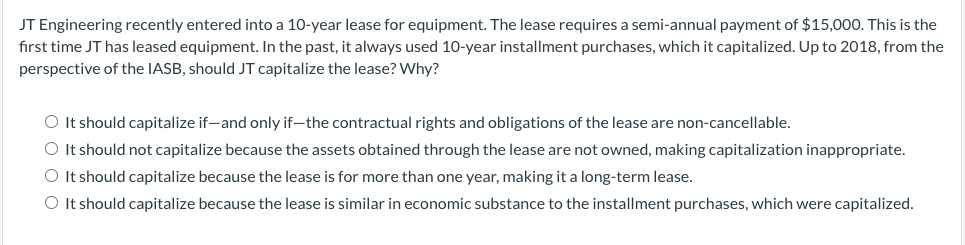

Question: JT Engineering recently entered into a 1 0 - year lease for equipment. The lease requires a semi - annual payment of $ 1 5

JT Engineering recently entered into a year lease for equipment. The lease requires a semiannual payment of $ This is the

first time JT has leased equipment. In the past, it always used year installment purchases, which it capitalized. Up to from the

perspective of the IASB, should JT capitalize the lease? Why?

It should capitalize ifand only ifthe contractual rights and obligations of the lease are noncancellable.

It should not capitalize because the assets obtained through the lease are not owned, making capitalization inappropriate.

It should capitalize because the lease is for more than one year, making it a longterm lease.

It should capitalize because the lease is similar in economic substance to the installment purchases, which were capitalized.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock