Question: JSolutions Ltd . sponsors a defined benefit pension plan for its employees. At the beginning of 2 0 X 3 , there is an accrued

JSolutions Ltd sponsors a defined benefit pension plan for its employees. At the beginning of X there is an accrued SFP pension liability of $ as follows:

Defined benefit obligation $

Plan assets fair value

Net defined benefit liability $

There are also actuarial losses of $ in accumulated OCI with respect to the pension plan.

The following data relate to the operation of the plan for the years X and X:

XX

Current service cost $ $

Yield rate on longterm corporate bonds

Actual return loss on plan assets

Annual funding contributions, at yearend

Benefits paid to retirees, at end of year

Increase in defined benefit obligation due to changes in actuarial assumptions as of December each year

Required:

Prepare a spreadsheet that summarizes relevant pension data for X and X As part of the spreadsheet, calculate pension expense, the net defined benefit accrued benefit assetliability and accumulated OCI for X and XTR Defined Benefit Plan; Spreadsheet Approach LO

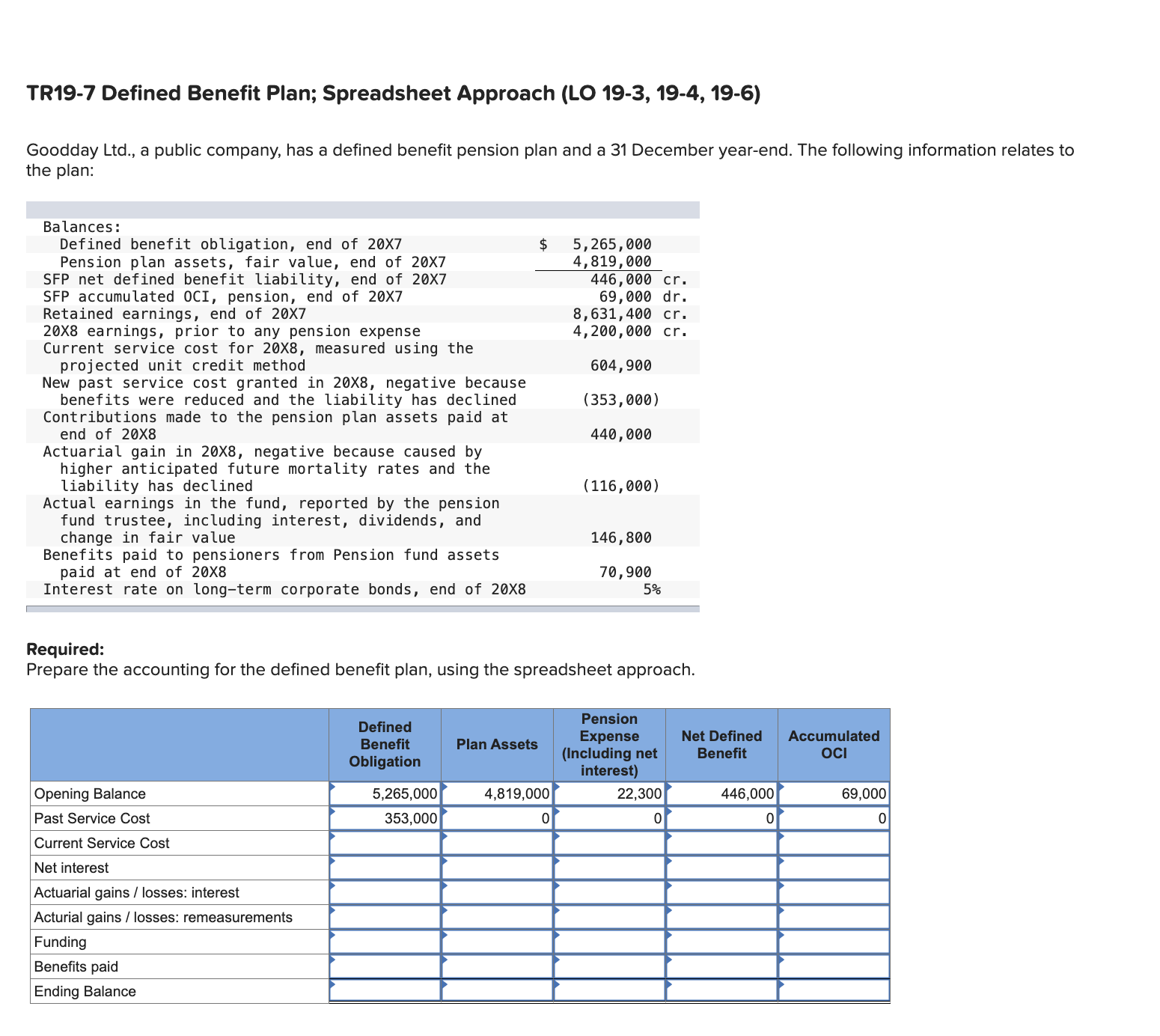

Goodday Ltd a public company, has a defined benefit pension plan and a December yearend. The following information relates to

the plan:Defined benefit obligation, end of X $

SFP net defined benefit liability, end of X cr

Retained earnings, end of X cr

X earnings, prior to any pension expense cr

Current service cost for X measured using theNew past service cost granted in X negative becauseContributions made to the pension plan assets paid atActuarial gain in X negative because caused byliability has declined

Actual earnings in the fund, reported by the pensionchange in fair value

Benefits paid to pensioners from Pension fund assetsInterest rate on longterm corporate bonds, end of X

Required:

Prepare the accounting for the defined benefit plan, using the spreadsheet approach.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock