not used in the transaction leave the box empty; do not enter a zero. For accounts with a $0 balance, make sure to enter "0" in the appropriate cell. Use parentheses or a minus sign for decreases in accounts.) a. Invested $20,000 in his computer service Indicate next to each statement whether it refers to the income statement (IS), statement of owner's equity (OE), or balance sheet (BS). a. Withdrawals found on it b. Lists total of all assets c. Statement that is prepared last d. Statement listing net income f. Advertising Expenses g. J. Earl, Capital (Beginning) Jody White, owner of White's Stencilling Service in Grande Prairie, has requested that you prepare from the following balances (a) an income statement for April 2023 , (b) a statement of owner's equity for April, and (c) a balance sheet as of April 30, 2023. (Click the icon to view the accounts.) (a) Prepare the income statement. Begin with the heading, and then complete the rest of the statement. (Leave any unused cells blank.) Accounts Ask my instructor Jody White, owner of White's Stencilling Service in Grande Prairie, has requested that you prepare from the following balances (a) an income statement for April 2023, (b) a statement of owner's equity for April, and (c) a balance sheet as of April 30, 2023. (Click the icon to view the accounts.) Ask my instructor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts