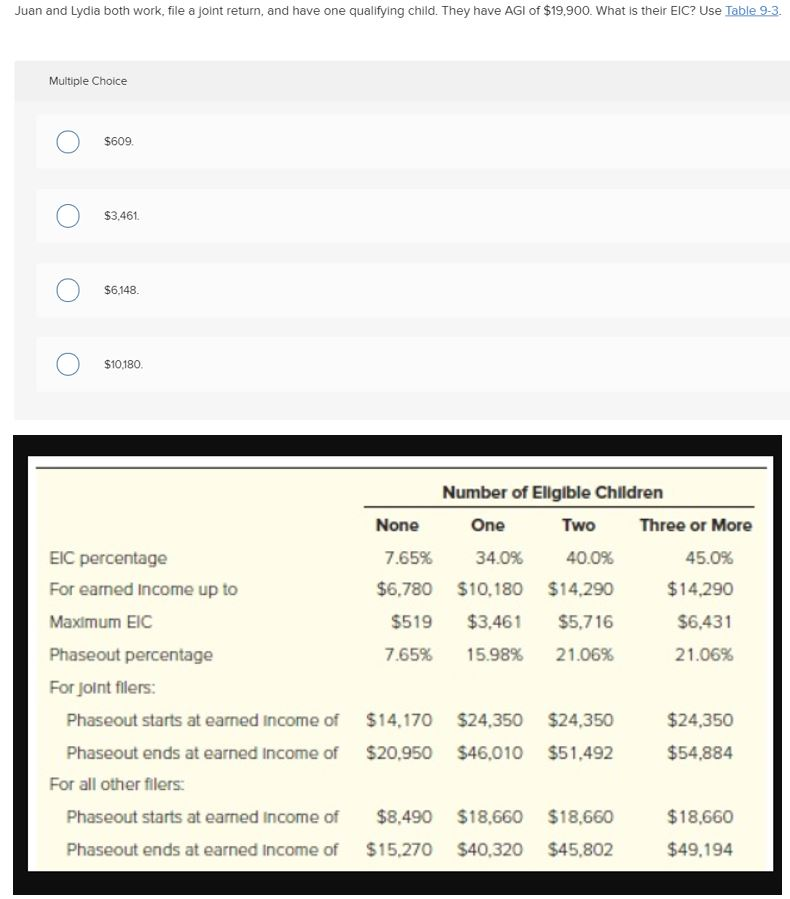

Question: Juan and Lydia both work, file a joint return, and have one qualifying child. They have AGI of $19.900. What is their EIC? Use Table

Juan and Lydia both work, file a joint return, and have one qualifying child. They have AGI of $19.900. What is their EIC? Use Table 9-3. Multiple Choice $609 $3.461. $6.148. O $10,180 Number of Eligible Children None One Two Three or More 7.65% 34.0% 40.0% 45.0% $6,780 $10,180 $14,290 $14,290 $519 $3.461 $5,716 $6.431 7.65% 15.98% 21.06% 21.06% EIC percentage For earned Income up to Maximum EIC Phaseout percentage For folnt filers: Phaseout starts at earned Income of Phaseout ends at earned Income of For all other filers: Phaseout starts at earned income of Phaseout ends at earned Income of $14,170 $20,950 $24,350 $46,010 $24.350 $51,492 $24,350 $54,884 $8.490 $15,270 $18,660 $40,320 $18,660 $45,802 $18,660 $49,194

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts