Question: JT (single taxpayer) is a software engineer who earns both salary income as an employee, and business income as the sole proprietor of a business

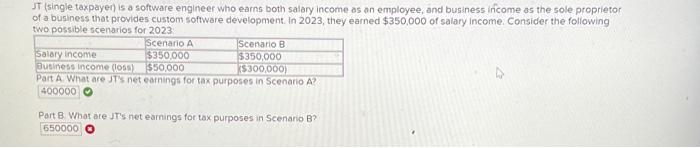

JT (single taxpayer) is a software engineer who earns both salary income as an employee, and business income as the sole proprietor of a business that provides custom software development. In 2023, they earned $350,000 of salary income. Consider the following two possible scenarios for 2023: Scenario A $350,000 $50,000 Salary income Scenario B $350,000 ($300,000) Business income (loss) Part A. What are JT's net earnings for tax purposes in Scenario A? 400000 Part B. What are JT's net earnings for tax purposes in Scenario B? 650000

JT (single taxpayen) is a software engineer who earns both salary income as an employee, and business income as the sole proprietor of a business that provides custom softwore development. In 2023 , they earned $350,000 of salary income. Consider the following two possible scenarios for 2023 . rart A. what are Jis net earnings for tax purposes in Scenario A? Part B. Whot are JT's net earnings for tox purposes in Scenario B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock