Question: Judgment Case 4-7 Income statement presentation L04-3, L04-4, L04-5 The following events occurred during 2021 for various audit clients of your firm. Consider each event

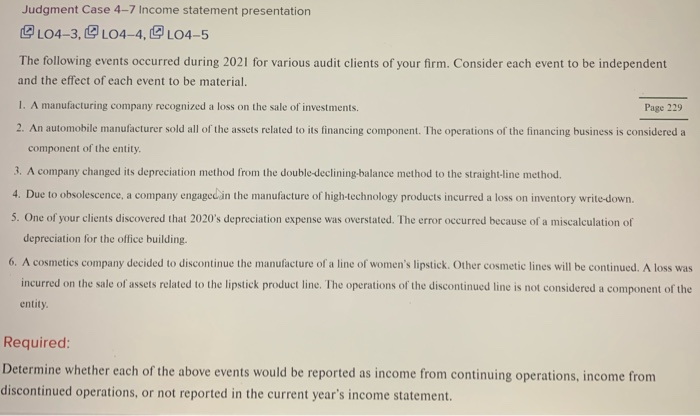

Judgment Case 4-7 Income statement presentation L04-3, L04-4, L04-5 The following events occurred during 2021 for various audit clients of your firm. Consider each event to be independent and the effect of each event to be material. 1. A manufacturing company recognized a loss on the sale of investments. Page 229 2. An automobile manufacturer sold all of the assets related to its financing component. The operations of the financing business is considered a component of the entity, 3. A company changed its depreciation method from the double-declining-balance method to the straight-line method. 4. Due to obsolescence, a company engaged in the manufacture of high-technology products incurred a loss on inventory write down. 5. One of your clients discovered that 2020's depreciation expense was overstated. The error occurred because of a miscalculation of depreciation for the office building. 6. A cosmetics company decided to discontinue the manufacture of a line of women's lipstick. Other cosmetic lines will be continued. A loss was incurred on the sale of assets related to the lipstick product line. The operations of the discontinued line is not considered a component of the entity Required: Determine whether each of the above events would be reported as income from continuing operations, income from discontinued operations, or not reported in the current year's income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts